9.20.23: Fed expected to pause rate hikes today

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang: The Federal Reserve is expected to pause its interest-rate hikes for the second time this year while leaving the door open for another increase as early as November. Economists surveyed by Bloomberg expect the median projection will show one more increase this year and several of them expect a trimming of the number of cuts for 2024.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4443.95

KWEB (Chinese Internet) ETF: $27.50

Analyst Team Note:

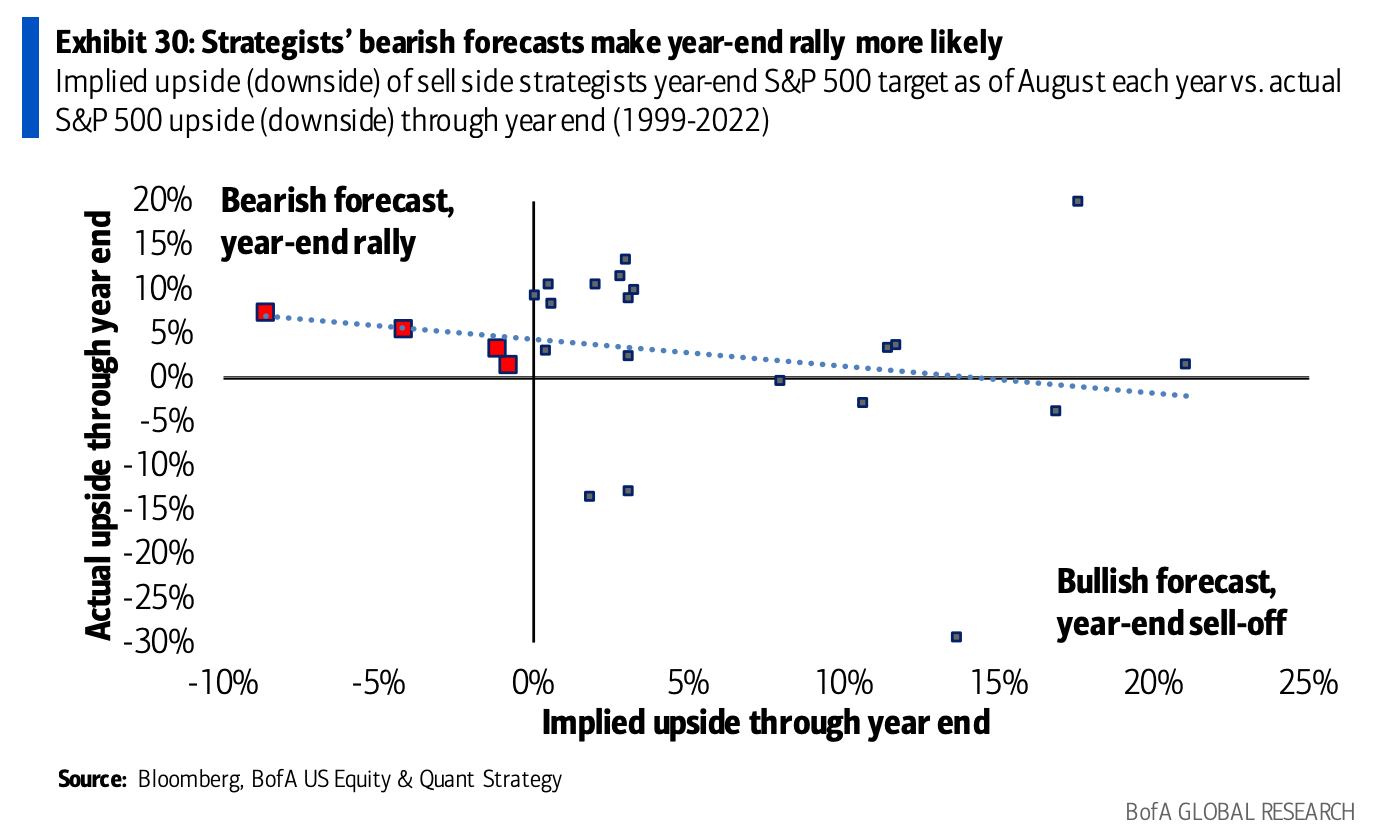

Typically, by the end of August, the average year-end target for the S&P 500 suggests a 5% gain, based on data since 1999. However, this year, the forecast indicates a 2% decline.

Interestingly enough, historical data reveals that whenever strategists predicted a year-end drop in the S&P 500, it has always concluded the year with a rise. Moreover, during these instances, the average returns were notably stronger at +4.3% through year-end, compared to the +2.5% when strategists projected an increase.

Macro Chart In Focus

Analyst Team Note:

On Monday, the total US debt surpassed $33 trillion, rising by $56 billion in one day, and by a mindblowing $1 trillion in just the past 3 months!

