9.1.23: Welcome to September, one of the trickiest months for Investors throughout the year

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note to readers from Larry: I hope everyone has a great Labor Day long weekend. It’s been a tremendous week for our Community, and I look forward to finding more opportunities for the Team. I pick & choose my spots carefully, and will not comment when there’s nothing compelling to do. Once folks get used to my style, they will realize that “less is more” in trading/investing and that one of the most profitable actions in the market is simply sitting on your hands until opportunity resurfaces.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4507.66

KWEB (Chinese Internet) ETF: $28.271

Analyst Team Note:

Despite the bear market last year, stocks have surprisingly outperformed expectations, surpassing the performance of past bear markets dating back to 1929…

Macro Chart In Focus

Analyst Team Note:

In 2023, the United States is expected to run a budget deficit of 5.8% of GDP, even as the country experiences economic expansion, strong job gains, and historically low unemployment rates. This is in contrast to countries like Germany, which has traditionally aimed for a 0.35% deficit-to-GDP ratio, or Indonesia, which is targeting a 2.3% deficit for next year.

Rising borrowing costs and the absence of any effort to address structural imbalances between government spending and revenue worsen the situation. The Congressional Budget Office warns that the U.S.'s debt burden is on a trajectory to surpass even World War II levels. With discretionary spending already at 6.5% of GDP, below the three-decade average, the upcoming 2024 election may (though unlikely) serve as a crucial platform for broader debates on fiscal responsibility.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China is taking multiple steps to stimulate its economy and improve its business environment amid rising concerns about growth prospects.

The People's Bank of China recently implemented its largest interest rate cut in three years, and financial regulators have also reduced stamp duties on stock transactions, the first since 2008. Efforts are also underway to make credit more accessible to private businesses and to boost consumer spending.

Despite these measures, there's skepticism about their effectiveness due to the lingering effects of Covid-19, a slumping property market, and rising unemployment. Unlike past downturns, the Chinese government is cautious about implementing large-scale fiscal stimulus, partly due to debt burdens at the local government level.

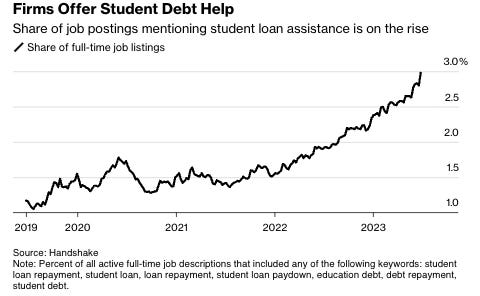

Chart That Caught Our Eye

Analyst Team Note:

According to Handshake, the share of full-time job listings mentioning such programs has doubled since 2019 to 3% of all listings. This trend comes as more than 40.5 million borrowers owe around $1.4 trillion in student loans, and about 50% of the class of 2024 is expected to graduate with debt. Experts predict that offering student debt relief will become a key strategy for companies to both attract and retain younger employees burdened by student loans.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.