8.22.22: Overextended U.S. markets find their new equilibrium ahead of Jackson Hole

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers: As the markets pull back from their recent highs, our internal cautionary opinion issued on August 1st of suggesting a weak sell on SPY and QQQ on an impulsive rally while remaining constructive on China is now materializing (see image below).

That said, we are still in a period of finding market equilibrium. Our opinion has worked out well up until this point in August, but again, we emphasize that a sustainable direction will only be determined after Jackson Hole. Our next steps will be revealed in our September Investment Strategy Report - we encourage you to be a part of our Community to navigate this market with the combination of fundamental, macro, valuation, and technical analysis - all in a manner that is simple to understand for all skill levels.

If you have not had a chance to read Strategist Larry’s recent email note, you can view it here.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4228.48

KWEB (Chinese Internet) ETF: $27.31

Analyst Team Note:

Looking at the 6 bear markets and 17 bear market rallies since 1981, the average bear market rally lasted 43 days and SPX bounced by 14%. The current episode: 63 days and 17%.

September has been the worst month for performance, averaging a negative 1.16% return. Q4 has been the best performing quarter, averaging +3.73% this century.

Rates volatility tends to drive both Credit and Equity vol. Some of the largest increases in Rates vol have come from Fed events and CPI releases. The combination of Jackson Hole, Sept 13 CPI print, and the Sept 21 Fed meeting may drive vol higher over the next few weeks.

The Fed’s focus on maintaining tight financial conditions requires that equities do not rise by too much. As equity valuations climb, financial conditions loosen by definition.

Sources: Goldman Sachs, J.P. Morgan

Macro Chart In Focus

Analyst Team Note:

Last week, the PBoC delivered a surprise rate cut. China’s policy stance has gradually moved from being restrictive at the start of last year towards a more accommodative stance. As a result, Chinese money supply has strongly increased. The monetary divergence between China and DM countries continues…

Source: J.P. Morgan

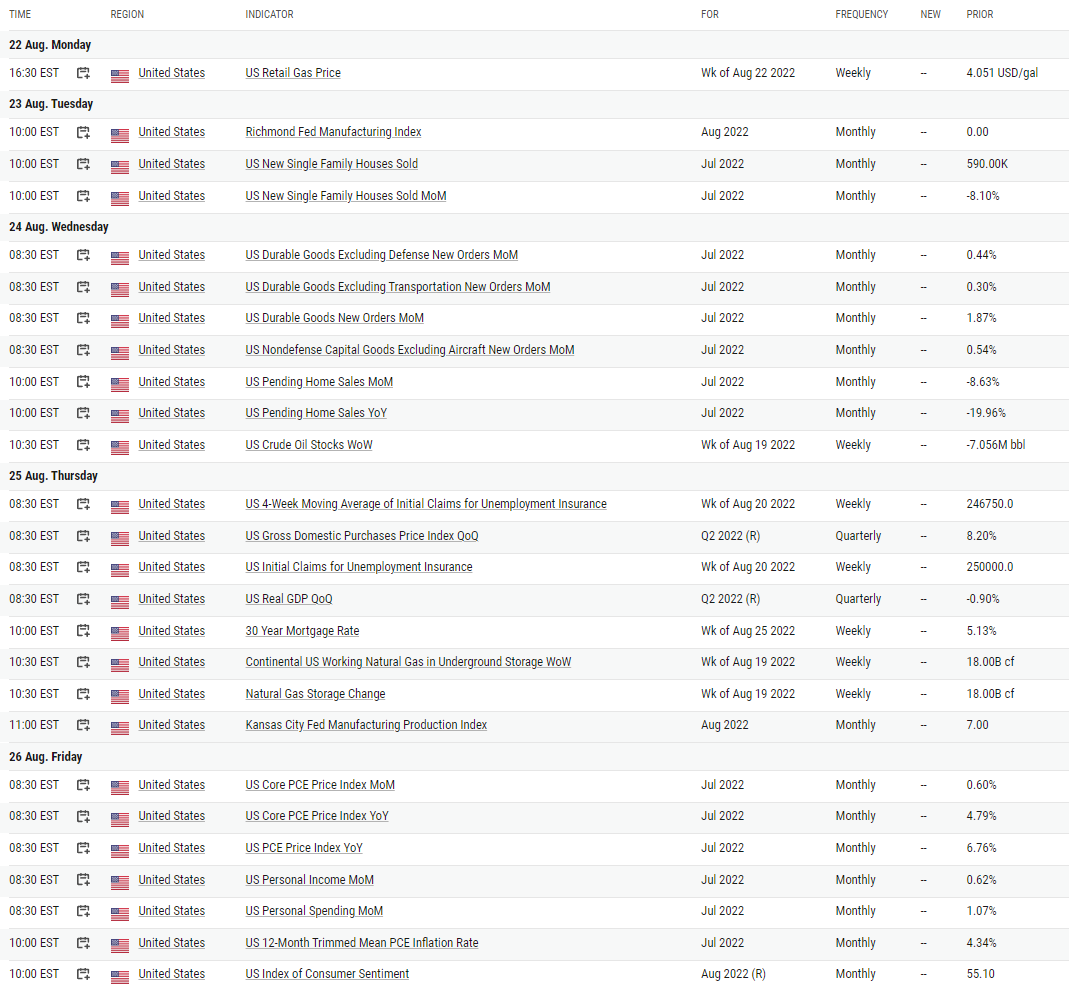

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The Jackson Hole Fed meeting will be the center of attention this week.

This Friday, Jerome Powell will speak about rate policy and inflation, though specific bps of hikes will likely be avoided. JPow has a chance here to reset expectations for markets. As mentioned earlier in this newsletter, financial conditions have loosened as the market staged its recent rally.

How much will Powell micro-manage financial conditions?

Chart That Caught Our Eye

Analyst Team Note:

When screening stocks…

The market has given less credit to sales and more credit to earnings and free cash during high inflation regimes.

Profitability-based metrics are increasingly becoming more important especially amid tightening financial conditions (sales multiples are less important than they were in 2020/2021).

“We continue to recommend focusing on companies with low EV-to-Free Cash Flow with a rising cash yield.” - Bank of America

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Our latest sentiment surrounding valuation in U.S. and China (August 19th) - on Twitter (follow Strategist Larry)