7.23.22: A Sleight of Hand Has Been Played

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers: We believe market makers are in the process of pulling a sleight of hand on retail investors yet again with numerous headline insertions of “Investors bet on a market bottom.” We issued a cautionary note on this in a previous public email note on Wednesday, and then another research note again inside our Community on Thursday. Friday witnessed a violent retracement of FAAMG, Semis, and High-Growth all at the same time. We strongly dislike being bearish. When markets go down, we lose as well. It is unavoidable. It’s just that our degree of loss is somewhat mitigated by timely risk-reduction.

While we do NOT like to produce market direction opinions on such a frequent basis given our long-term bias towards markets, Strategist Larry does feel he has the responsibility to share his opinion if he believes risk/reward is substantially IN or AGAINST our favor at certain market levels. That said, just a friendly reminder we have organized one of the most welcoming Investment Research Communities on Youtube. We do NOT run a short-term “trading” community. Please understand our primary objective is to provide our point of view and research process, which we believe is highly beneficial to all investors of different levels, background, and experience.

We are always ensuring that we are attracting the right types of friends to join us.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

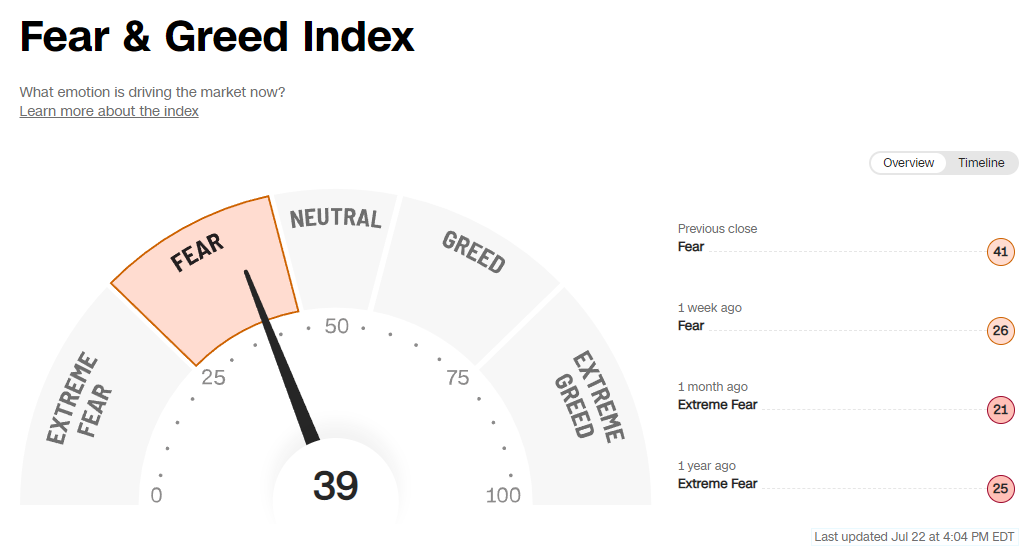

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3998.95

KWEB (Chinese Internet) ETF: $31.00

Analyst Team Note:

Great summary from J.P. Morgan’s Equity Strategy Team…

“As we end the week, the question is whether this current rally has ended and what that means for stocks moving forward. While the Banks painted a picture of strength in Consumer and Corporate sectors, bears will point to (lack of) hiring in Tech and headlines from companies such as AT&T that consumers are behind on payments (though company views this as similar to 2019 levels). Our conclusion is clearly the economy is slowing but it is not falling off a cliff. While recession risk (within 12 months) is elevated it may take a bit more time to eat through Consumer (~$2T remains in excess cash relative to 2019 level) and Corporate cashpiles (SPX had record high cash levels coming into 2022 with near record interest coverage ratios). Going forward, it feels like companies that pull guidance will be hurt worse than those that merely guide lower.”

Macro Chart In Focus

Analyst Team Note:

Margin debt declines as deleveraging continues, but BofA speculates that margin debt has declined to ‘oversold’ levels. Per BofA, “this marks the deepest oversold since the Great Recession in 2008-2009”.

While everyone is bearish, no one has seemed to be actually selling. BofA found that “for every $100 of inflow since Jan ‘21, there’s been just $2 of outflow from tech, $3 from equities”.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points

Analyst Team Note:

There’s been a massive slowdown in the housing market as tighter financial conditions combined with record home prices continue to create an affordability shock.

Homebuilder sentiment plunged to the lowest reading since 2015. Single family starts down 8.1% MoM and 15.7% YoY. Building permits fall below 1m authorizations for the first time in two years.

A lot of this slowdown in the housing market is really just mean reversion. Record low rates needed to normalize eventually.

Chart That Caught Our Eye

Analyst Team Note:

During the ‘08 GFC, the markets bottomed before earnings estimates bottomed. Something to keep an eye on…

Bull case includes a combination of (i) improving macro data; (ii) earnings holding up better than expected; (iii) having reached a peak in inflation; (iv) visibility that the tightening cycle ends.

Bear case includes a combination of (i) increasing inflation, especially across the stickier categories; (ii) margin compression hurting forward guidance; (iii) a more hawkish Fed.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.