7.8.22: Getting ready for Inflation CPI coming on July 13th

Key U.S. and China brief market notes by Larry's Analyst Staff Team

Note to Readers: This is a new concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3902.62

KWEB (Chinese Internet) ETF: 32.89

Analyst Team Note:

Bloomberg reported yesterday that China’s Ministry of Finance is considering allowing local governments to sell $220 billion worth of bonds, a massive acceleration of infrastructure funding.

Caixin services PMI surged to 54.5 in June (from 41.4), the largest single-month rise since April 2020. Strong reopening so far.

“Geopolitical and Covid shocks inflicted a 32% peak-to-trough drawdown on Chinese stocks in 1Q, but MSCI China has rebounded 24% from its lows in mid-March and has lost only 13% ytd, posting the strongest 3m outperformance vs. SPX in the past decade at a time when global equities endured the worst 1H returns since 1970.” - Goldman Sachs

Macro Chart In Focus

Analyst Team Note:

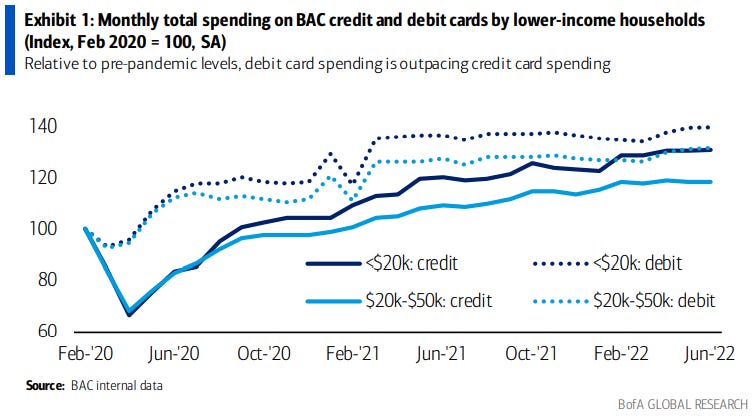

A common viewpoint shared on financial media is whether or not lower-income households with liquidity constraints are being forced to spend more on their credit cards because of inflation.

According to BofA card data, while credit card spending has modestly outpaced debit card spending for lower-income cohorts over the last year, debit card spending has grown much more relative to pre-pandemic levels.

“The share of credit cards in total card spending is only up slightly since end-2021 for all income cohorts, and is below the pre-pandemic share for all but the top income cohort.” - BofA

