8.7.23: Stocks shrug off Apple's earnings and gear up for Inflation Data later this week

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Public Readers from Larry: Folks, hope you had a good weekend! I’ve sent out two notes for today - one was the Daily Market Note for 8/7 and the other is my Collab announcement with Wall Street Prep to get my Community the best possible pricing on analyst education courses.

Make sure to check out Interactive Brokers above as idle cash now will yields 4.8% on all uninvested cash balances as the Fed just raised rates.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4478.03

KWEB (Chinese Internet) ETF: $30.58

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

Rising oil prices, which surged by over 18% in the past month, are pressuring U.S. inflation rates, reversing the trend of decreasing inflation. These increases are affecting various sectors, from daily commutes to the production of goods such as plastics, clothing, and fertilizers. The initial spike in oil prices came after Russia's invasion of Ukraine last year but began to moderate following U.S. interventions, including utilizing the SPR. However, recent production cuts by Saudi Arabia and Russia, coupled with investor optimism regarding the U.S. economy, have led to a renewed surge in prices.

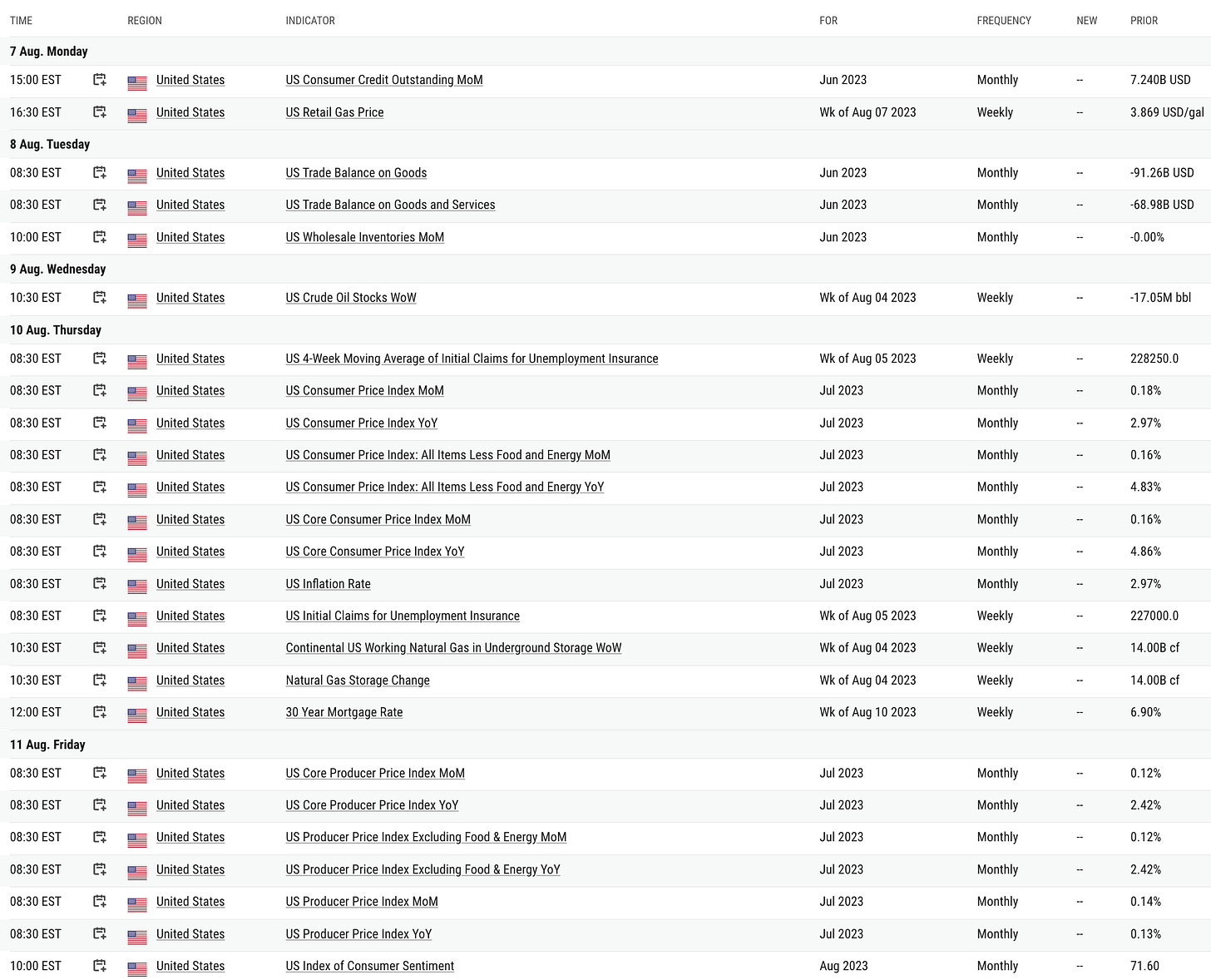

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

In May, nearly 40% of the U.S. starter homes were bought with cash, a trend driven by real estate investors targeting affordable properties. This has resulted in a competitive market for many potential homeowners, especially in pricier regions.

Chart That Caught Our Eye

Analyst Team Note:

In Q2, global M&A value decreased by 6.5% from Q1 to $873.4 billion, marking a 33.7% decline on the year and a 41.9% drop from the peak in Q4 2021, making it one of the weakest quarters since the 2020 pandemic downturn. However, the count of deals remains robust, close to record highs. This discrepancy between the deal value and count results from two main factors: the rise in interest rates and the vast unused funds in corporate and financial sponsors.

Specifically, increased interest rates have affected LBOs, pushing borrowing costs up and reducing deal sizes. Corporations, especially in the US, have amassed significant cash reserves, amounting to over $5.8 trillion, prompting a shift towards revenue acquisition via M&A due to stagnant or declining organic profit growth.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.