8.15.22: The S&P 500 is within .5% of its 200 Moving Day Average, a signal that is closely watched by the Buyside. Bears are getting nervous.

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers: Fully positioned Bears are close to being flushed out of their positions. Once Bears become Bulls, caution is advised.

We intend to provide tremendous guidance when volatility returns. Prepare for that moment ahead of time by studying the combination of Fundamentals, Macro, and Technical analysis. At this moment, markets are overextended but momentum continues to be strongly positive. Stay on guard. Formulate a Plan. Fight complacency.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

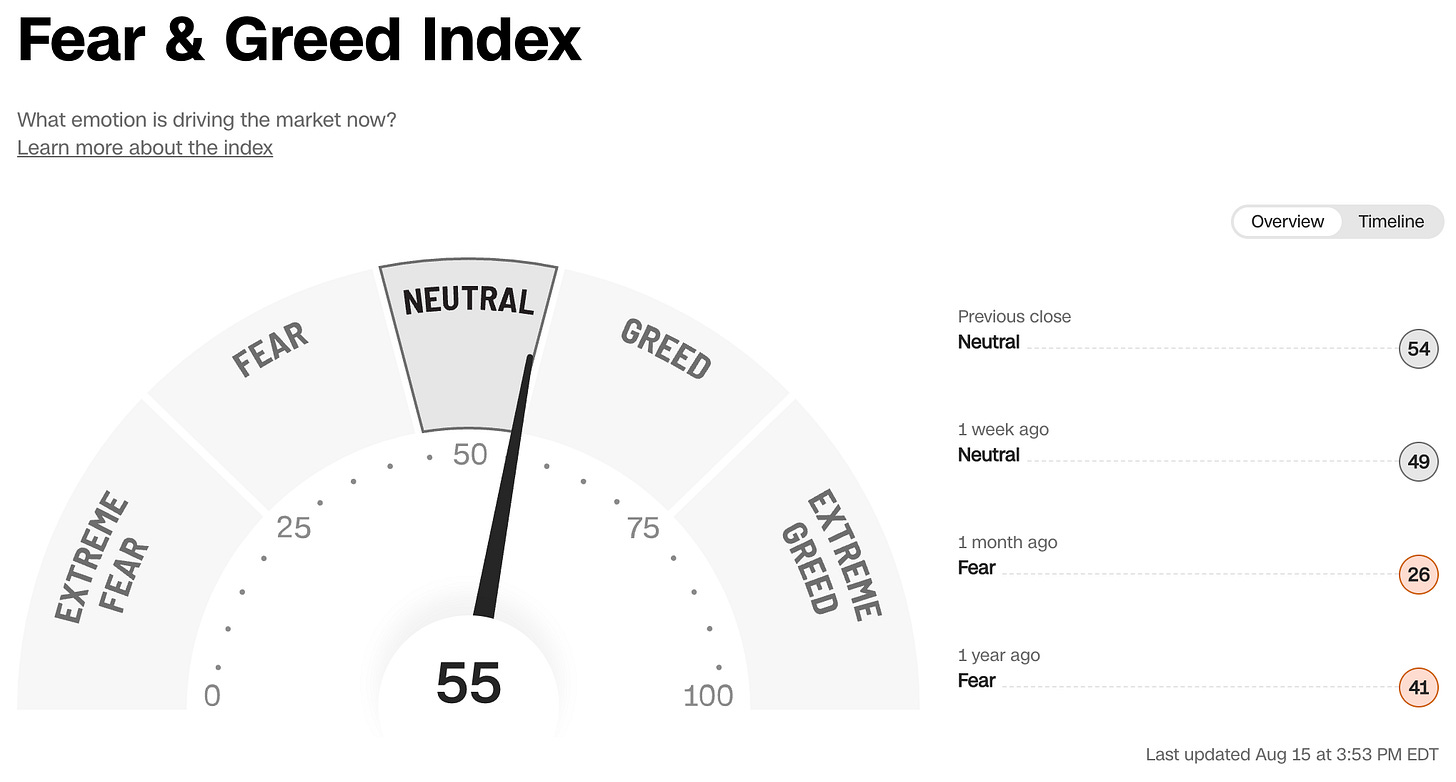

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

The 200d MA is 4330 so there would likely be significant upside buying should we get there.

Volatility collapsed after the CPI print. Fed days and CPI have been the primary drivers of rate volatility this year, so we may see volatility lower and VIX lower in the near-term, which would support another leg higher in stocks.

The bond market has repriced the probability of a 75bps hike in Sept from 80% to ~35%. Keep an eye on the Aug 17 Retail Sales and Aug 23 PMI prints; in-line to stronger prints here may mean that the Fed continues to front-load hikes.

Source: J.P. Morgan

Macro Chart In Focus

Analyst Team Note:

Even after a bear market, stocks are not inexpensive, especially relative to inflation. Based on the strong relationship between trailing P/E and CPI, today’s P/E 19.4x implies 2.6% CPI (and 8.5% CPI implies 11x on trailing P/E).

Either the S&P 500 EPS needs to be higher or the price of the S&P 500 needs to much much lower.

The refrain we hear from bulls is that corporates did better than expected in 2Q - the S&P 500 grew sales by 15%! But most of that was driven by Energy’s +77% YoY sales growth. Just 53% of S&P 500 companies had sales growth that cleared inflation; the most crowded, growth-y sectors (Comm. Services and Tech) reported negative real sales growth.

Since 1964, sales growth has been strongly correlated with CPI (even slowing CPI) but earnings have not been. Sales growth is easy when inflation is high…

Source: Bank of America

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

In China…

Industrial production rose 3.8% from a year ago, the National Bureau of Statistics said, lower than June’s 3.9% and missing economists’ forecast of a 4.3% increase.

Retail sales growth slowed to 2.7% in July, lower than economists’ projection of 4.9%

Fixed-asset investment gained 5.7% in the first seven months of the year, also worse than the 6.2% projected by economists. Property investment contracted 6.4% in the period.

The surveyed jobless rate fell to 5.4% from 5.5%, while the youth unemployment rate hit a record 20%.

Source: Bloomberg

Chart That Caught Our Eye

Analyst Team Note:

The sharp downside surprise in China’s July activity shows the economy lost momentum after only a brief reopening-driven rebound in June.

Beijing’s attempts to boost the economy has centered on encouraging local governments to borrow to fund infrastructure. Those efforts saw some success in July, but the scale of investment wasn’t enough to compensate for the sharp decline in housing investment.

Coming after extremely weak credit for July, these figures support the PBOC’s decision to cut rates - and we don’t think the central bank is done yet.

Source: Bloomberg

Sentiment Check

Analyst Team Note:

One tick away from “Greed”

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs