9.22.23: Fed officials see more hikes possible as inflation persists

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang: The S&P 500 is rebounding today from near-oversold levels, and the Nasdaq 100 is performing even better. Shares of US-listed Chinese companies got a boost following news of Washington and Beijing forming working groups to discuss economic and financial issues. Meanwhile, labor tensions continue to rise for General Motors and Stellantis as they faced potential walkouts at 38 additional facilities due to stalled union negotiations.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4330.00

KWEB (Chinese Internet) ETF: $26.53

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

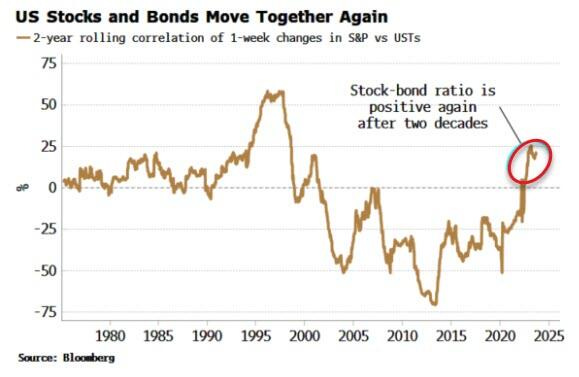

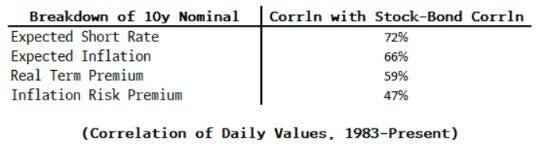

After two decades of a negative stock-bond correlation, the ratio is back to positive, driven largely by inflation expectations.

Bond prices, especially after the recent hawkish lean from the FOMC, are structurally moving downwards. Per Bloomberg, this shift in correlation, which previously saw bonds acting as a hedge for stocks, now poses a challenge for investment strategies such as risk parity, as most market players, due to recency bias, haven't fully grasped the implications of this change.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

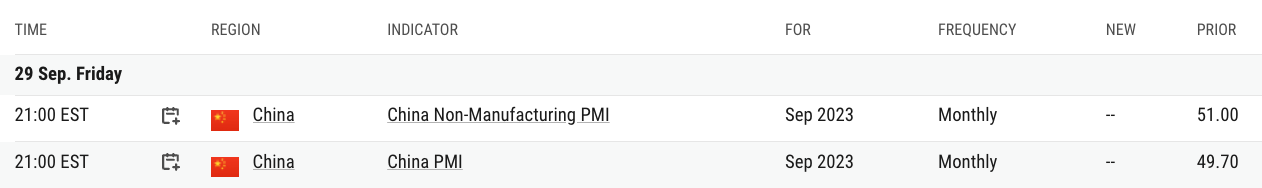

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Per Bloomberg, the ongoing selloff in front-end Treasuries may persist, with two-year yields potentially reaching 5.43%, a level unseen since December 2000, if the Federal Reserve sticks to its recent hawkish dot plot. At the same reason, the 10-year bonds could rise to 4.55%, deepening the curve inversion.

This change in sentiment all comes from the Fed's September dot plot, which indicated a shift from a planned 100 basis points rate cut through 2024 to just 50 basis points.

Chart That Caught Our Eye

Analyst Team Note:

Emerging-market stocks erased their year's gains due to persistent inflation concerns and anticipation of an extended period of high interest rates, negatively impacting growth in developing countries.

Compounding the downturn is a significant selloff in China, resulting from its economic deceleration and debt issues. While emerging markets continue to underperform compared to US equities, there remains cautious optimism as analysts believe China's economic downturn might stabilize, offering potential investment opportunities in the future.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.