8.14.23: Tech bounce back puts a pause on 2 Weeks of Nasdaq Selling

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.8% as the Fed just raised rates.

Note to Public Readers from Larry: Markets firm up after a soft 2 weeks for the tech sector. Whether the rally has legs or not is a story we’ll continue to follow. In the meantime, we continue to focus on generating income in the market with options selling premium setups. I sincerely believe learning Options is a strong supplement for long-term investors. I have designed our Community so that the cost to learn is low yet the benefit of doing is quite high. Come join us!

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our public emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4464.05

KWEB (Chinese Internet) ETF:

Analyst Team Note:

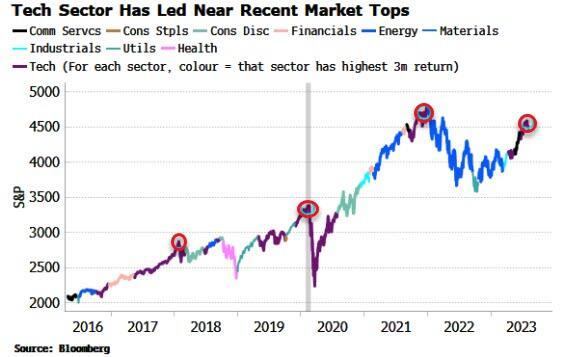

The tech sector, despite its recent lag, has shown prominence in the past three months driven by enthusiasm for AI. However historical patterns suggest that such peaks often precede market corrections, similar to the mild correction in early 2018 and the one in 2022.

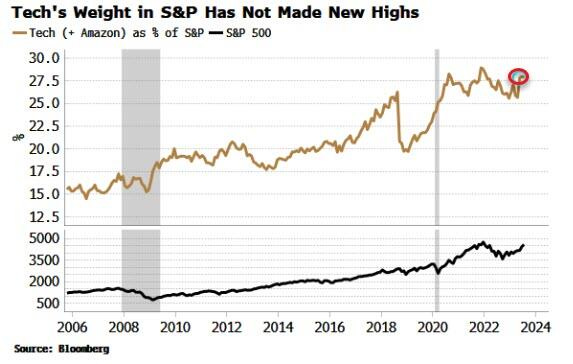

In addition, the combined influence of the tech sector and Amazon in the S&P 500 has not surpassed its November 2021 high, hinting at potential market vulnerabilities.

Macro Chart In Focus

Analyst Team Note:

Federal student loan payments are set to resume with interest accruals starting on September 1 and payments due in October.

According to a Credit Karma survey, 56% of borrowers will have to choose between paying their loans or essentials such as rent and groceries. Even though most of the pandemic's economic impact has subsided and inflation has decreased, the resumption of these payments is poised to strain households that have gained some financial stability in recent years.

The burden is not just on low earners; while 68% of those with incomes under $50,000 express concerns, 45% of borrowers with household incomes of $100,000 or more anticipate facing similar challenges. Although there are options like the income-driven repayment plan, only 34% of borrowers plan to use such methods, and a staggering 45% expect their loans to become delinquent post-forbearance.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

Goldman Sachs is predicting that the Federal Reserve will begin interest rate cuts by the end of June next year. Although there's expectations that the FOMC will forgo a rate hike in the upcoming month due to indications of slowing core inflation, Goldman remains uncertain about the exact pace of these reductions, forecasting 25 basis points of cuts per quarter. Recent data revealed a slower US inflation rate at 3.2% with the core CPI at 4.7%.

Since March 2022, the Fed had raised their target for the benchmark rate to 5.25%-5.5%, but Goldman expects it to stabilize around 3-3.25% in the future.

