9.9.22: The S&P 500 once again surpasses its 100 Day Moving Average ahead of key inflation data next week.

Key U.S. and China brief market notes by Larry's Analyst Staff Team for our Public Email List

Note to Readers: We continue to believe that selective stock-selection will help capture the same returns and rewards of index investing, while offering less risk. In our coverage universe, there are a number of defensive companies that are actually outperforming the SPY and QQQ on market advances since the bounce from SPX 3900, while experiencing smaller drawdowns when the indexes fall. We continue to remain cognizant of risks, while attempting to take advantage of market rallies.

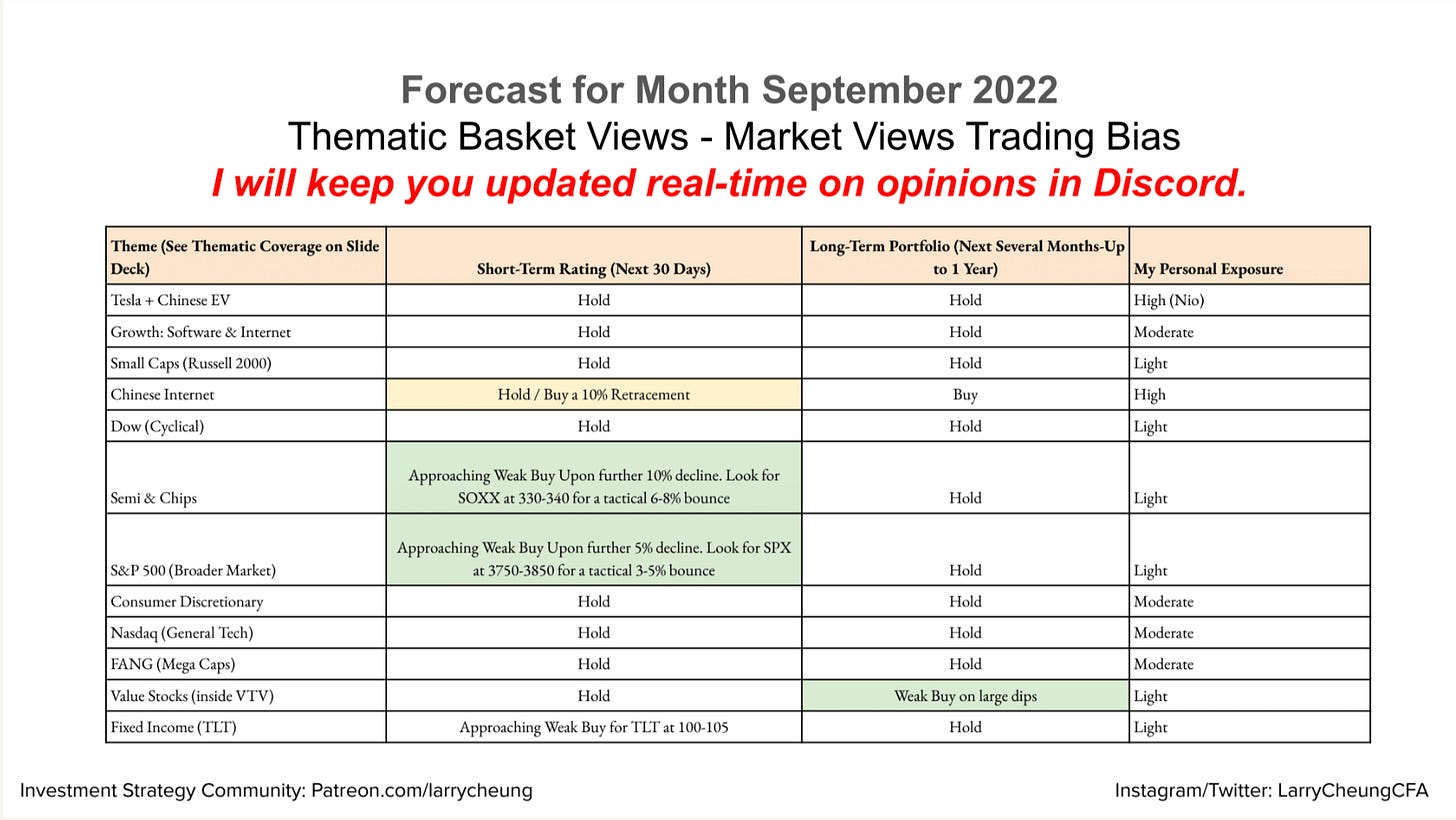

We intend to share as many of those opportunities as they come up inside our Community. On September 1st in our Monthly Slide Deck, we removed our bearish ratings across all our thematic coverage points compared to the previous month. Directionally, this has been the correct opinion and has helped our members to avoid aggressively being bearish after a 400 point fall in the S&P 500. Execution-wise, Strategist Larry was able to capture parts of the rebound via stock-selection (DLTR, JNJ, KR) as the indexes came close to his target buy ranges, but did not get to fully buy back into the indexes themselves (SOXX ETF for Semis or SPX) as they bounced before entering our target ranges.

You can expect our guidance to be matched with our integrity. We recognize that it is impossible to capture all of the opportunities, all of the time. As our Community grows in size, we must provide guidance that is designed for capital preservation first, capital gains second. We cannot provide overly aggressive guidance in this environment.

If you are interested in finding a Strategist who will be objective about his research and execution, our Community could be a home for you. We welcome you inside.

Strategist Larry’s Opinion on September 2022 Thematic Coverage (published Sept. 1st inside Patreon)

Strategist Larry’s Opinion on August 2022 Thematic Coverage (Published August 1st inside Patreon)

Our Investment Community now has roughly 45% of members from the U.S, 15% from Canada, 20% from Europe, and 20% from Asia Pacific (HK, Singapore, Australia).

Strategist Larry can answer any questions inside Patreon 1:1 chat relating to his current coverage universe and the S&P 500, QQQ ETF, KWEB ETF, and SOXX ETF. If you hold any of these companies, and want to understand the risk/reward behind these companies, we can help you. Please understand that we are unable to take questions on companies outside our coverage universe as it wouldn’t be a researched opinion. We focus on providing the highest quality opinions on names that we understand well.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4006.18

KWEB (Chinese Internet) ETF: $27.70

Analyst Team Note:

Even after conditioning for the 11 prior years when the S&P was already down 10%+ through August, Sep returns still have a negative skew (-2% on average)

4Q rallies are much more common if the S&P is up already YTD through Sep, which is unlikely to be the case by month-end

However, we have often seen some upside in 4Q even in years when the S&P was already down a lot YTD through August

Given the rallies often came after Sep weakness, the average Sep-Dec returns in years when the S&P was down 10% through Aug were flat on average

Source: JPM

Macro Chart In Focus

Analyst Team Note:

“Either consumers have never had it so good still or assets are still the wrong price” - Deutsche Bank

“Although we project the expansion to last longer than before, we still expect tighter monetary policy to ultimately push the economy into a mild recession. If there has been a shift in the Fed’s tone in recent months, it has been in the direction of a stronger committment to reducing inflation, even at the risk of a downturn. The more the Fed emphasizes price stability as the primary goal of monetary policy, the more we think the Fed is willing to stomach a larger rise in the unemployment rate to get there.” - BofA

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Next FOMC meeting will be on Sept. 20-21 where the market is pricing in a 75 bps move. Even as higher rates does its best to suppress housing and investment trends, the economy has held up pretty well due to steady consumer spending. With the labor market still incredibly strong, we expect the Fed to continue to go big.

Chart That Caught Our Eye

Analyst Team Note:

“lows will be next year, not this year” - Deutsche Bank

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs