8.24.22: China's PBOC continues to defend its economy with further easing, widening the gap between its strategy and the Central Banks of the West

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

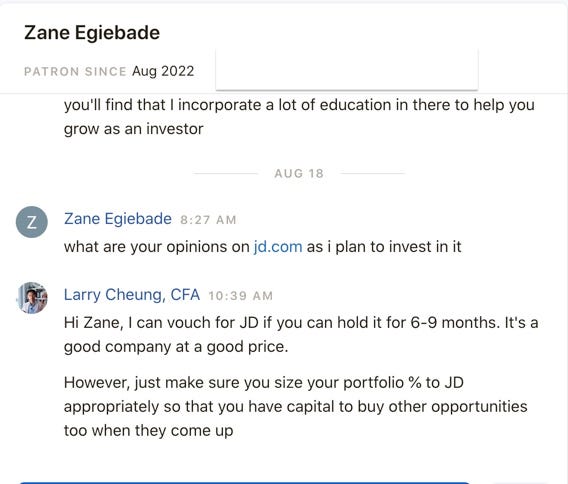

Note to Readers: Strategist Larry has emphasized that China is one of the few areas in the marketplace that offers relative value (discussed publicly and internally). The Chinese economy continues to face incredible challenges, but the PBOC is on its side. Today, the Chinese Internet Sector sees a modest relief rally post PBOC easing. Follow Larry on Twitter, and for longer-form commentary and key levels of actionable strategy, join our Investment Research Community. You will want to know when is the right time to reduce/add risk. Every selloff will eventually bounce. Every rally will also eventually retrace. Learn how to size positions appropriately.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4128.73

KWEB (Chinese Internet) ETF: 28.12

Analyst Team Note:

Last week, during which the S&P 500 fell -1.2%, BofA Securities clients were small net sellers of US equities (-$0.4B) after seven consecutive weeks of net buying.

Buybacks by corporate clients accelerated to their highest weekly level since early Jan. A 1% buyback tax in‘23 (part of the Inflation Reduction Act could cause some pull-forward in buybacks in ‘22.

Last week was the first week since January in which cyclical sectors (in aggregate) saw outflows while defensive sectors saw inflows.

Hedge funds remain more exposed to Value than usual but continued the rotation back toward Growth that began early in 2022. Among sectors, funds added most to net tilts in Info Tech and Consumer Discretionary while cutting positions in Energy and Materials.

Stymied by an uncertain market environment and poor recent returns, hedge funds have cut leverage, shifted back towards Growth, and increased portfolio concentrations in their favorite stocks.

Sources: Bank of America, Goldman Sachs

Macro In Focus: Jackson Hole and the Fed

Analyst Team Note:

Let’s not get it mistaken. The inflation fight is still far from over.

Currently, the interest rate market is pricing in a terminal rate of approximately 3.3% by December, below the June FOMC dot plot median of 3.375%.

The market is pricing in:

Growth concerns are weighing on the Fed’s mind which could lead to a pivot.

Inflation prints will fall in coming months, as evidenced by the drastic decline in CPI swap rates, which suggest one-year-ahead CPI of around 2.9%, fairly close to the Fed’s target.

Yes, growth is slowing which could lead some chance in tone from the Fed. But the fact that the market is pricing in 2.9% CPI a year from now is too optimistic in our view.

With highly variable inflation inputs like the Russia/Ukraine conflict, labor market conditions, and still-present COVID threats, the market’s conviction on inflation is likely misplaced and premature.

First of all, with the labor market still so tight, inflation is unlikely to decline until unemployment picks up. As rough as it sounds, unemployment needs to increase in order to drive down inflation.

So if the Fed is already “pivoting” and the unemployment rate hasn’t even started moving higher, this brings higher risks of the Fed needing to reiterate/emphasize a hawkish tune in the coming months.

Second of all, the factors contributing to falling inflation are also the same factors that are slowing the economy. The risks of recession/hard landing are growing, and as Morgan Stanley points out, “Although a 2022 recession is not our base case, rising risks demand higher risk premiums than those embedded in today’s valuations.”

Source: Morgan Stanley

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

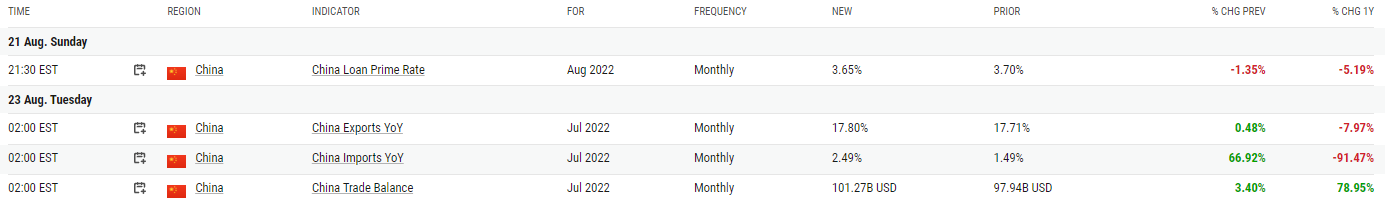

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Mortgage rates have roughly doubled from 3% to 6% over the last year on the back of Fed tightening. This has led to a major slowdown in housing activity. Real residential investment fell 14% annualized in Q2 and July activity data points to an even larger drop in Q3. Housing starts fell 9.6% on the month and permits weakened as well. Sales of existing homes are at 26-month lows and declined across all regions of the country.

Despite this major slowdown in the housing market, prices have held up thus far and will likely only experience a moderate drop going forward. The main reason is that inventories remain tight due to shortages of construction labor and materials.

For example, despite the decline in existing home sales, the number of days on market stands at only 14, down three days from the same time last year. However, we do note that months supply has been steadily improving in the existing home sales market – from the January low of 1.6 to 3.3 in July – which signals some relief going forward.

Source: Bank of America

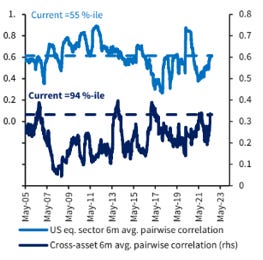

Chart That Caught Our Eye

Analyst Team Note:

Going into the Jackson Hole Fed Meeting, cross-asset correlation has recently increased, and is not too far from the 2013 Taper Tantrum peak when prospects of tightening monetary policy spooked markets.

TLDR: It’s a tough time for effective portfolio diversification.

Source: Barclays

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs