8.5.24: Japanese Markets Sees Worst Day Since 1987

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,449.65

KWEB (Chinese Internet) ETF: $25.06

Analyst Team Note:

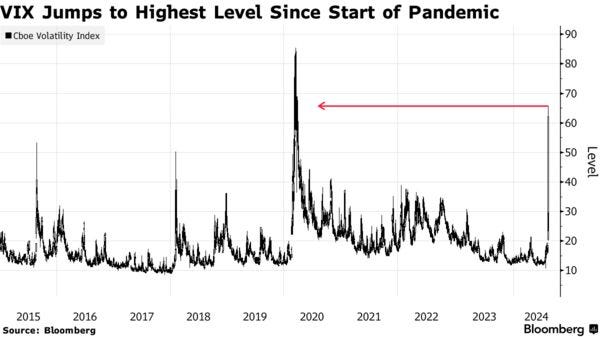

Macro Chart In Focus

Analyst Team Note:

Global bond markets are seeing a massive rally as traders increasingly bet on aggressive interest rate cuts by central banks, including the Federal Reserve, amid growing concerns about faltering economic growth.

This shift in sentiment has led to a sharp decline in bond yields, with the US two-year Treasury yield falling to its lowest level in over a year and similar trends observed in European and Asian markets.

The market's reaction has been so dramatic that at one point, there was a 60% chance priced in for an emergency rate cut by the Fed before its next scheduled meeting.

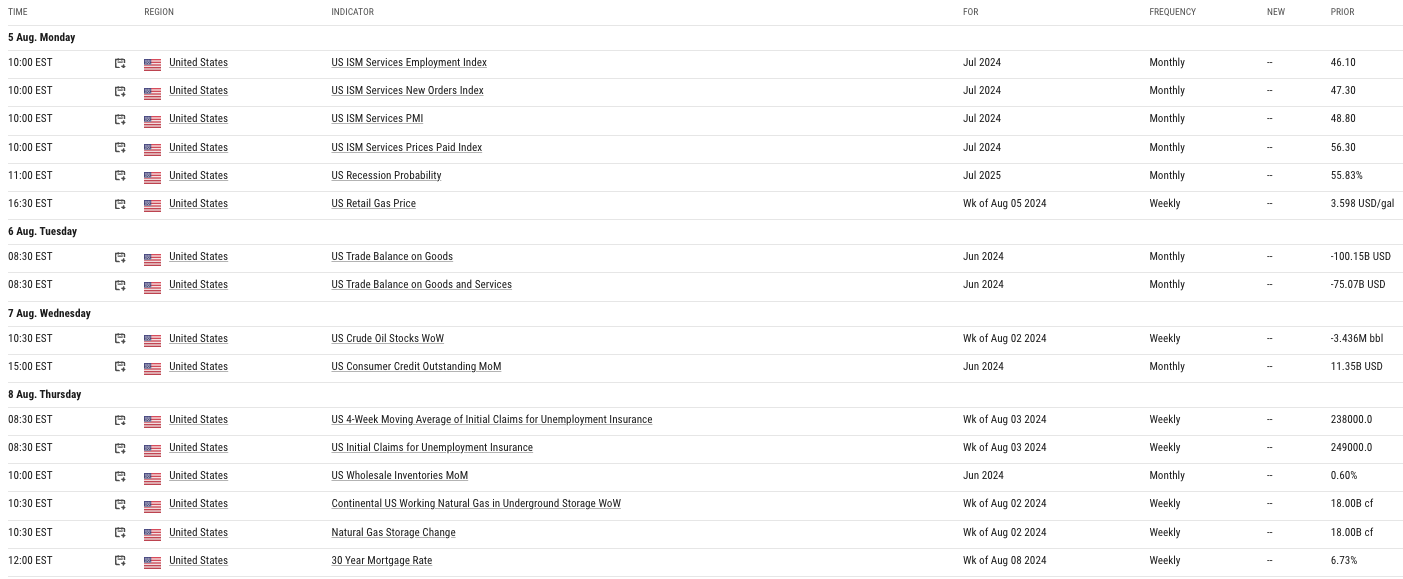

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The July jobs report revealed a significant slowdown in U.S. hiring, with only 114,000 jobs added, far below the expected 175,000.

This deceleration in job growth was accompanied by an increase in the unemployment rate to 4.3%, the highest level since October 2021.

Average hourly earnings rose 0.2% on a monthly basis, also less than forecast, and on an annual basis increased by 3.6% — the least since May 2021.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.