12.5.22: Today's SPX drop isn't yet the "Big One". The next big drawdown will come when folks least expect it.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Okay so last week, I gave a public heads up that margin of safety was thinning and new long positions were dangerous. Cool, that played out today.

But to be honest, I don’t think we go straight down from here. Without fundamental data such as CPI and FOMC, the auction pricing of markets will not finalize and establish its true intention.

The “Big One” will be when everyone throws caution to the wind and starts flexing their profits screenshots to family and friends. This is the moment when fools will be parted from their money, as the timeless wisdom has repeatedly rang true.

Although I don’t know exactly when that will be, I have a general ballpark and I have a plan to take advantage of this (Premium Note sent to Members today). When these folks start embracing the “new-born” bull market in light of the seriously challenged macro environment we’re in, I will be ready to minimize positioning and avoid chaos as best as possible.

For now, we plan, we wait, and we patiently observe. The demise of many amateur investors who haven’t learned their lesson yet from 2022 is coming in the weeks/months ahead.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

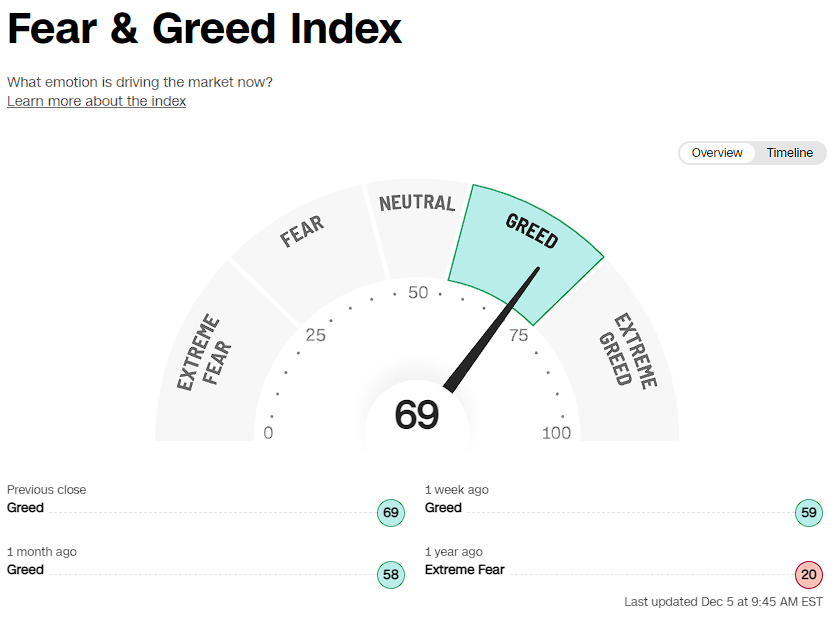

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

“The crux of the bear argument is this downturn will be deeper and more prolonged to help clean the excesses of the COVID-19 era that took chip demand and valuations well above trend. There is merit to this argument - CY22 chip sales are tracking north of $550bn, 34% above pre-COVID levels.

The crux of our more optimistic argument is that chip stocks could be volatile, but will look past potential 1H23 macro headlines, towards a potential 2H23 and CY24 recovery. Unlike prior upturns that were globally synched, the CY22 global economy was driven primarily just by the US. So even if the US slows down in CY23, global chip demand could be boosted by a potential upturn in China.” - BofA

Macro Chart In Focus

Analyst Team Note:

On Chinese stocks, Morgan Stanley is now bullish… “Multiple positive developments alongside a clear path set toward reopening warrant an upgrade. We are at the beginning of a multi-quarter recovery in earnings revisions and valuations.”

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The government has accelerated its shift toward reopening as it became evident its strategy of eliminating infections was failing to bring the current record Covid outbreak under control. The virus restrictions have caused widespread damage to the economy and fueled protests in several major cities, prompting authorities to roll back some restrictions in recent days.

Beijing is now allowing some low-risk patients to isolate at home instead of quarantine camps. Shanghai scrapped PCR testing requirements to enter parks or use public transportation. And top officials and the state media have also softened their rhetoric about COVID.

Chart That Caught Our Eye

Analyst Team Note:

“Sixty-five trillion dollars is a not big number: It’s a huge, barely comprehensible number. It’s more than two-and-a-half times the size of the entire US Treasury market, the world’s biggest. It’s 14% of the value of all financial assets globally, according to a tally from the Bank for International Settlements.

It’s also the value of hidden dollar debt unrecorded on the balance sheets of non-US banks and shadow banks as of June this year, also according to the BIS, the central bankers’ central bank. It has been growing rapidly, having nearly doubled since 2008.

Years of ultra-low interest rates and investors’ aggressive hunt for returns have driven leverage higher — and the growth FX swap and forward liabilities is one mammoth example of that. Rising rates and volatile asset prices make high leverage a dangerous source of instability, ever more so because it is hidden.” - Bloomberg

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Inspirational Tweets from Strategist Larry