8.19.22: An important Options Expiration date occurred today, potentially ending suppressed volatility.

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers: As we get closer to the all-important Jackson Hole event, we recommend investors (from all experience levels) to join our Community to stay on top of what the Fed is thinking. You can see on Strategist Larry’s Instagram stories here that he has been very proactive with advocating for caution/risk-reduction as markets remain out of sync with fundamental and macro considerations. In addition to market strategy, our work integrates elements of investor’s education. All investors can use our opinions as a valued second opinion to their primary biases.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4283.74

KWEB (Chinese Internet) ETF: $27.47

Analyst Team Note:

We’ve extensively talked both in the public newsletter here and in our Patreon community that this rally has been mostly due to short covering and NOT long buying.

Now the covering is getting quite extreme (a 2z event globally over the past 20 days and a >3z event in N. America), while the rally is one that hedge funds are not trying to chase with longs.

This would suggest that few investors find the market fundamentally attractive.

However, given positioning is still relatively low overall and few have been willing to chase the rally, historical data would suggest the market can keep moving higher over the next few weeks to months, absent a meaningful negative catalyst.

However, it wouldn’t surprise us to see some choppiness given how extreme the short covering has been and our view that it’s unlikely to be sustained at this magnitude for a prolonged period of time.

Source: J.P. Morgan Prime Services

Macro Chart In Focus

Analyst Team Note:

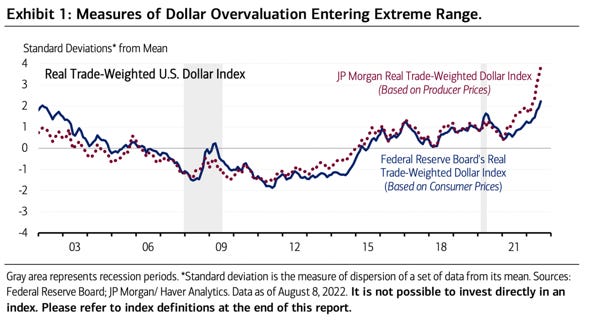

The dollar is getting key support from rising interest rates as the Fed tries to rein inflation in despite the growing risk of recession. In doing so, the Fed is rebuilding its battered credibility, which is a critical element fortifying the dollar’s backbone.

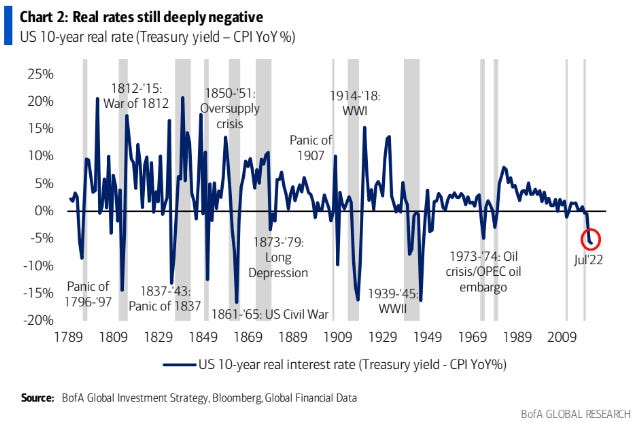

Complete success, however, is still a long way off. Inflation-adjusted or real official interest rates are deeply negative, which suggests much more aggressive tightening will be necessary in order to push real rates into positive territory and bring inflation down sustainably—despite the potential negative effect on economic growth.

Global economic, financial and geopolitical uncertainty are keeping bets against the dollar contained, especially given its persistent ability to surprise to the upside in recent years.

Source: Merrill Lynch

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Median rent payments for Bank of America customers increased by 7.4% YoY in July, a slight pickup from the 7.2% YoY in June.

Rent inflation is an important area of focus because 34% of US households are renters and, according to data from the Bureau of Labor Statistics, consumers spend 7% of their aggregate annual expenditure on rent.

Chart That Caught Our Eye

Analyst Team Note:

“The Biggest Picture: real rates still deeply negative, Fed tightening so limp (for every $100 of bonds Fed bought during COVID, $5tn in total, they have sold just $2), very few fear Fed (think “pivot” and return of meme stocks); yet last time Fed ended hiking cycle with negative real rates was 1954 & even assuming CPI gains halve next 6 months, inflation will still be 5-6% next spring; whether Fed knows or not, they’re nowhere near done".” - Michael Hartnett, Chief Investment Strategist at BofA

Back to Neutral… “Greed” was short-lived…

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs