8.17.22: The Fed Minutes Leave Investors Guessing their Next Step.

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers: We are actively studying the July Fed Minutes to assess any clues on the Fed’s next steps. We continue to believe the Fed will not be friendly to the market as long as Core PCE U.S. Inflation is significantly greater than 4% (based on Buyside Surveys - discussed inside our Investment Community).

Follow Strategist Larry on Instagram for tactical commentary, motivational perspective, and personal growth content discussed on his Instagram Stories

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe. Hosting your shares on the HK-listed market will avoid US delisting issues if they materialize.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

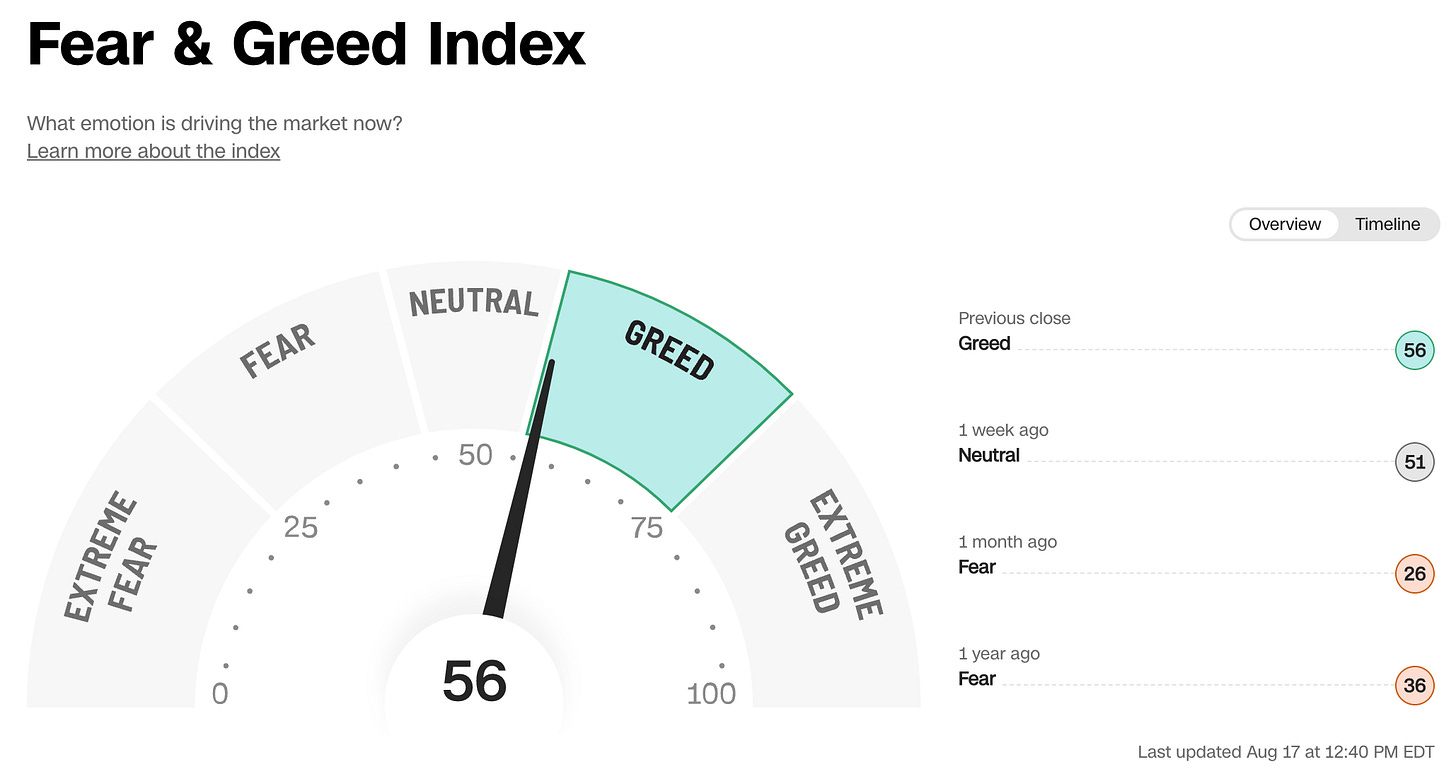

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

Meme stocks are back (look at BBBY).

From this, we can infer that there is still way too much liquidity in the system and that the “high-risk” crowd is back in action.

JPM’s Data Intelligence group noted that social media posts regarding meme stocks have increased to the 79th percentile, the highest this year.

So much for tighter financial conditions…

Source: J.P. Morgan

Macro Chart In Focus

Analyst Team Note:

Regular readers of the newsletter will know that we’ve been extremely cautious about this recent rally and its sustainability.

One rule that BofA noted today is the “Rule of 20”: the sum of CPI YoY + trailing P/E has been lower than 20 every time the market bottomed. We are clearly nowhere near <20.

“Outside of inflation falling to 0%, or the S&P 500 falling to 2500, an earnings surprise of 50% would be required to satisfy the Rule of 20, while consensus is forecasting an aggressive and we think unachievable 8% growth rate in 2023 already.”

“Stocks are still not inexpensive despite the bear market. In fact, they are more expensive after the S&P 500’s 17% rally from its June low, driven by a drop in the cost of equity (real rates + ERP). Our analysis of the ERP indicates a 20% likelihood of a recession is now priced in vs. 36% in June. In March, stocks priced in a 75% probability of recession.”

Source: Bank of America

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

US retail sales stagnated last month on declines in auto purchases and gasoline prices, though gains in other categories suggested consumer spending remains resilient.

The value of overall retail purchases was flat last month after a revised 0.8% jump in June, Commerce Department data showed Wednesday. Excluding gasoline and autos, retail sales rose a better-than-expected 0.7%. The figures aren’t adjusted for inflation.

Source: Bloomberg

“As the year’s progressed, we’ve seen more pronounced consumer shifts and trade down activity... The rising costs for essential items and customers reprioritization spend led to significant mix shifts in our business.” -- John David Rainey, chief financial officer of Walmart Inc., on an Aug. 16 earnings call

“It’s critically important that you all understand we are not currently seeing any measurable reduction in customer spending or any evidence of customers trading down.” -- Howard Schultz, interim CEO of Starbucks Corp., on an Aug. 2 earnings call

These executives are talking about different consumers. Higher-income consumers are still doing fine while the lower-income consumers are trading down to keep up with inflation.

Source: Seeking Alpha

Chart That Caught Our Eye

Analyst Team Note:

The net percentage of fund managers that think ‘Growth’ will outperform ‘Value’ over the next 12 months turned positive for the 1st time since August 2020

Source: Bank of America

Sentiment Check: Greed, Greed, Greed

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs