9.15.23: IPO Market Has Reopened Following Arm's Massive NASDAQ Debut

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note from Tim Chang: Some things that caught my eye this morning when reading through the news… Rising Rates Make Big Companies Even Richer, US Inflation Expectations Fall to Lowest Levels in Over Two Years, Apple iPhone 15 Pro Max Deliveries Slip to November in Sign of Demand, UAW launches unprecedented strike against GM, Ford and Stellantis.

It seems like the IPO market is open again… Arm Holdings, a British chip design company, debuted on the NASDAQ at a $60 billion valuation yesterday. Since then, it has skyrocketed 25%. Following Arm’s strong debut, grocery delivery business Instacart is preparing to price its IPO on Monday. German footwear maker Birkenstock is also planning to file an IPO soon.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4505.10

KWEB (Chinese Internet) ETF: $27.89

Analyst Team Note:

Equities: biggest weekly inflow ($25.3bn) since Mar '22, as confidence in soft landing consensus grows

US equities: biggest weekly inflow ($26.4bn) since Mar '22

Large cap stocks: biggest inflow ($18.7bn) since May '22

Macro Chart In Focus

Analyst Team Note:

China's economy showed promising signs in August, with an uptick in consumer spending and factory output due to a summer travel surge and increased government stimulus.

Both industrial production and retail sales surpassed expectations while urban unemployment experienced a slight dip.

Despite the encouraging August data, challenges persist, such as the ongoing real estate crisis and slowing fixed-asset investment growth. The overall sentiment is cautiously optimistic, with some believing Beijing's measures to support the economy are beginning to take effect, while others emphasize the importance of sustained data to confirm recovery.

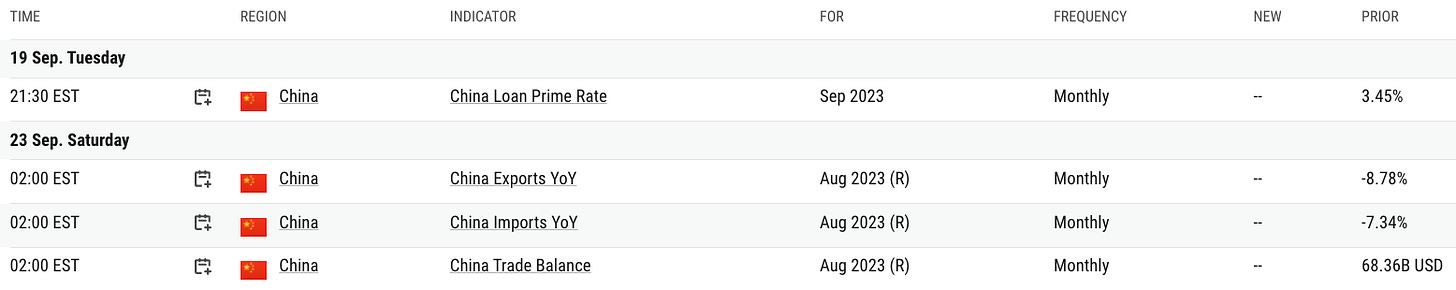

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Retail sales in August surpassed Wall St. expectations, with headline and ex-auto retail sales increasing by 0.6%. However, the notable rise in ex-auto retail sales was primarily due to increased gas spending, influenced by the spike in gas prices for the month.

Additionally, significant downward revisions were made to the June and July data, suggesting that consumer momentum during these months was weaker than initially estimated.

Other sectors, such as groceries, clothing, and restaurants, showed minor positive contributions, while miscellaneous stores and sporting goods noted slight decreases.

Chart That Caught Our Eye

Analyst Team Note:

The recent edition of the BofA Fund Manager Survey, which reveals Wall Street's views on markets, and comically, serves as a valuable source of contrarian insights, indicated that sentiment towards China had reached an all-time low.

If I were to bet, Chinese stocks are nearing the bottom…

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.