8.5.22: Markets are priced for substantially lower inflation - we believe this is a dangerous bet.

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers: Heading into August, Strategist Larry viewed Alibaba to have strong risk/reward at 89/share (12.5X Forward P/E) and noted this in his August Investment Strategy Report. Post-earnings, Alibaba had proven this opinion correct and staged a rally to near 100/share on better than expected outcomes. Our work is focused on qualitative commentary, as we cannot possibly know how “sustainable” a specific price level may last (this is NOT in our control). Objectively speaking, our discussion of risk/reward for the names under our coverage has been a powerful source of guidance.

However, with China’s latest geopolitical worries, Strategist Larry believes that the market may restructure the risk-premium assigned to the Chinese Internet Sector. He now believes the risk of a US-ADR delisting event is higher after the Nancy Pelosi Taiwan visit.

If you hold Alibaba, KWEB, Tencent, or the top 5-6 names within the KWEB ETF, it would be in your best interest to follow his views inside our Community to understand the constantly changing risk/reward profile in this sector. The risks in Chinese Internet are higher than before, and the sector may not fully trade on Fundamentals.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe. If you are concerned about US-delisting of Chinese stocks, we strongly encourage you to explore HK-listed shares on Interactive Brokers.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

Some notable predictions from sell-side…

“We say fade SPX >4200, go short SPX >4342 (200-day MA); if wrong, EM debt, banks & resources best hedges for further upside”

“Now is the time for patience and building dry powder. This bear in our view has one last act. Stay well diversified and close to target asset allocations. And enjoy the dog days of August!”

“In general, temporary unwinds from extremely bearish levels can contribute to fueling and supporting some rallies in equities. The current low levels of liquidity, which are likely to persist over the summer, might also contribute to exacerbating market moves. This dynamic has played out in the bear market rallies we have seen YTD, including the current one, and could still have further room to go, especially if equity volatility continues to reset lower.”

“Today, it seems the rhetoric is mostly about selling the rally, positioning is still low, there’s very little upside capture in performance, CTAs are reducing equity shorts, non-L/S funds are de-grossing, and riskier stocks are outperforming a little. Thus, given the current set-up, it wouldn’t be surprising if the short squeeze extended further, particularly among riskier stocks.”

“At some point, that money on the sidelines is pulled into the market but many investors think we need to retest and make new lows. Look for a ‘flush day’ with VIX thru 40 and SPX down 4-5% as part of forming that bottom."

Sources: Bank of America, Morgan Stanley, Goldman Sachs, J.P. Morgan

Macro Chart In Focus

Analyst Team Note:

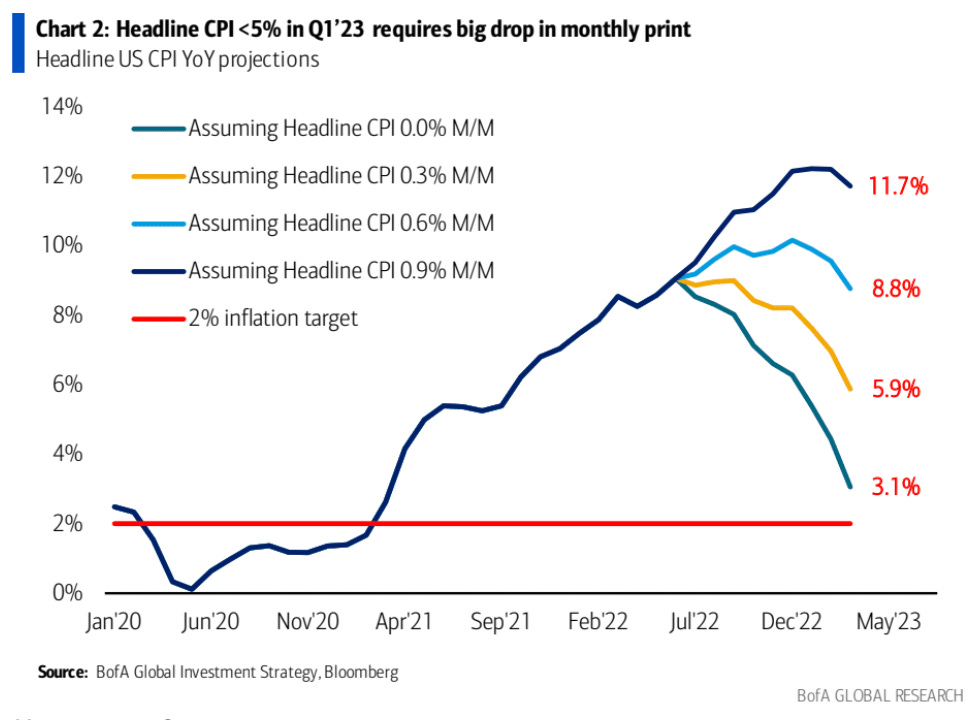

Over the past week, we’ve been talking about the “Fed Pivot” a lot and why the market may be dangerously wrong on this issue.

In order to get 3.1% headline CPI in Q1 ‘23, we would need 0% month-over-month CPI prints… ANY increase in CPI from here would likely lead to headline CPI over 5%.

How can the Fed ‘pivot’ when inflation is still a long ways from the 2% target and the labor market is red hot?

Source: Bank of America

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

We got some pretty incredible numbers today.

Nonfarm payrolls rose 528k in July—more than double the consensus of +250k and a pickup from the 384k average pace in Q2. Fears of rising layoffs in the goods and tech sector showed little impact on the report as payrolls increased in 68.6% of industries.

The unemployment rate declined by a tenth to 3.5%—matching the 50-year low.

Average hourly earnings increased by 0.5% in July.

Everything from today’s job reports indicates that the labor market is still overheated and that the Fed will need to go further. There is no Fed pivot.

Sources: Goldman Sachs, Bloomberg

Chart That Caught Our Eye

Analyst Team Note:

US equities price in around 50% probability of recession, down from around 90% on June 16th. US credit markets assessment of recession is little changed since then, hovering at around 30-40%.

In contrast to equity markets, US rate markets appear to be currently pricing in higher probability of recession relative to mid-June.

Therefore, the risk of US recession is now more uniformly priced in across asset classes with convergence between US equity and rate markets over the past month.

Source: J.P. Morgan

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs