8.25.23: No surprises from Jackson Hole ends up stabilizing sentiment for U.S. Stocks

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

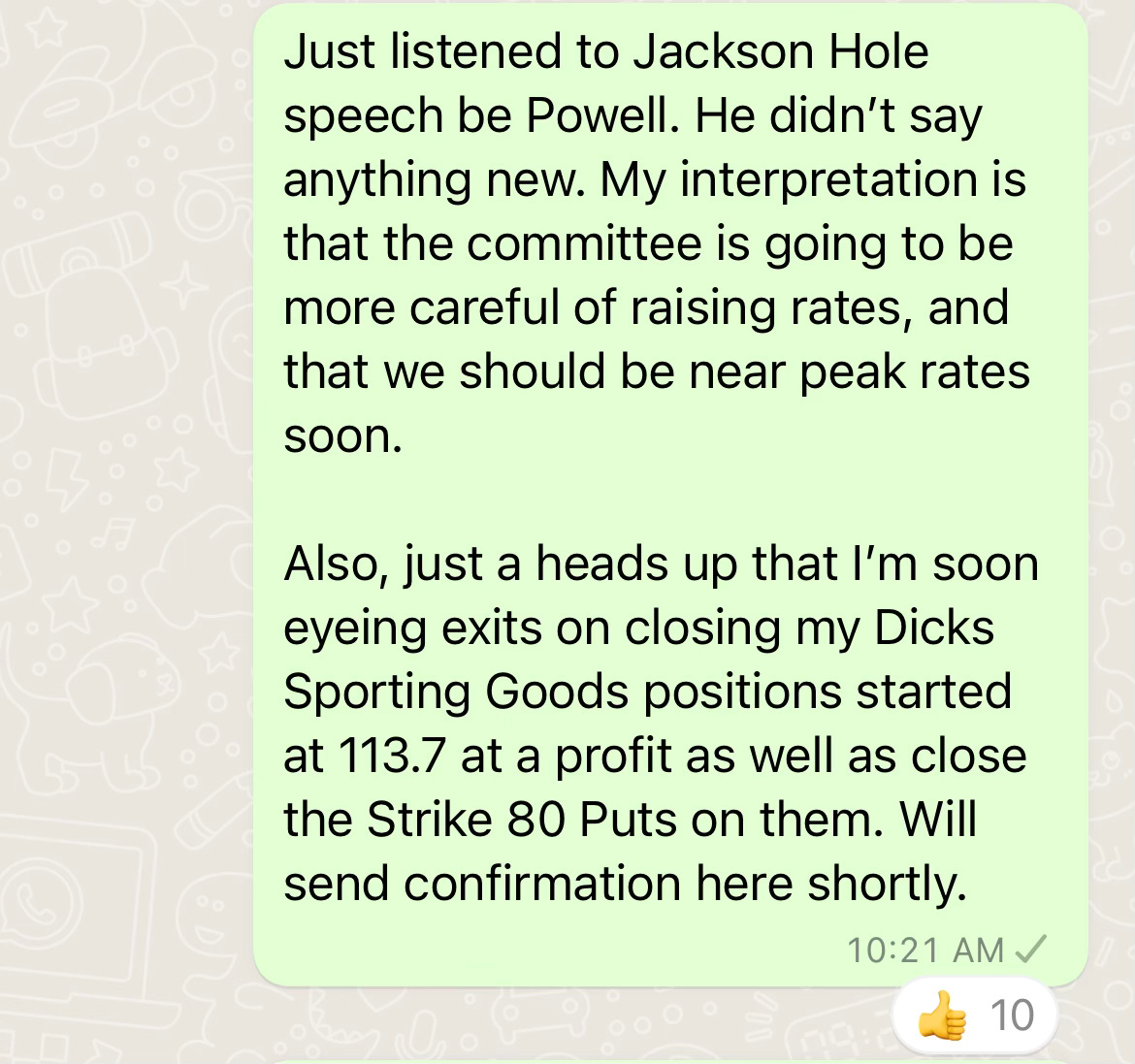

Note to readers from Larry: We don’t need to complicate what happened at Jackson Hole. Jerome kept repeating his stance on the higher for longer narrative but this time being more cautious about rate hikes. Because there were no surprises from his speech, it balanced the market’s sentiment and choppiness gave way to recovery. Here’s what I said inside our Private Group after I listened to it.

