9.29.23: Fed President says rates should higher for longer

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang: Stocks turning red as New York Fed President John Williams said that although Fed may be done raising interest rates, the central bank should keep them elevated to bring inflation back to the central bank’s 2% goal.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4299.70

KWEB (Chinese Internet) ETF: $27.01

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

The return of inflation has broken the two-decade old relationship between equities and bonds. Since 1998, equity markets have risen with bond yields on perceptions of stronger growth momentum in a disinflationary setup. That correlation has reversed in the past year, presaging tougher times ahead for equities if bond yields keep climbing higher.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

The Federal Reserve observed a deceleration in core inflation, as indicated by a 0.1% rise in the core PCE in August, the slowest monthly pace since late 2020, according to a recent Bureau of Economic Analysis report.

This slowing inflation, coupled with a modest 0.1% increase in inflation-adjusted consumer spending, might provide policymakers with a basis to defer an interest-rate hike in the upcoming meeting.

Chart That Caught Our Eye

Analyst Team Note:

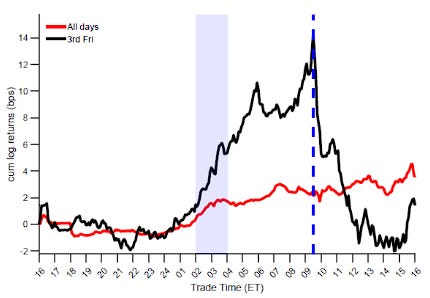

New research has found that the fate of stock options with a face value of trillions of dollars is being influenced by unusual trading activity in the S&P 500 outside of regular market hours.

There’s a monthly pattern where the market will jump just before the expiration of options tied to the S&P 500. This phenomenon generates roughly $3.8bn per year for bullish-positioned speculators.

The authors of the paper hypothesize that traders are taking advantage of thin trading, pushing up the index either through futures or the pre-market to benefit their option positions.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.