8.28.23: Market Stabilization continues as Big Players push back on the Rates narrative of "Higher for Longer"

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.8% as the Fed just raised rates.

Note to readers from Larry: Hope everyone had a great weekend! 😊 Be on the lookout for more updates from me to get more actionable insights on the market! My latest Daily Market Note is linked here.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4405.71

KWEB (Chinese Internet) ETF: $27.56

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

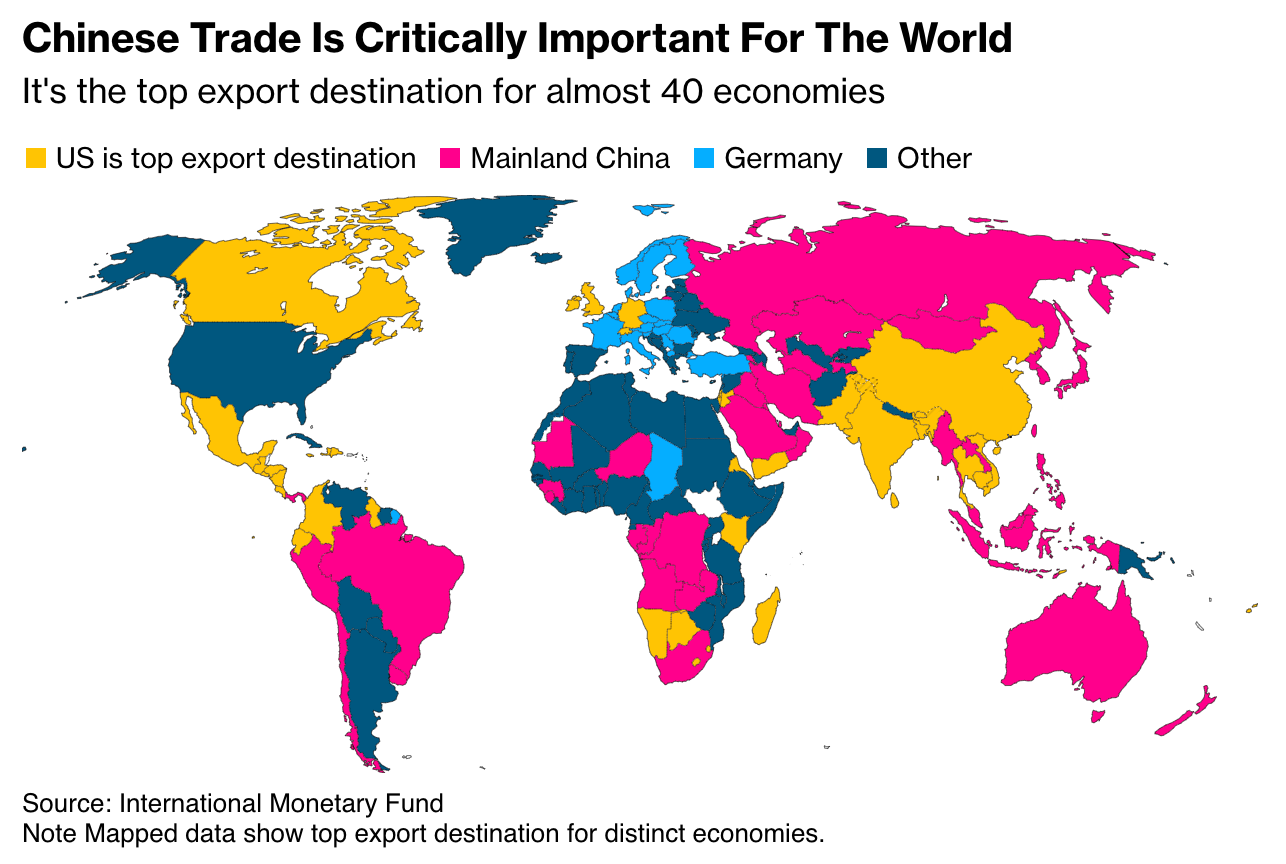

China's recent economic slowdown is raising concerns globally, given that it was expected to drive a third of the world's economic growth this year. Policymakers worldwide are bracing for economic impacts as Chinese demand for various imports like construction materials and electronics falls.

Investors around the world have already pulled more than $10 billion from China's stock market, and both Goldman Sachs and Morgan Stanley have cut their price targets for Chinese stocks.

While the slowdown may bring down global oil prices and offer some benefits to countries battling inflation, the International Monetary Fund warns that a prolonged slowdown in the world's second-largest economy will negatively affect global economic growth.

Asian economies and countries in Africa are experiencing the most immediate impacts, with Japan seeing a drop in exports and central bankers in South Korea and Thailand downgrading growth forecasts due to China's weak recovery. Though some emerging markets like India see potential opportunities to attract foreign investment.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China's producer prices have been contracting for the past 10 months, leading to a decrease in the cost of goods being exported from the country. This deflationary pressure is seen as a positive development for countries grappling with high inflation, including the United States, where the price of Chinese goods at U.S. docks has fallen consistently this year. Economists at Wells Fargo predict that a 'hard landing' for China's economy could reduce the baseline forecast for U.S. consumer inflation in 2025 by 0.7 percentage points to 1.4%.

Chart That Caught Our Eye

Analyst Team Note:

Top executives at major retailers like Dick's Sporting Goods, Dollar Tree, Macy’s, Foot Locker, Home Depot, and Walmart have recently highlighted "shrink," referring to missing inventory, as a significant concern for their businesses.

Share prices for Foot Locker and Dick’s Sporting Goods fell by 33% and 24% after they attributed weaker earnings to increasing rates of theft. Dick’s CEO emphasized that the problem of "organized" retail crime was significantly larger than anticipated. In response, retailers are taking measures such as locking up higher-priced items and implementing anti-theft technology to combat shoplifting.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.