9.18.23: Fed Expected to Keep Rates on Hold this Week

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang (Larry’s Head Analyst): Major central banks, including the Federal Reserve and the Bank of Japan, gear up for key rate-setting meetings this week. Many will be watching the Federal Reserve's "dot plot" economic forecasts, with speculation on potential rate changes for 2024.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4450.32

KWEB (Chinese Internet) ETF: $27.70

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

The US Treasuries market awaits the Federal Reserve policymakers' updated forecasts for their benchmark interest rate, which could be a deciding factor for the market that's facing a potential third consecutive year of losses.

The main area of discussion at the September Fed meeting revolves around how long the rates will be held. While Chair Jerome Powell has sometimes downplayed the importance of the "dot plot" projections, their significance has grown, especially given the lack of specific verbal guidance on policy outlook.

Key questions for the upcoming dot plot include whether policymakers will maintain expectations for another 25 basis-point rate hike by year-end and their easing projections for 2024.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

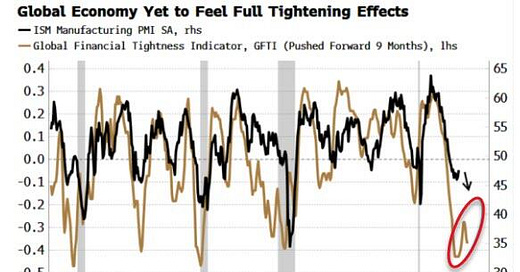

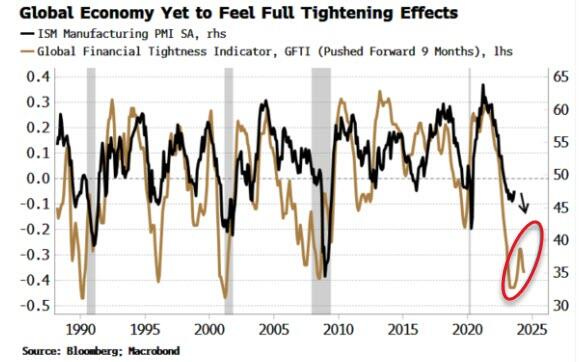

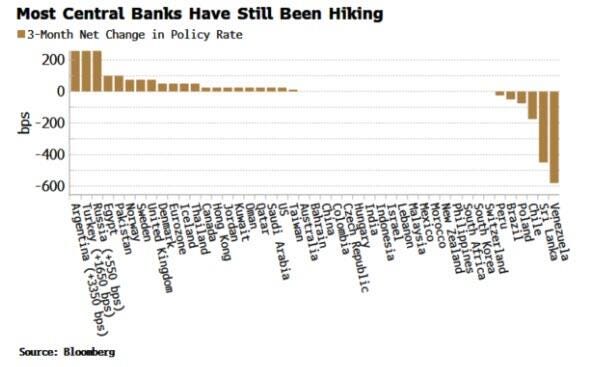

Global central bank rate hikes' long-term effects haven’t been entirely absorbed by the markets and economy, signaling potential challenges for equities in the future. Even as significant central banks like the Fed, ECB, and BOE near the end of their rate-hiking phases, many are still in the midst of hiking.

Bloomberg’s Global Financial Tightness Indicator (GFTI), which traces central bank rate hikes globally, suggests that the full impact of financial tightening has yet to materialize. The GFTI's trajectory hints that the US manufacturing ISM, a key influence on global stock markets due to its strong connection to corporate profits, might decline later this year or early next, which could put pressure on global equities.

However, in the short term, excess liquidity—resulting from the gap between real money growth and economic growth—remains favorable for stocks, thanks to reduced inflation and a weaker dollar.

Chart That Caught Our Eye

Analyst Team Note:

August saw a sharp increase in bankruptcy filings, according to data from Epiq Bankruptcy. Commercial Chapter 11 filings surged by 54% from August 2022, reaching 634 from the previous year's 411. The total commercial filings rose 14% to 2,328, while small business filings saw a 43% increase to 194.

Overall, bankruptcy filings for the month totaled 41,614, marking an 18% rise from the 35,409 reported in August 2022. Individual filings also showed a similar 18% jump to 39,286 from the previous year's 33,364.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.