The historic breakout takes place just weeks before the interest on total Federal debt is set to hit $1 trillion, surpassing how much the US spends on defense - and soon after - every other category.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Oil is nearing $100 a barrel again… Central bankers worldwide will need to grapple once again with the implications of a significant spike in crude oil prices.

Brent crude hit a 10-month high of around $95 a barrel, driven by export restrictions from Saudi Arabia and Russia, and an optimistic economic outlook for the US and China.

While there's concern that rising oil prices can intensify inflationary pressures, a recent IMF study indicates that consumer-price growth notably slowed in only about 60% of over 100 inflation shocks since the 1970s.

Chart That Caught Our Eye

Analyst Team Note:

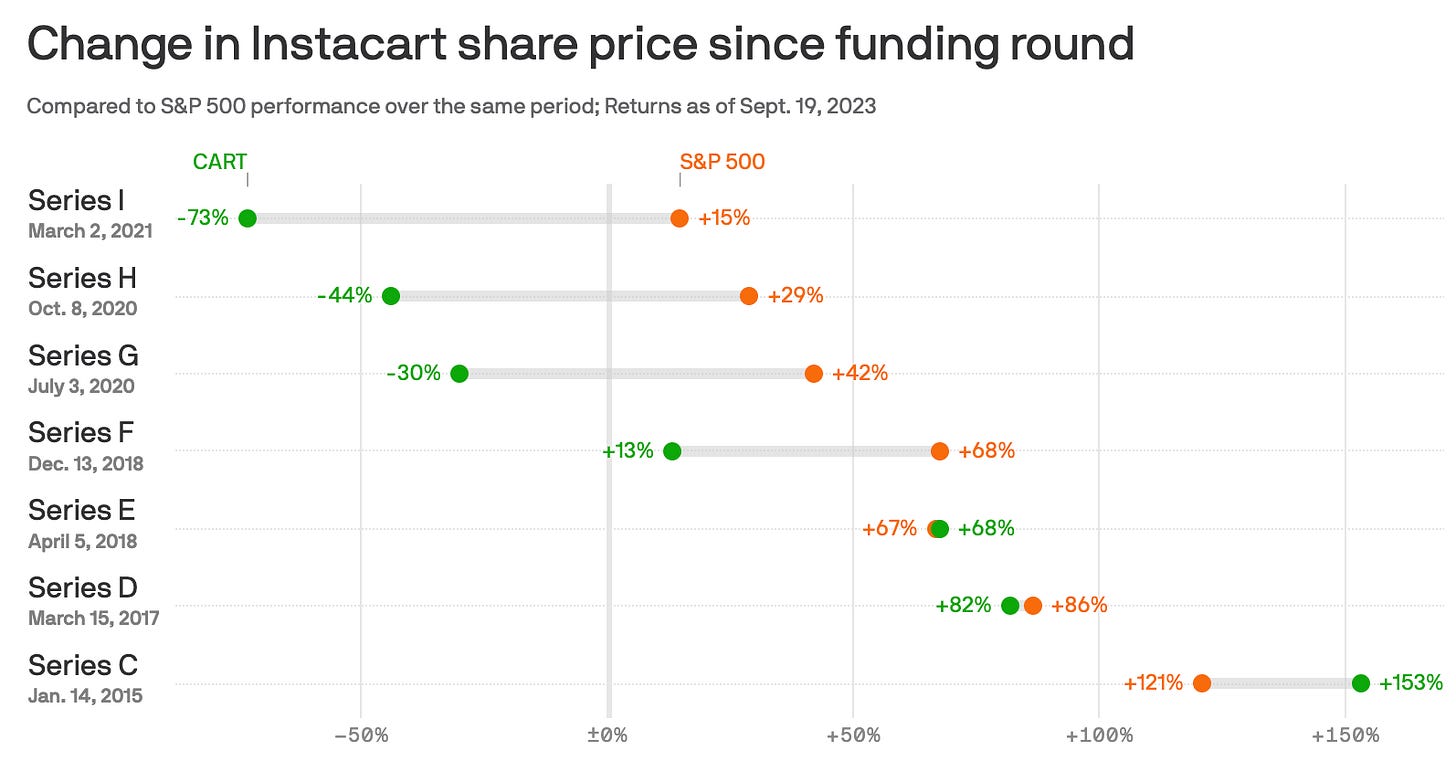

Instacart's debut in the stock market saw its shares rise to $42 but closed at $33.70, which was 12% above its $30 IPO price. However, the company's valuation was drastically lower ($9.9 billion) than the previous private funding round at a $39 billion valuation. Those who invested in the last three funding rounds are yet to see a profit, with only those from the January 2015 Series C round having returns that notably outpace the market.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.