12.2.22: Markets shake off hot jobs report to have weekly close above 200 Day Moving Average.

Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Investor positioning suggests that there could be a bit more near-term upside in the cards given that the SPX successfully shook off a hot jobs report. But margin of safety is quickly thinning.

Just like a few weeks ago where I discussed that the markets would likely go higher when SPX was already at an elevated level of ~3960, I now believe we are entering a dangerous zone for new long positions. My December research suggests that we are entering a valuation zone that leaves little margin of error if terminal rates don’t come down as quickly as the markets are hoping.

Our constructive stance on China is being sincerely rewarded, but it is of course to have a strong grasp on the ongoing valuation, growth estimates, and WACC (Discount Rate) to know when shares start becoming overextended. We provide guidance on upside ranges in our December report, and when risk may return to the market.

China Internet has been an incredibly difficult sector to evaluate and properly assess, but I objectively we have done a tremendous job doing so (our previous research issued from August/September/October/November is readily available to be read inside). We’ve put in an incredible amount of effort in assuaging investor fears both inside our Community and publicly on Twitter.

We are unable to provide commentary on why investors felt a pressing need to sell at the lows after 20th Party Congress. The H-Shares and ADR market now has greater influence from Onshore China Traders and less influence from Foreign Investors. This transaction activity strongly implies that many foreign investors (including many of my readers) who hold ADRs sold at massive losses when BABA traded ~60.

Oh well, I tried my best to help. I’m convinced that it doesn’t matter how good my research and strategy is. It will NOT help impatient folks who need extreme handholding. They can’t be helped. They’ll eventually fall victim to either fear or greed…or both.

2023 will leave behind these impatient folks, and for the rest of you, that means you’ll be competing with stronger-minded individuals. Be prepared. The greatest challenges lay ahead. The competition will become more intense.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4076.57

KWEB (Chinese Internet) ETF: $28.08

Analyst Team Note:

“Equity performance already looks overdone. Equities have rallied 10% in the period October-November – the median rally over 4Q is 5.5% (and the average is 4.3%). Additionally, when the S&P rallies above its 50 & 100DMA, it looks technically vulnerable as it heads towards its 200DMA.” - TS Lombard

Macro Chart In Focus

Analyst Team Note:

“We have learned relatively little about the likely peak in the funds rate in recent weeks. Powell’s message simply confirms the obvious.

Central banks are downshifting the pace of hikes due to (1) the fact that they have been hiking at three times the normal pace, (2) they are likely at or above the neutral rate and hence the urgency of hiking has dropped and (3) they are aware that monetary policy works with lags. They are shifting from going 3-times faster than normal to 2-times?” - BofA

