9.12.22: Apple carries the SPY, DIA, and QQQ on iPhone 14 optimism.

Key U.S. and China brief market notes by Larry's Analyst Staff Team for our Public Email List

Note to Readers: Yesterday, right after Strategist Larry posted his weekly strategy email (see box below) to his public/private Community, he issued a more in-depth analysis into the August CPI figures coming out tomorrow on September 13th. In this note, he discusses how to think BEYOND this upcoming inflation data point and how to view this market’s risk/reward based on current investor positioning.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4067.36

KWEB (Chinese Internet) ETF:

Analyst Team Note:

Per the WSJ, analysts have cut their estimates for third-quarter earnings growth by 5.5 percentage points since June 30, the largest cut since Q2 2020.

Companies also have been looking increasingly pessimistic lately. A total of 240 companies in the S&P 500 mentioned recession on their post-earnings conference calls for the last quarter, the most ever since 2010.

If recession isn’t here yet, the fear of one surely is.

Macro Chart In Focus

Analyst Team Note:

We are currently witnessing one of the most aggressive monetary tightening programs ever with 85% of global central banks in tightening mode, the highest since the 2008 global financial crisis. I don’t think we’ll be seeing anything as dramatic as 2008 but a soft landing is out of the question.

-Tim Chang (Larry’s Analyst Staff)

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

All eyes on the inflation print this week.

At this point, strong economic data is a double-edged sword. It reduces the likelihood of a near-term recession, but also brings higher chance of additional policy rate tightening, which increases the risk of a hard landing over time.

Chart That Caught Our Eye

Analyst Team Note:

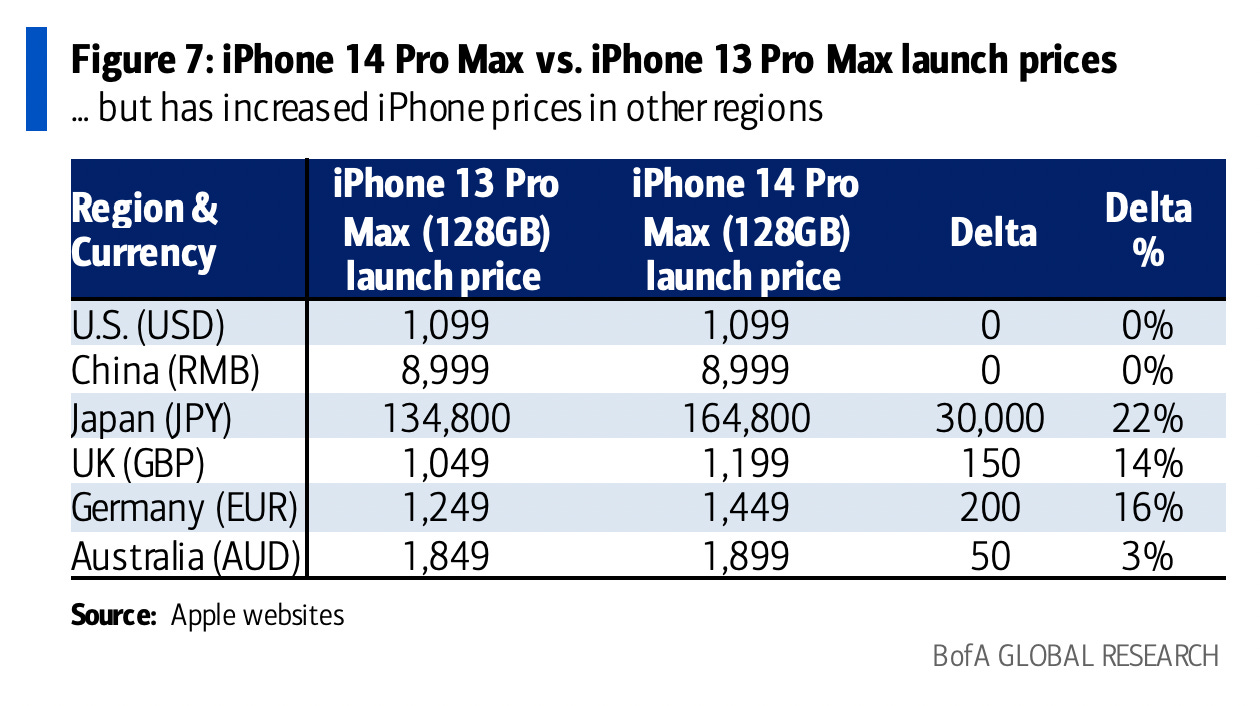

Apple decided to not implement price hikes in the U.S. and China but raised prices in Japan, the UK, Germany, and Australia. This was likely done to offset FX headwinds but how will this affect the consumer that is already struggling heavily with the looming energy crisis?

Sentiment Check

Analyst Team Note:

Markets still flushed with liquidity…. We still need a drain…

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.