9.22.22: Do not be Overly pessimistic. Late Bears may be challenged by Early Bulls soon.

Key U.S. and China brief market notes by Larry's Analyst Staff Team for our Public Email List

Note to Readers: We’ve listened to the September FOMC. We know the Fed is hawkish. While Fed hawkishness was a recipe for disaster at SPX 4300 (which we clearly discussed), will that hold true at SPX 3700? Time will tell, but believe upon further weakness, the stock market is likely to see a bounce before resuming its longer-term downtrend. Join our Community to position yourself for different timeframes based on your risk-tolerance. We share conservative ideas and higher-beta ideas across multiple timeframes.

However, U.S. Housing is a very different story. And the macro forces that drive housing are incredibly bearish. Strategist Larry’s latest public Youtube video is now out. This video is designed to be educational in nature to understand the Real Estate industry. Share this video with friends and family. A case study of how to evaluate a REIT is discussed inside.

Our mission continues to be to help you upgrade your equity research analyst skills, which are life-long skills that you can use to generate income in any environment.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3855.93

KWEB (Chinese Internet) ETF: $26.94

Analyst Team Note:

Per BofA, “upside risks to our baseline USD views are growing, given the contrast between expectations of future Fed action and other major central banks, particularly the Bank of Japan with regard to USD-JPY… And ultimately, the USD view is effectively an inflation view, implying that continued surprising persistence in inflation would likely mean that much more USD upside.”

Macro Chart In Focus

Analyst Team Note:

The FOMC revised down GDP growth in 2022 and 2023 more than expected, to 0.2% and 1.2% respectively. 0.2% is basically a “mark-to-market” given negative growth in 1H 2022, but the 2023 revision suggests a tougher path to a soft landing.

Meanwhile the unemployment rate is projected to increase to 4.4% by 4Q 2023, 70 bps higher than the current level. Note: In the last 75 years, the US economy has entered a recession every time the unemployment rate has risen by at least 50bp in 12 months.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Per the Fed dot plot, the median member expects another 125bps of hikes by year-end (two more meetings left in year) and a terminal rate of 4.5-4.75%. Almost a third of the committee sees a terminal target range of 4.75-5.0%.

Chart That Caught Our Eye

Analyst Team Note:

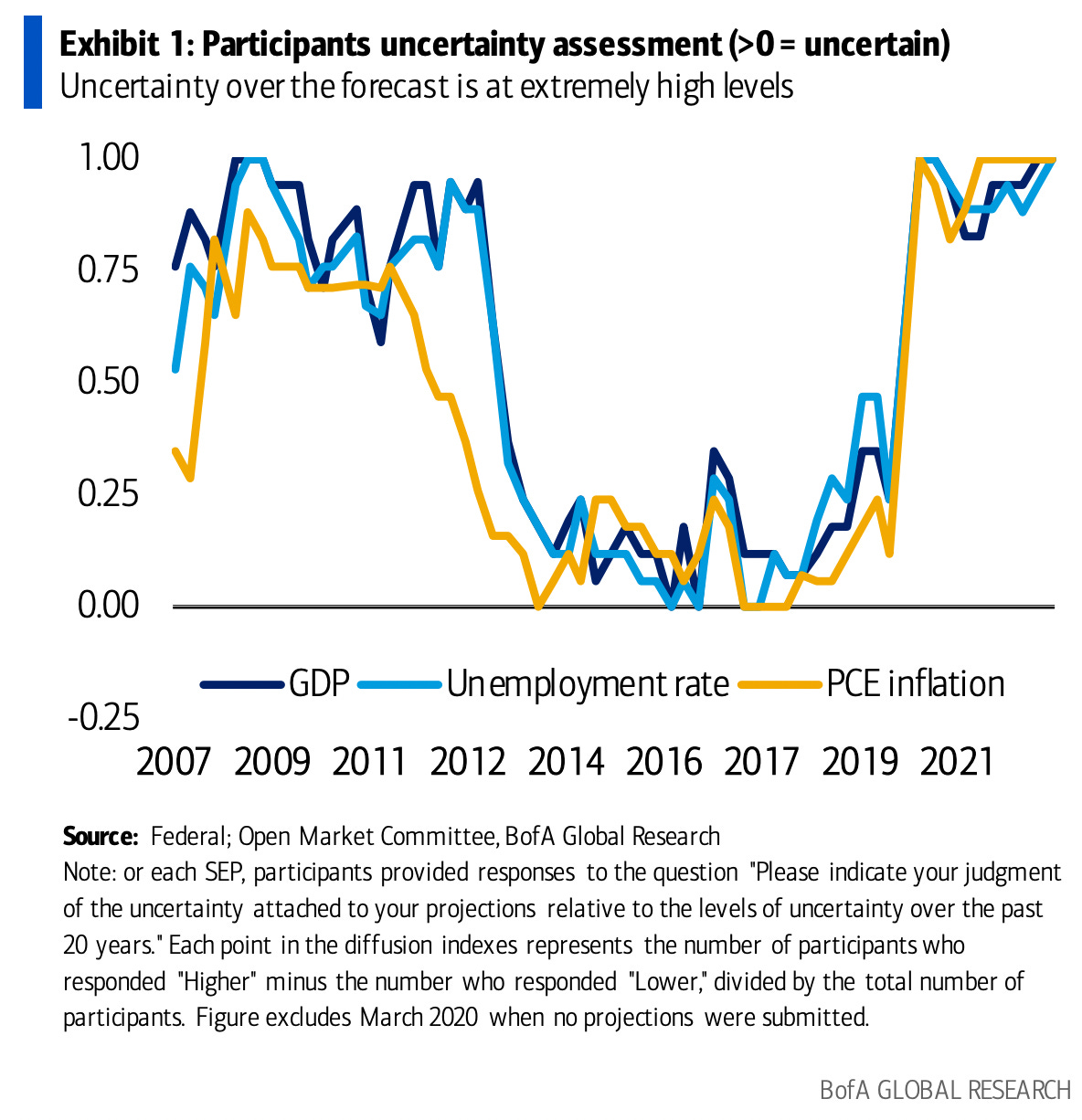

Don’t know what may happen to the economy? It’s ok. The Fed doesn’t know either.

The Fed’s uncertainty about its forecast is at its most extreme level.

17 (of 19) FOMC participants see risks to growth to the downside, 18 see upside risk to the unemployment rate, and 17 see upside risk to PCE inflation.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.