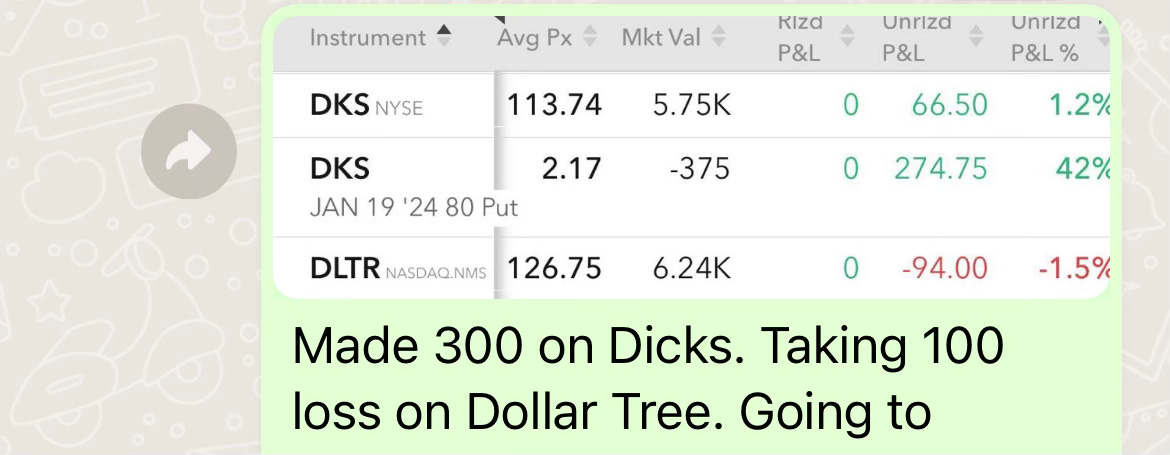

Inside our private group chat, we closed out the Direct Shares and Options position on Dicks Sporting Goods (DKS). The retail sector experienced extreme heat this week, but we did find a small opening yesterday for DKS at 113.7 and took it. I was looking for only a modest 2-4% bounce. I got the return profile I was looking for today and exited the position. Not bad for a holding period of 24 hours. I will take what the market gives me. Can’t ask for too much.

I would love for public readers to join our Community. I put a lot of time & thought into my notes to members to help them extract more profits in the market with Selling Options.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4376.31

KWEB (Chinese Internet) ETF: $27.68

Analyst Team Note:

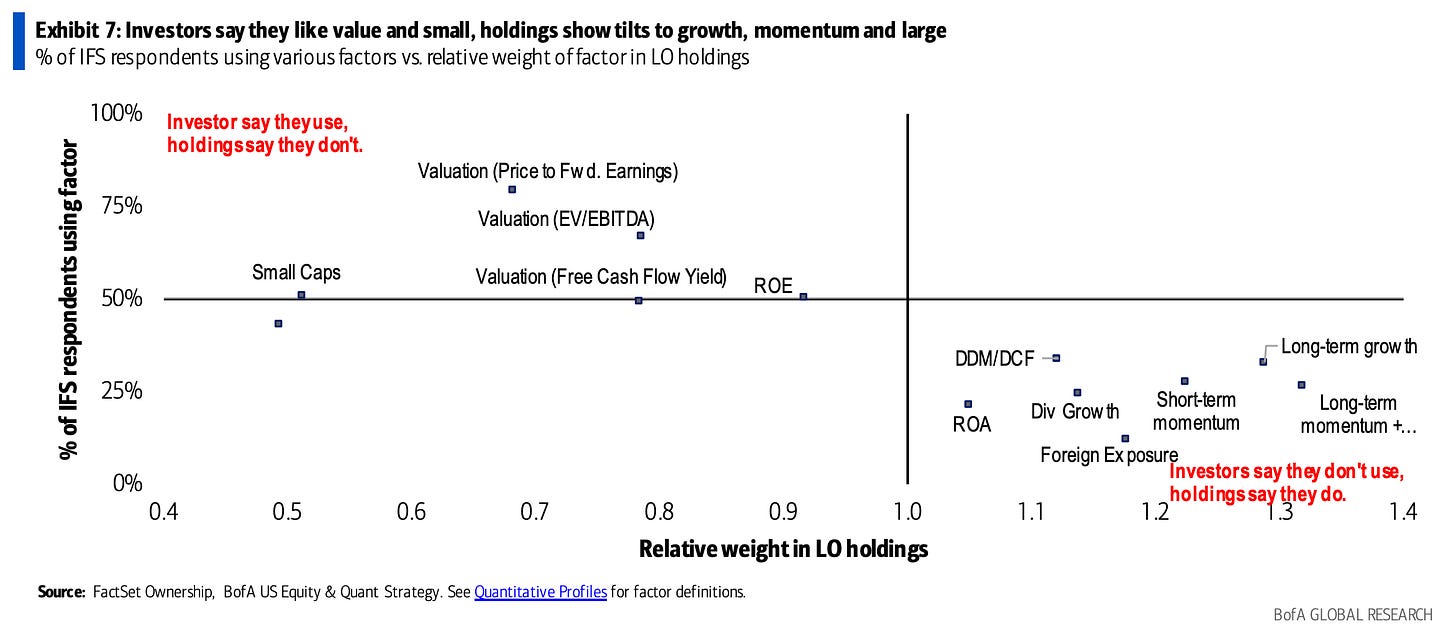

Really funny graph from BofA. Even though investors are claiming to like value stocks and stocks with cheap valuations (P/E, EV/EBITDA, FCF yield, etc), they are actually largely exposed to momentum and growth stocks…

Do as I say, not as I do.

Macro Chart In Focus

Analyst Team Note:

Central bank balance sheets have seen a significant contraction, with a decline of roughly $3 trillion. Despite this, the Nasdaq is pushing towards new record highs.

AI > Everything

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

U.S. home turnover is at its lowest rate in a decade, with only 1% of homes having changed hands this year. A significant factor behind this trend is the advantage of low mortgage rates that current homeowners hold. With 30-year mortgage rates exceeding 7%, many homeowners are reluctant to move and give up their existing rates, especially when over 90% of them have interest rates below 6%.

At the same time, the inventory of available homes for sale is at its lowest since the late 1990s, leading to increased home prices and thus, reduced housing affordability. On the upside, U.S. homeowners are witnessing near-record levels of home equity, with tappable equity reaching $10.5 trillion in June. This increased equity (via HELOCs) provides a potential boost for the economy, as homeowners might tap into it for purposes like home renovations or debt consolidation.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.