9.24.22: A moment of worry for Investors has arrived. Opportunities await only Prepared investors.

Key U.S. and China brief market notes by Larry's Analyst Staff Team for our Public Email List

Note to Readers: There was a gigantic opportunity to reduce equity exposure in the 4200-4300 region for the S&P 500. We believe that attempting to sell positions now is considered very reactive. While more downside can be in store, a snap back rally can come at any moment, and this is precisely what we have shared with our members over the past several months leading up until today.

The S&P 500 revisiting this key level of 3600 region should not be a surprise for long-time followers of our content. That said, we hope that you choose to be proactive and get ready for the next big move in the market with us and uplevel your skillsets at the same time.

At a time when many services have been unable to provide proper guidance at far higher price points, our Community is globally accessible yet incredibly impactful based on our opinions shared. There are many ambitious college students in our Community. We’ve designed our Community to be accessible to everyone. If College Students can afford it, any working professional can.

As long as you are patient and long-term, we are confident that our Community can be a supportive home for you. Our strategies are not for Day-Traders, short-term scalpers, or zero-days-till-expiration types of traders.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

“Equity valuations have closely tracked real interest rates until recently. Real yields have soared from 0.4% to 1.3% during the past month and could reach 1.5% by year-end. For context, real yields were negative 1% at the start of the year when the S&P 500 index hit an all-time high of 4800 and traded at a P/E of 21x. The tightest yield gap between equities and rates since the pandemic further tilts the balance of risks to the downside.” - Goldman

Macro Chart In Focus

Analyst Team Note:

From 2010-2021, corporate earnings only explained 23% of S&P 500 price returns while Fed balance sheet expansion explained 51% of price returns. Compare that to 1997-2009 when corporate earnings explained 48% of returns and the Fed balance sheet had no impact on price returns.

The idea that “stocks only go up” and to always “buy the dip” has only originated over the past decade due to the structural tailwind of the Fed and QE.

We haven’t even begun to see the full effect of QT as G4 central banks have barely started to reduce their balance sheet.

Will they continue to let assets just runoff or start actually selling?

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

While the median Fed projection envisions a soft landing, the updated projections continue to suggest that the path to more favorable outcomes is narrowing. Nearly all FOMC participants see downside risk to their outlook for GDP growth, and upside risk to both unemployment and inflation.

Chart That Caught Our Eye

Analyst Team Note:

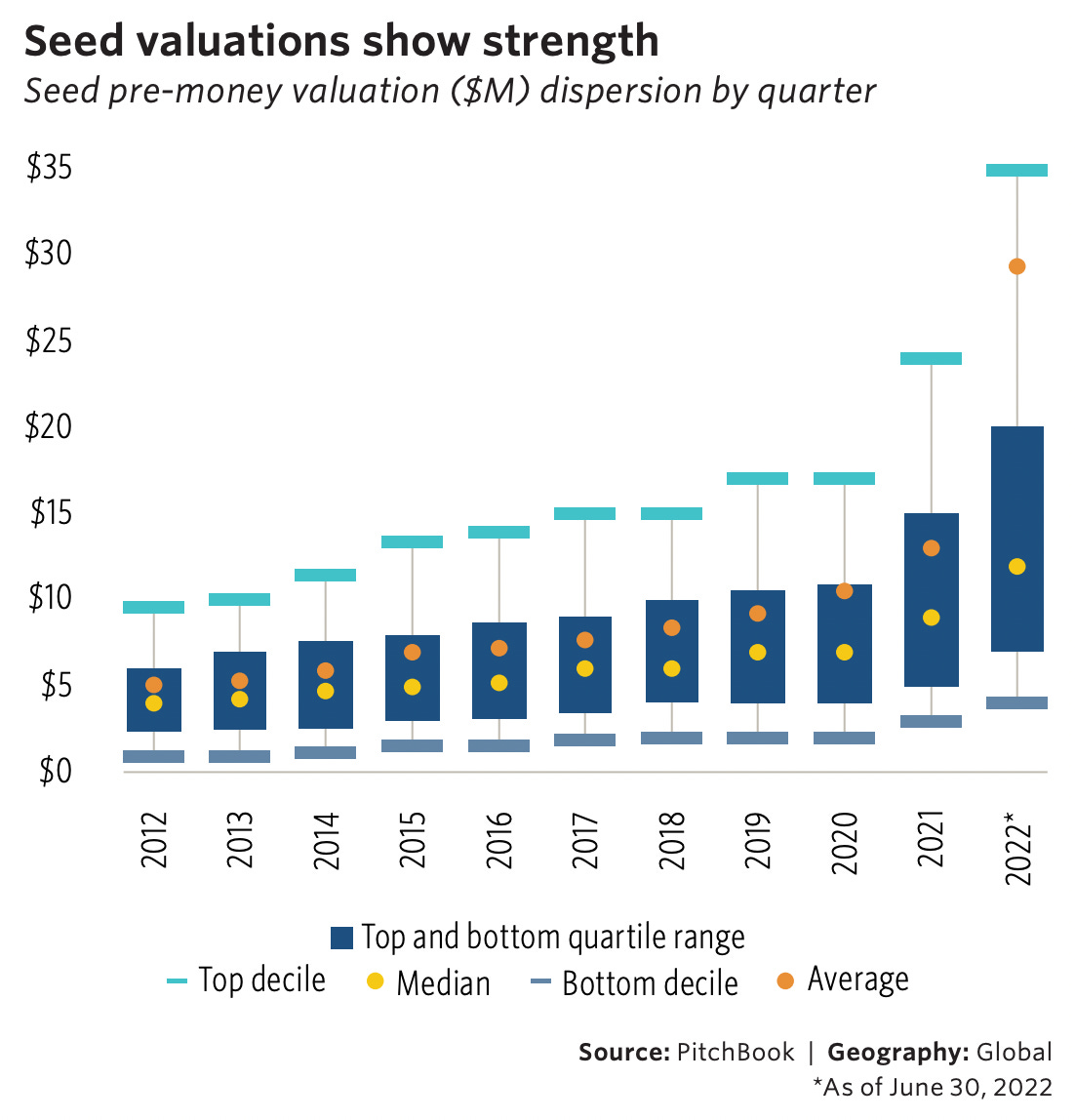

Seed deal counts have remained elevated and median deal sizes and valuations continue to grow. The median pre-money valuation for seed in 2022 has reached $12.0 million, 33.3% above 2021’s figure of $9.0 million.

In fact, Pitchbook also found that fewer than 6% of completed financings in 2022 have been at valuations lower than what the company previously raised.

Less than 6%…

Sentiment Check: Well that was fast.

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs