7.8.24: 58% of S&P 500 Returns Come From 10 Stocks

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,567.72

KWEB (Chinese Internet) ETF: $27.34

Analyst Team Note:

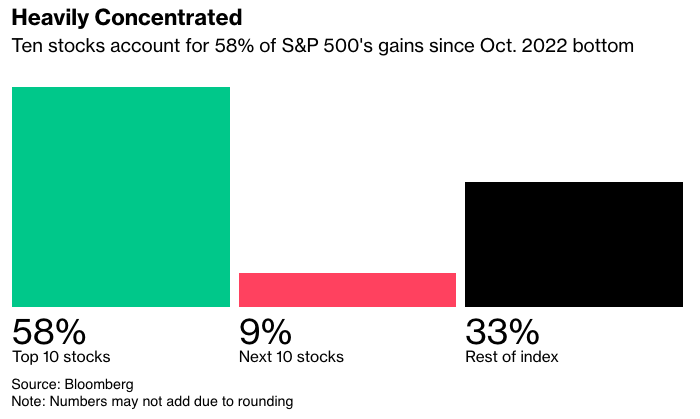

The S&P 500 has experienced significant gains since October 2022, with a 55% increase.

However, this growth has been heavily concentrated, with 58% of the advance coming from just the top 10 stocks in the index.

Ed Clissold from Ned Davis Research notes that the current streak without a 2% down day is one of the longest since 1928.

Macro Chart In Focus

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

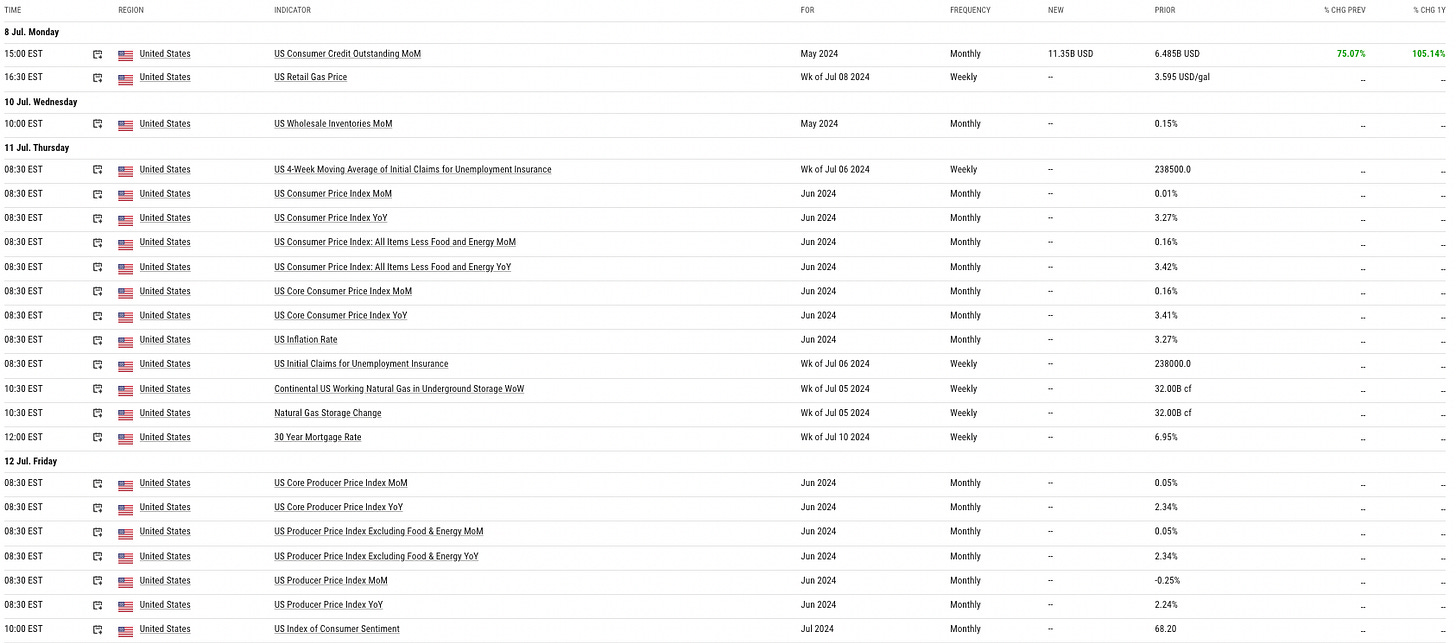

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

According to the Federal Reserve Bank of New York's Survey of Consumer Expectations, U.S. consumers' near-term inflation expectations declined for the second consecutive month in June.

The survey showed that consumers expect prices to rise at an annual rate of 3% over the next year, down from 3.2% in May. This decline aligns with recent data indicating a deceleration in inflation after a stubborn first quarter.

Chart That Caught Our Eye

Analyst Team Note:

JPMorgan Chase, Wells Fargo, and Citigroup are set to kick off the US banks' earnings season on Friday, with traders showing optimism and little concern about potential market stumbles.

The stocks of these banks have surged over 22% this year, and options market data indicates low hedging costs, suggesting minimal worry about the rally faltering.

Overall, the setup for banks looks favorable over the next 18 months, with anticipated interest rate cuts, potential decreases in funding costs, and ongoing economic expansion expected to boost loan growth.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.