8.23.23: Strong NVDA Earnings likely continues the recovery rally party into Thursday Aug 24th

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Note to Public Readers from Larry: NVDA’s stellar earnings are likely to extend the market’s positive sentiment going into tomorrow’s session. I’ll continue to keep Members updated through my Daily Market Notes and Private Group Chat. Latest note is here. So far so good. Cheers!

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4387.55

KWEB (Chinese Internet) ETF: $27.02

Analyst Team Note:

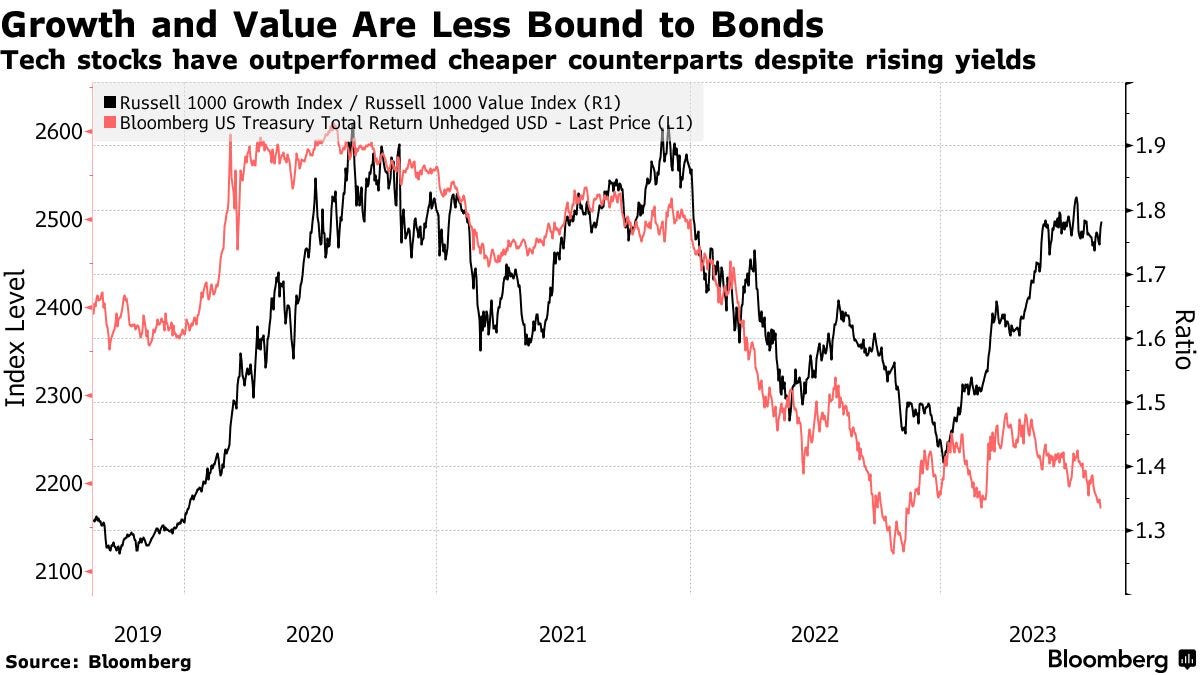

The correlation between growth/value investing strategies and interest rate fluctuations have diminished. In 2022, shares considered undervalued rebounded, while high-potential growth stocks like Tesla and Nvidia faced declines, largely attributed to rising interest rates.

But in 2023, despite a surge in 10-year Treasury yields, tech-focused indices like the Nasdaq 100 have outperformed the broader market.

Macro Chart In Focus

Analyst Team Note:

A recent survey by the Federal Reserve found that the average reservation wage in the US, which is the lowest annual pay a worker would accept for a new job, surged to a record $78,645 in July.

Pay expectations among female workers rose by 11% in the past year, doubling the rate for men. While this increase in wage expectations occurs against a backdrop of a strong labor market with a 3.5% unemployment rate, there are signs of slowing momentum, such as declining chances of receiving multiple job offers. In addition, the survey found that more US workers are thinking about earlier retirements, which might reduce the available labor pool.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

US mortgage applications for home purchases dropped to their lowest level since 1995, as the index fell 5% reflecting the impact of rising mortgage rates.

The rate for a 30-year fixed mortgage surged to 7.31%, the highest since 2000, causing many homeowners to avoid moving. Instead, potential buyers are looking towards new constructions, with new-home sales reaching their highest in over a year.

Chart That Caught Our Eye

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.