9.13.23: Yields stay high after Inflation report as a higher for longer monetary policy is likely

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

From Tim Chang: As Larry mentioned in his previous daily note, the current dividend yield on the S&P 500 (SPY ETF) is about 1.5%, which is minuscule compared to the risk-free treasury 10Y yield of 4.3%. To make dividend stocks attractive, they MUST have some type of capital appreciation potential. That means if a dividend stock yields about 2-4% and has a capital appreciation potential of 5-7%, then that opportunity is stronger than the 10Y yield.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4461.90

KWEB (Chinese Internet) ETF: $27.96

Analyst Team Note:

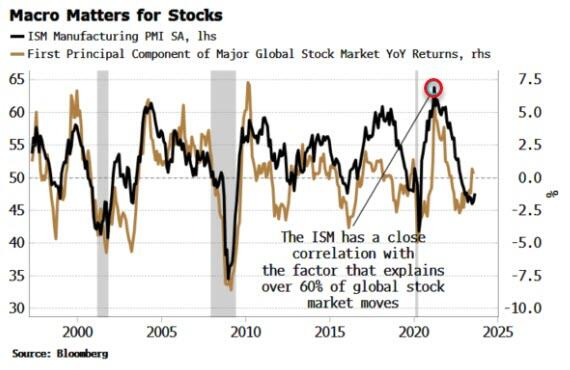

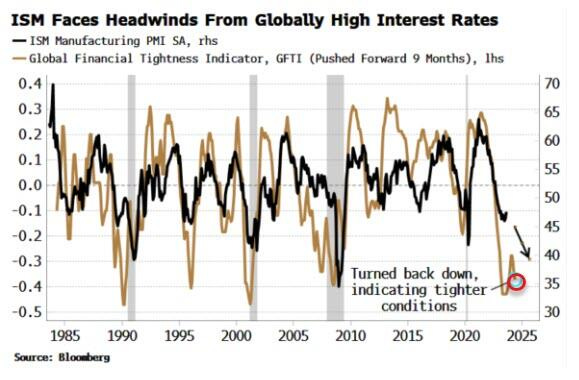

Over 60% of stock-market moves are highly correlated to the US's ISM manufacturing index, even though US manufacturing accounts for only about 11% of the nation's GDP.

The importance of manufacturing lies in its outsized influence: it supports over a third of economic activity in gross output terms, contributes heavily to patents, exports, R&D spending, and is an early-warning indicator for broader economic shifts due to its sensitivity to interest rates.

While short-term indicators suggest that global stocks may remain resilient in the near future, rising global interest rates over recent years could soon exert downward pressure on the ISM and, by extension, the stock market.

Macro Chart In Focus

Analyst Team Note:

“While demand appears brisk for the handful of coming IPOs, it is being fueled by sharp discounts to prior values. Instacart, for example, is seeking a valuation more than 75% below the level it last raised cash at in 2021. Klaviyo’s target is some 13% below its last funding round valuation in July 2022, according to data from PitchBook. Even Arm Ltd., the SoftBank Corp.-owned firm with AI ambitions expected to be the year’s biggest listing, is coming out at a valuation some $15 billion below where pundits predicted it would just weeks ago.

The haircuts reflect just how far private companies have fallen since the 2021 tech boom. Back then, investors poured a record $338 billion into US IPOs just in time for the Federal Reserve to turn off the monetary spigot. Shares in most of those companies, like Rivian Automotive Inc. and Coupang Inc., have foundered. The Renaissance IPO ETF plunged 69% from a February 2021 peak to a low late last year.” - Bloomberg

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Global growth expectations remain pessimistic with 53% expecting a weaker economy over the next 12 months (up from 45% in August).

Note that the ongoing disconnect between growth expectations & the S&P 500, suggests that market optimism is driven by the expectation rate cuts.

Chart That Caught Our Eye

Analyst Team Note:

In 2023, investors appear to be operating under the pretense that inflation is dead. "Inflation" ETFs have experienced nearly $30bn in outflows, especially in value, energy, and high-yield bonds. This follows record inflows in 2021 ($151bn) and 2022 ($86bn). In contrast, "Deflation" ETFs such as tech, growth, and Treasuries, which dominated the market for the past two decades, have seen a resurgence in 2023, with over $70bn in flows.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.