Chart That Caught Our Eye

Analyst Team Note:

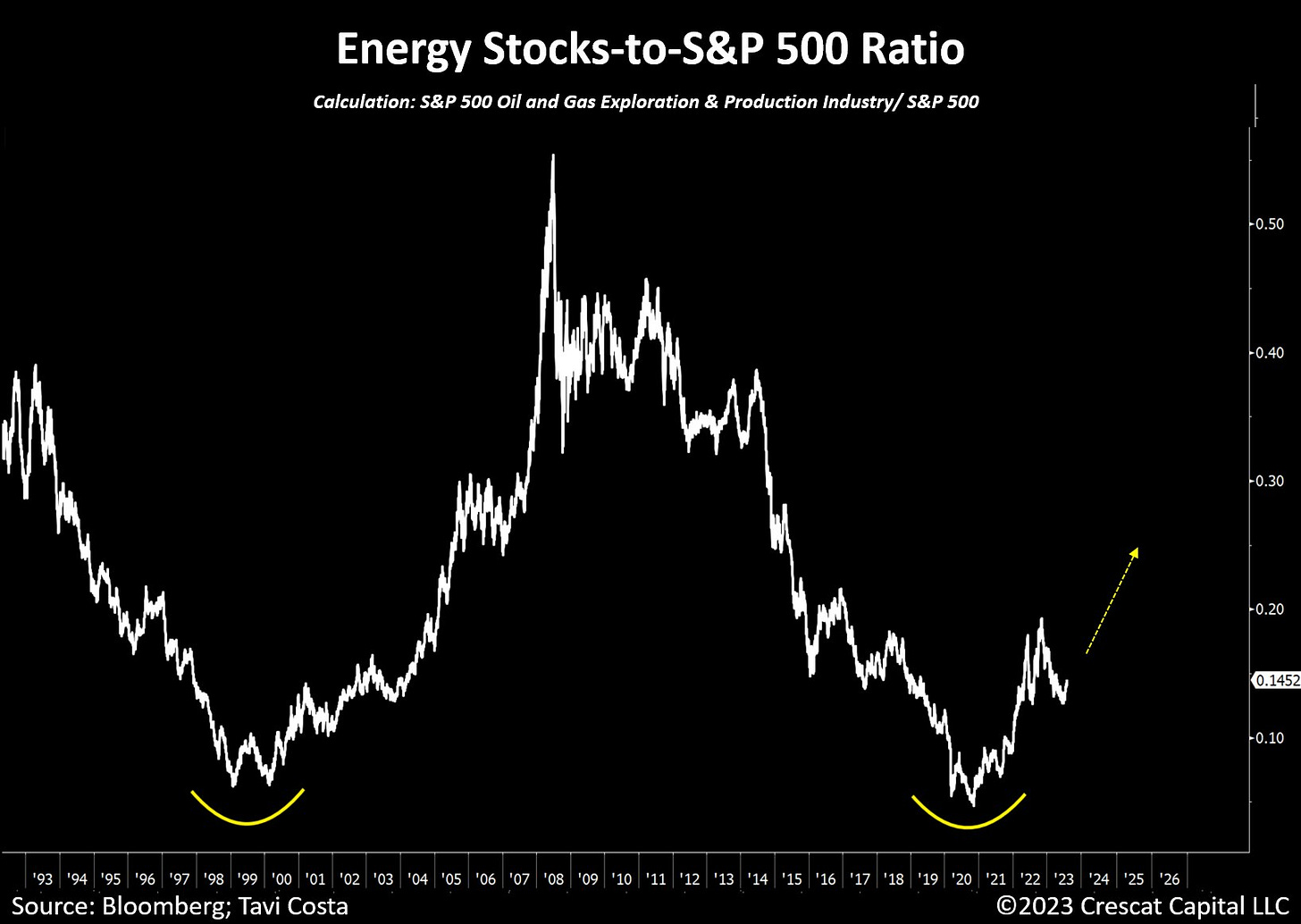

The energy sector represents over 12% of S&P 500 earnings but only about 4% of S&P 500 market cap, the widest gap since 2009. The last time Energy's earnings weight was above 12% was in 2013. Back then, the sector made up over 10% of the index's market cap.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.