8.29.22: Markets digest Jackson Hole. Semiconductors lead tech weakness.

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers: If you haven’t yet already, check out Strategist Larry’s latest exclusive research post shared to all our friends on our public email list here. August was a particularly good month for the Community in terms of actionable opinions shared. Right or wrong, our committment remains the same: high-quality research delivered with integrity.

While there are no guarantees ever in the market, we hope to continue doing so for the remainder of this year - which we expect to get even trickier from here.

Markets may agree or disagree with our views via its constantly changing pricing. But we continue to commit to delivering a holistic overview so that surprises in the market are minimized. If you read our work, we know you’re knowledgeable in markets already (or have a strong desire to learn). We will make you even sharper.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4057.66

KWEB (Chinese Internet) ETF: $30.24

Analyst Team Note:

The post-Jackson Hole tumble in the stock market has been generally unsurprising to us, as we’ve been firmly in the “no Fed pivot” camp.

The stock market likely got way too excited and pre-traded a Fed pivot that was never going to come.

From a technical perspective, this move looks pretty textbook. In June, we reached extreme oversold conditions and in August, we were rejected at the 200-day moving average for the S&P 500 and many key stocks.

What to focus on now?

“While most investors remain preoccupied with the Fed and their next move, we have been more focused on earnings and the risk to forward estimates, particularly as we enter the seasonally weakest time of the year for earnings revisions.” - Morgan Stanley

Macro Chart In Focus

Analyst Team Note:

To see what forward multiple the S&P 500 is trading at, you would take the current SPX price and divide it by consensus forward EPS.

The forward multiple depends on what the consensus forward EPS is. The higher the EPS, the ‘cheaper’ the multiple will appear to be.

Right now, consensus EPS estimates are still extremely elevated and we believe more revisions are to come.

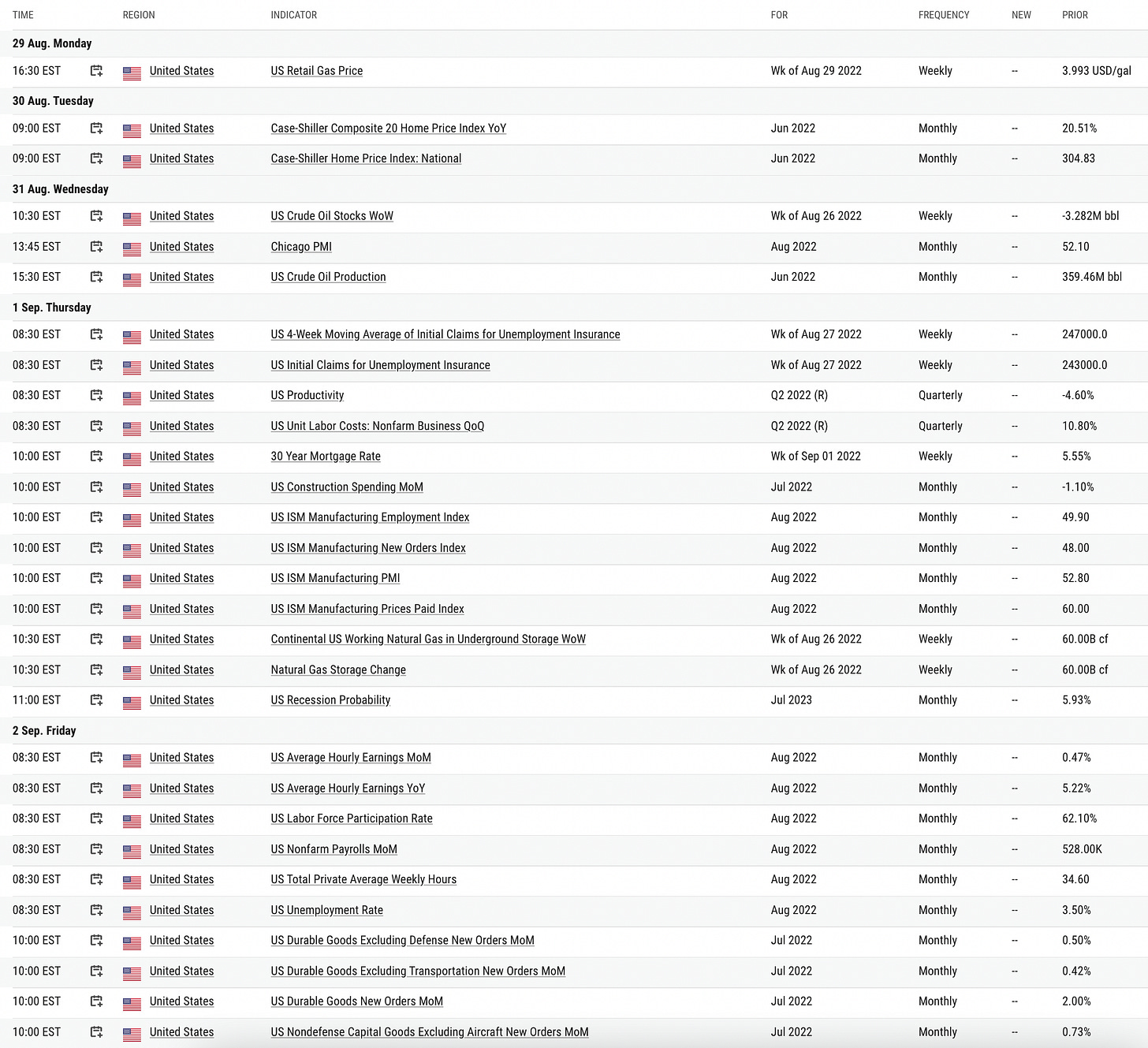

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China’s MoF and the U.S. SEC recently announced that the two regulators have reached preliminary agreements to open access for the U.S. to inspect accounting firms in Hong Kong and Mainland China.

While this is still just a preliminary agreement, this is BIG news and could remove concerns of potential delisting for Chinese companies with ADRs. To read more about the agreement, you can go here.

Chart That Caught Our Eye

Analyst Team Note:

In theory, GDP should equal GDI (gross domestic income), as they are just different ways of measuring overall economic activity. But in practice, the two variables can differ for several reasons, including measurement errors caused by imperfect data and differing seasonal adjustment.

Currently, the gap between GDP and GDI reached a record -$774bn or -3.9% of GDP. History suggests that large statistical discrepancies usually lead to GDP getting revised in the direction of GDI.

So the good news is that a lot of the weakness in 1H 2022 GDP could get revised away in the annual benchmark revisions for 2022.

Source: Bank of America

Sentiment Check: One tick until Greed… Again?

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Support our Newsletter by simply clicking on the Interactive Brokers link below and see how they allow Investors to invest on the Hong Kong listed market. Click the link below and learn about IB! Signing up is up to you - simply check out what they have to offer.