8.21.23: Tech stages the comeback I was looking for from last week. Will it last?

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.8% as the Fed just raised rates.

Note to Public Readers from Larry: I am excited to onboard Members into my Private Group Chat tomorrow.

Please remember that I do not ever start a message to people 1:1 Directly on Discord or Instagram. There are an increasing number of sophisticated impersonators. When in doubt, please ask me @LarryCheungCFA on Instagram. I have one account on IG only.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4369.71

KWEB (Chinese Internet) ETF: $26.86

Analyst Team Note:

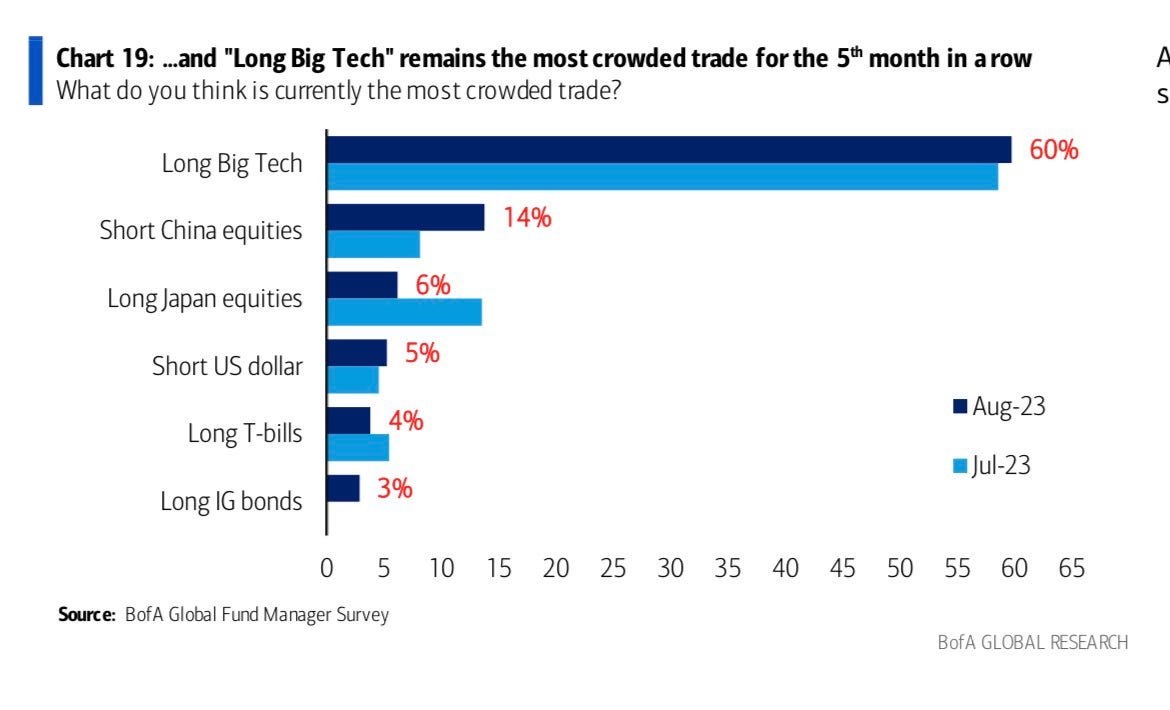

Despite the recent drop in Chinese stocks and coordinated policy measures unable to boost market sentiment, investors are showing increased optimism towards Chinese stocks.

The China Bull 3x leveraged ETF has seen an inflow of $160 million in August, setting it on course for a monthly record. On the other hand, its bearish counterpart experienced a withdrawal of $47 million.

Shorting China is becoming a crowded trade, which means this recent inflow could just be to offset/reduce existing short exposure to China.

Macro Chart In Focus: Soft Landing Coming??

Analyst Team Note:

Confidence among economists regarding the Federal Reserve's ability to achieve a soft landing for the U.S. economy has increased. According to the National Association for Business Economics, approximately 70% of economists are now optimistic that the Fed can reduce inflation to its 2% target without causing a recession.

Additionally, nearly 75% believe that the current monetary policy is appropriate, a rise from the 60% who felt the same way in March.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

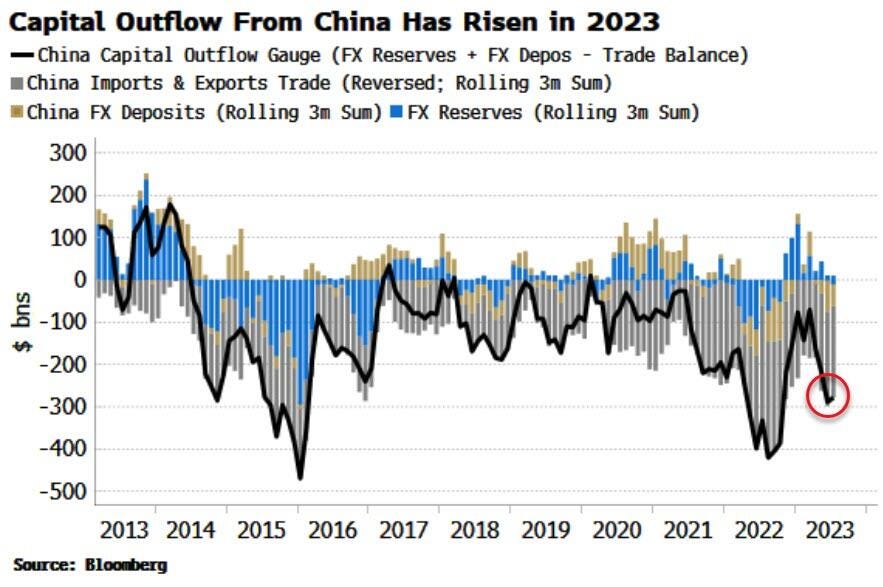

Dim prospects for domestic growth continue to hammer China.

Chart That Caught Our Eye

Analyst Team Note:

Baby Boomers own half of the US’ $156 trillion in assets despite making up 21% of the country’s population. Their biggest category of assets is Equities & Mutual Funds, where they own 56% of the national total. Millennials, on the other hand, have just 2%.

Where millennials do have more wealth is in Real Estate, with 12% of the national total, suggesting that millennials have foregone investing in financial assets in order to purchase a home.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.