9.7.22: A near-term bounce is in the cards for select companies. However, no broad rally is sustainable until the macro confirms it, in our view.

Key U.S. and China brief market notes by Larry's Analyst Staff Team for our Public Email List

Note to Readers: There are certainly pockets of value after the market selloff that has repriced the indices lower by nearly 10% over just a 2-week period. We believe this is a stock-selection environment. The indices are too dependent on the Mega Cap stocks; the Mega Cap stocks are too dependent on the Macro outlook. And the macro outlook still leaves much to be desired. Macro will get better in mid-2023 and beyond in our opinion, but is it appropriate to quickly price in mid-2023 in September 2022? We welcome market surges - more importantly, we want to help you do something with it.

Stock-selection and thematic selection will likely work better in this environment. We have a few stock-selection ideas (already up 5% since publication inside our Patreon Community), but believe there’s still more room to run, and that dips can be bought in these select names. Remember, think about every company you hold - do they make sense in this environment?

Do NOT just rely on the index. The index depends on a healthy economy. Learn how to select companies with a process. Learn that process inside our Community. Ask 1:1 questions inside. The best time to learn stock-selection is now - not when prices fully recover.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe. Simply visiting IB’s website is a sign of support for our Newsletter. Visit them today!

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

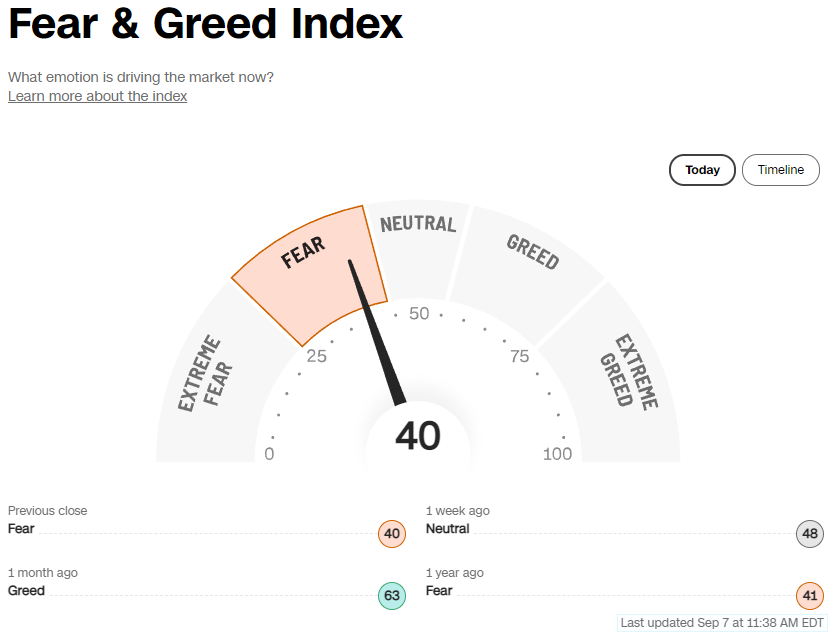

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3908.19

KWEB (Chinese Internet) ETF: $27.68

Analyst Team Note:

“We think the lows for this bear market will likely arrive in Q4 with 3,400 minimum downside and 3,000 if a recession arrives. From there, we think prices will recover to our base (3,900) or bear (3,350) case June 2023 targets. In the very near term, if back end rates fall, stocks may hold up or even rally until later this month when QT potentially increases and earnings estimates are likely revised lower.” - Mike Wilson, Morgan Stanley

Macro In Focus

Analyst Team Note:

Bull Case

Fed does its last outsized (>25pbs) hike in September, which may include ending the tightening cycle in December

QT ramps up to its maximal caps without any increase in vol or yields

CPI continues to move lower, accelerating the pace of its declines

WTI remains at/below $100 but perhaps more critically does not see rapid increases

Equity positioning increases as markets stabilize

Bear Case

Fed continues with its outsized rate hike cadence in Nov/Dec bringing Fed Funds above 4.0%

QT puts upward pressure on yields, retesting YTD high of 3.47% in10Y

CPI remains in the 8% - 9% range

WTI moves back above $100, in response to either supply disruptions and/or an increase in demand from China

Positioning remains light with increases to short leverage

Source: J.P. Morgan

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Yesterday, two indicators of services activity gave very different signals. The S&P PMI index fell to contractionary territory while the ISM index moved higher into expansionary territory.

There’s a couple differences between the two indicators that can help us understand the recent divergence.

S&P Global designs its sample to be representative of the broader industry according to workforce size. ISM, on the other hand, simply surveys its members, which tend to be from larger businesses. Therefore, S&P Global arguably captures more smaller and medium-sized businesses than ISM.

ISM was originally named the non-manufacturing index, as it includes construction and mining. S&P Global, on the other hand, focuses purely on services industries but excludes retail.

ISM is an equally weighted average of four component indexes—business activity, new orders, employment, and supplier deliveries; S&P Global is simply the business activity index.

Chart That Caught Our Eye

Analyst Team Note:

S&P 500 gross positioning has been dropping sharply while Nasdaq gross positioning has been growing… This pretty much shows the level of uncertainty and mixed feelings that investors have about the market.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.