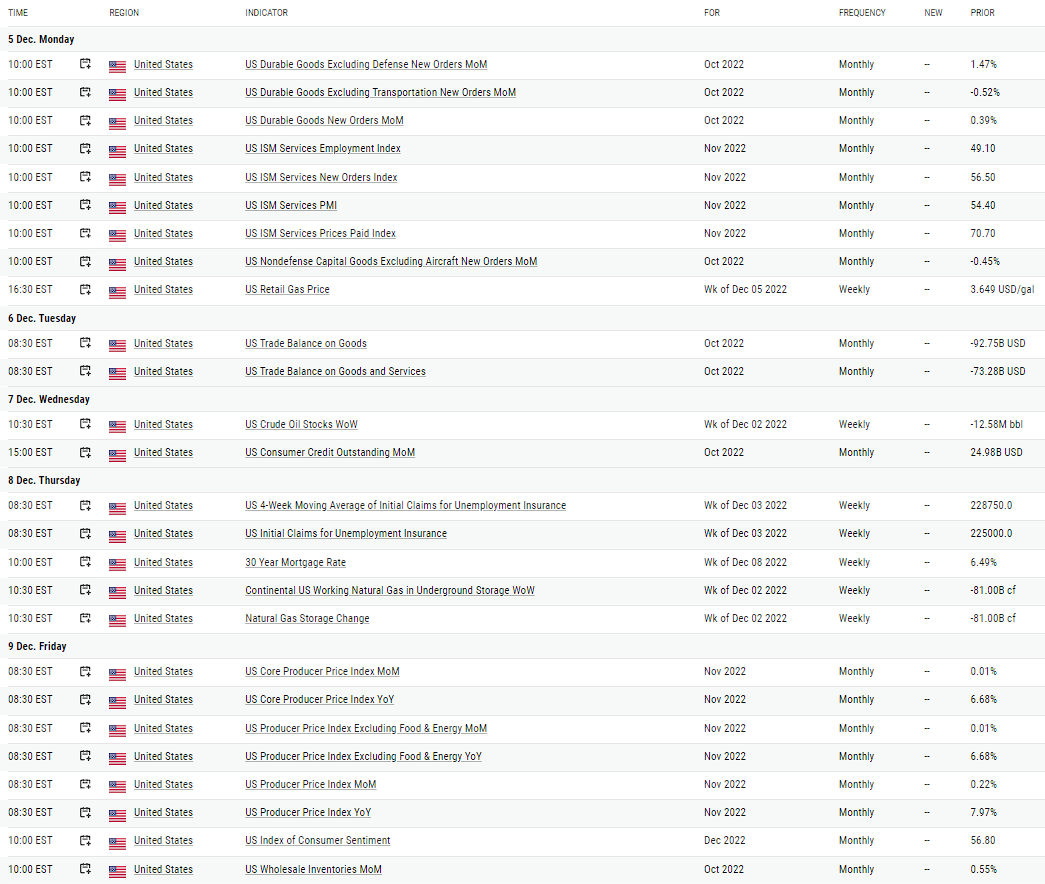

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

A superficial take of today's jobs report would note that both jobs and earnings "blew past expectations, flying in the face of Fed rate hikes", and while that is accurate at the headline level, there’s more than what meets the eye.

There’s an increasingly large gap between the Household survey and the Establishment survey, both of which are supposed to track the number of employed workers. Despite the continued rise in nonfarm payrolls, the Household survey continues to show growing weakness.

There were 158.458 million employed workers in March 2022... and 158.470 million in November 2022 an increase of just 12,000 over 8 months, a period in which the number of payrolls (which is the main number the market follows) reportedly increased by 2.7 million!

Strange stuff…

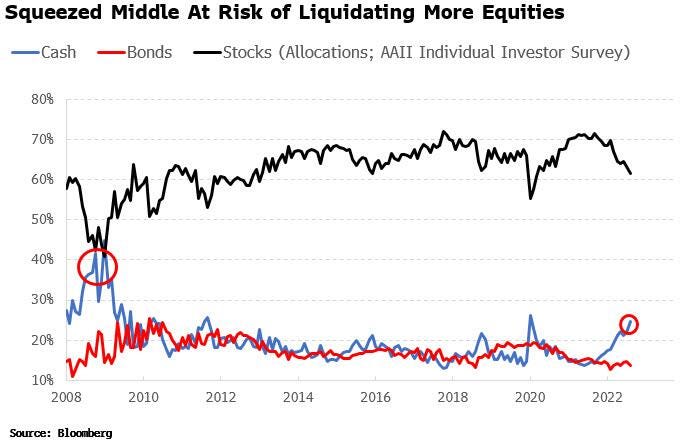

Chart That Caught Our Eye

Analyst Team Note:

Investors’ cash allocations have risen sharply, but are still nowhere near the GFC, when equity holdings of the 50th-to-99th percentile fell almost 20% in excess of the market’s fall, implying significant selling.

Household allocation to equities in this cycle is beginning to turn lower from all-time highs. This tends to lead long-term equity returns -- higher allocations typically lead to larger reductions in equity exposure, dragging down returns.

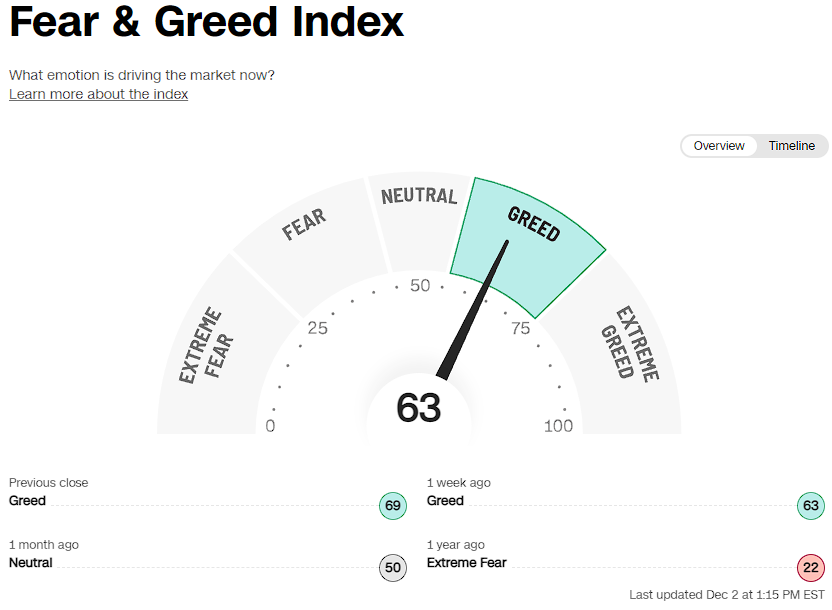

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs