8.31.22: A New Month Begins Tomorrow. New Opportunities are Brewing.

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers: August has come to an end. Tomorrow is a new month. New opportunities await. We are sharing with you here an Investment Strategy note that we published back on August 8th inside our Community by making this post Public. As always, we wish everyone following our work best of luck.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3986.16

KWEB (Chinese Internet) ETF: $28.83

Analyst Team Note:

“The S&P 500 Index break through initial support levels near 4100 extends the pullback from key medium-term resistance in the 4300s. Next support rests at 3899-3945. The latter is a key support to watch given the late-summer/early-fall seasonality. The 4120-4132 Jul-Aug pattern breakdown area now marks important tactical resistance.” - J.P. Morgan

Some interesting notes on volatility…

Retail has been buying long VIX, which according to Morgan Stanley, “elevates the risks of a vol squeeze”

VIX is cheap relative to SPX 1m ATM implied vol (spread is at the 12th percentile). In other words, hedge using VIX rather than SPX derivatives.

Macro Chart In Focus

Analyst Team Note:

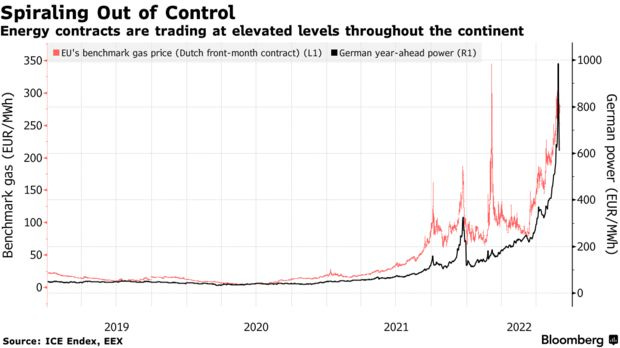

We generally don’t cover European macro, but it’s hard to ignore the energy disaster that has been going on.

In the forward market, UK power for December 2022 is fast approaching £1,000 per megawatt hour, up 50% from current prices. British households were told last week that their power and gas bills will increase from Oct. 1 by 80%. And this is just the UK…

In just the past week, Gazprom (Russia’s largest nat gas company) has halted supply to Italy, Germany and France. Not only that, but they’ve also decided to completely shutdown Nord Stream 1 for three days.

Europe is hostage.

According to one expert, “Europe is sort of bracing itself for things to get worse before they can get better. The big question is just how worse will they get.”

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Recent jobs data has been quite conflicting…

Conference Board’s August sentiment index rose to a 3-month high

Job vacancies unexpectedly rose to 11.2 million in July, close to a record

The ratio of jobs available to unemployed workers, rose to about 2 in July (this is a metric closely watched by JPow)

These 3 datapoints point towards a more aggressive Fed. However, data from the ADP Research Institute and Stanford University say otherwise.

According to a new report, private businesses’ payrolls rose 132,000 this month, the smallest gain since the start of 2021, after a nearly 270,000 increase in July. The median estimate was a 300,000 increase…

Chart That Caught Our Eye

Analyst Team Note:

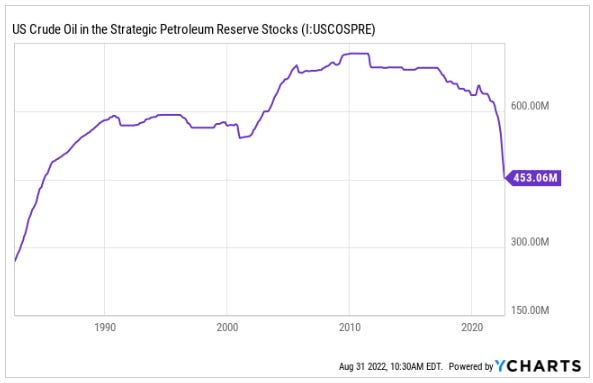

There’s been plenty of headlines from mainstream media regarding the rapid decline in gas prices across the country. But at what cost?

The Strategic Petroleum Reserves (SPR), the United States’ emergency supply of crude oil, is at levels not seen since 1984.

With the SPR release set to end this Fall, what will happen to domestic gas prices?

More importantly (in our opinion), a big concern going into this winter will be oil and energy prices in the EU, which could quite literally break the Eurozone and drive them into recession.

Sentiment Check: Where’s the Capitulation?

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.

Thanks for reading Larry's Analyst Team! Join our email community for 3X market updates like these each week.