8.19.23: Markets end another challenging week for Tech. Better days ahead?

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.8% as the Fed just raised rates.

Note to Public Readers from Larry: Since the beginning of August, the Nasdaq-100 QQQ has shed about 8% off its 2023 High of 388 to end the week at 358. A myriad of issues combined with seasonality is beginning to turn the sentiment tide, but this should be largely well anticipated for readers of my work.

Before any sustained move lower, I discussed my belief that we would see some type of bounce as discussed in my Thursday Daily Market Note. We saw Friday experience a comeback session where markets rebounded from -1% during the intraday session to end near the flat line. That type of price action is characterized as a bounce. While a one day intraday recovery offers little reprieve from the tough August most investors are going through, it demonstrates that bit by bit, commentary such as this allows for more optimal mindset and positioning as the markets’s choppiness begins to make a portion of Investors queasy.

More strategy/research/insights to come - read my latest members’ note here (sent out M-Thurs) - have a great weekend.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4370.36

KWEB (Chinese Internet) ETF: 27.87

Analyst Team Note:

Trouble brewing in China…

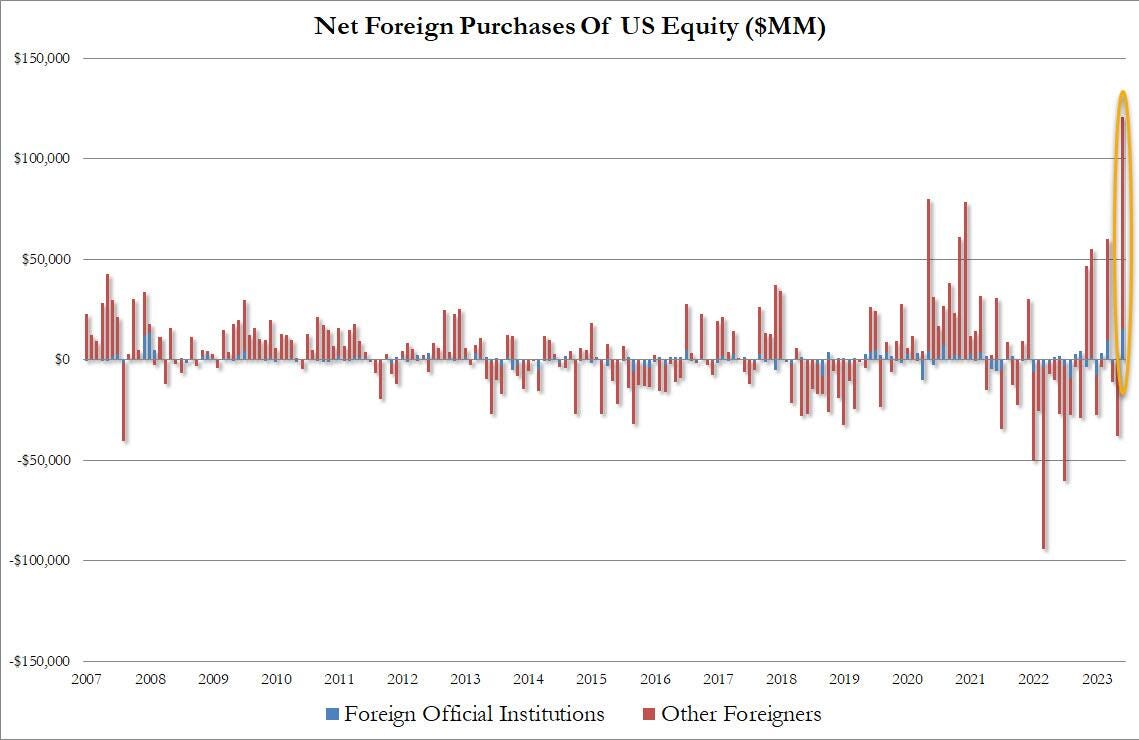

Macro Chart In Focus

Analyst Team Note:

In June, the amount of US stocks purchases by foreigners exploded to an all time high $120.6 billion.

Foreigners also bought $66.4BN in US Treasuries, $25BN in Agencies, and $32BN in Corporate bonds, for a total of $244BN in total long-term assets purchase by foreigners, the biggest monthly total on record.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Borrowers with poor credit histories are experiencing heightened stress as the 60-day-plus delinquency rate for subprime auto loans reached 5.37% in June, the highest June level ever, according to S&P Global Ratings. However, the current financial distress among consumers doesn't match the previous instances when card or auto loan delinquencies reached these levels. The number of new foreclosures and bankruptcies remains considerably below pre-pandemic figures, with some foreclosure relief measures still in place.

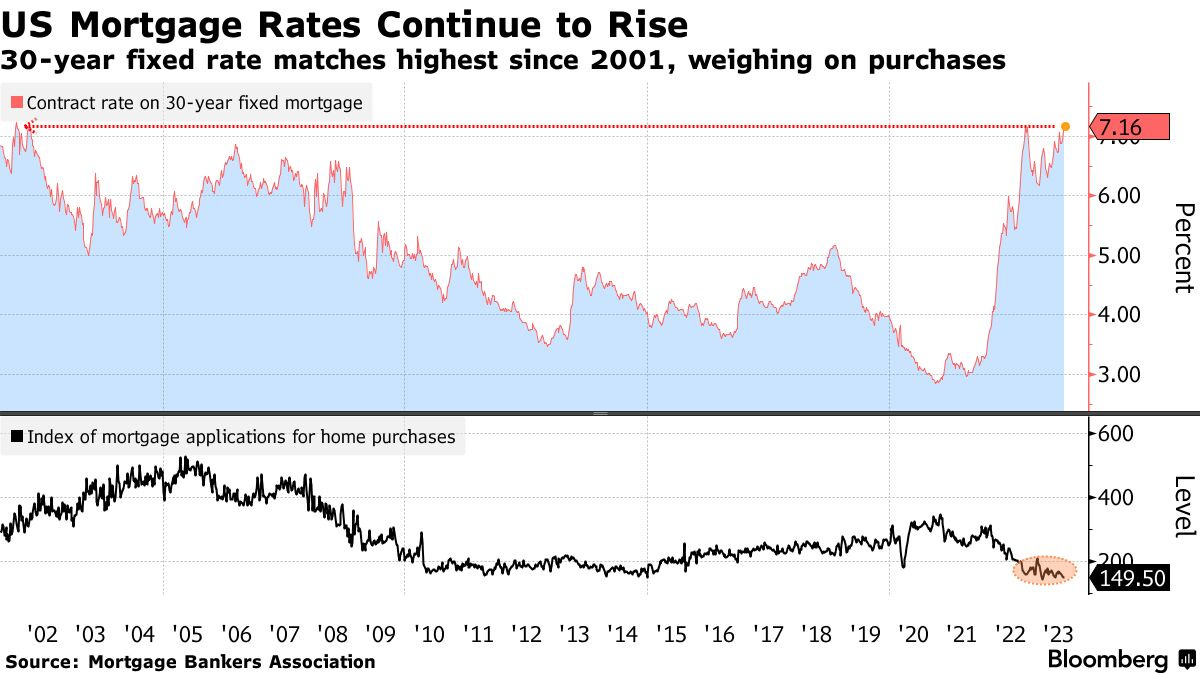

Chart That Caught Our Eye

Analyst Team Note:

The 30-year mortgage rate increased to 7.16%, its highest since 2001, impacting both property sales and refinancing activities.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.