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

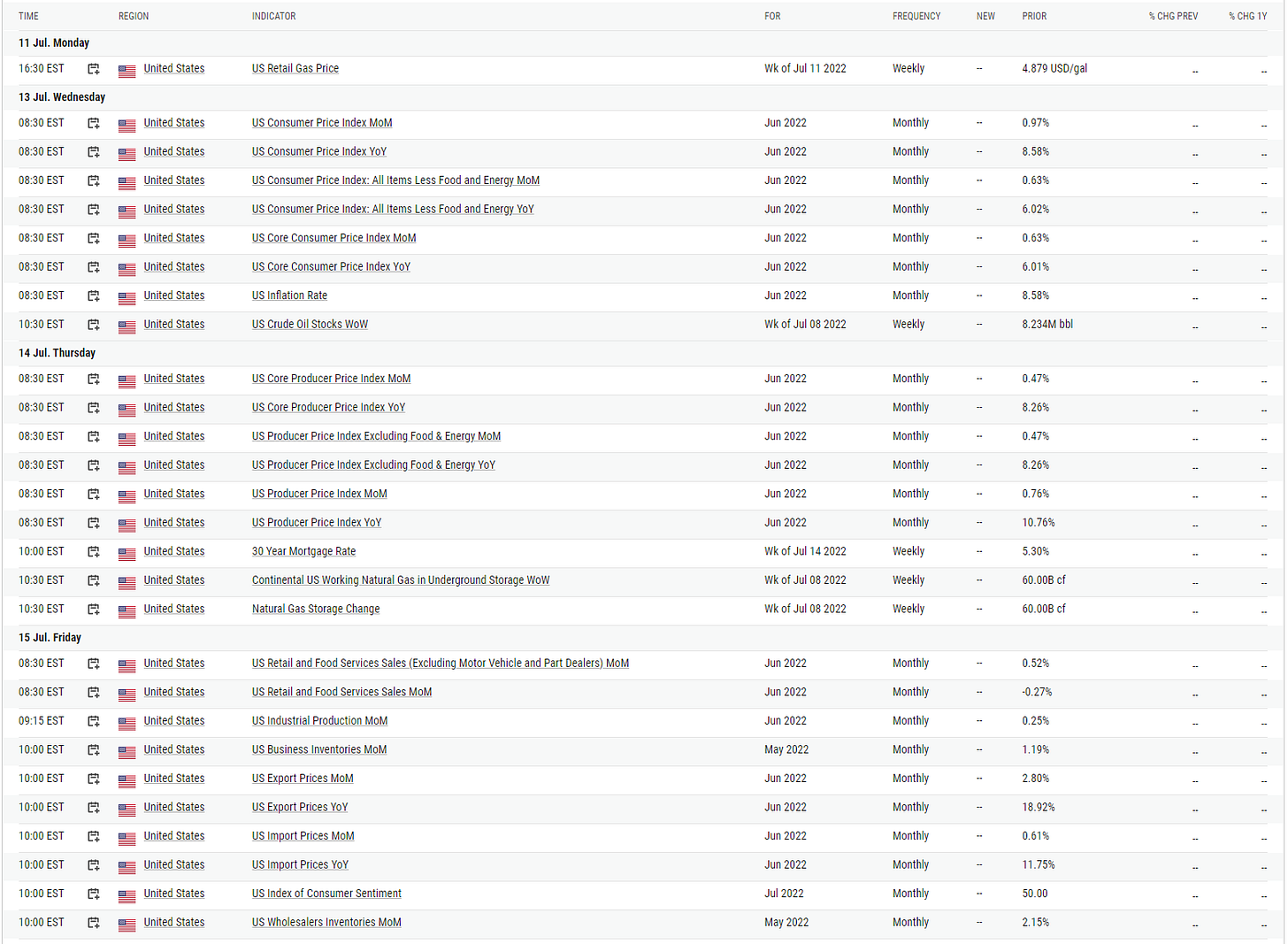

U.S Economic Calendar (Upcoming Data Points)

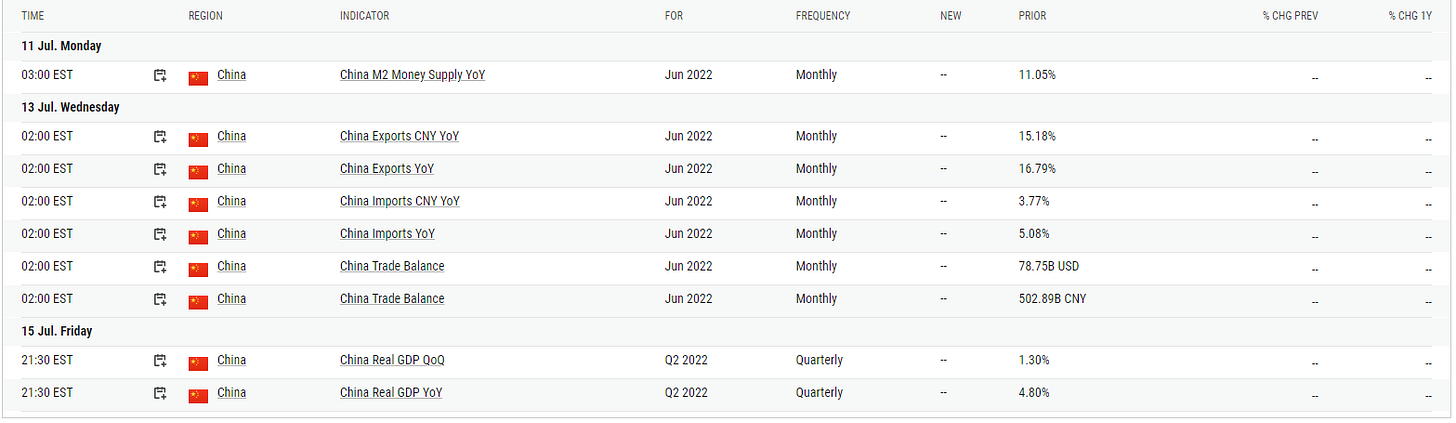

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Nonfarm payrolls rose 372k in June, above consensus of +265k. The details of the report were somewhat less positive, with a third month of downward revisions and of underperformance in household employment. The unemployment rate was unchanged at 3.6% as expected, though the underemployment rate fell sharply on fewer part-time workers.

Today’s payrolls report displays an overheated labor market that is only beginning to slow. Markets have subsequently priced in a 75bps hike in July at a higher probability.

Chart That Caught Our Eye

Analyst Team Note:

“In terms of the risk of a recessionary environment and the resulting impact on digital & total media spend, we’d also note that advertising spend tends to be more of a lagging economic indicator (by ~1-2 quarters). To illustrate, estimates show that US digital ad spend growth bottomed in Q3 2009, several quarters after US GDP growth bottomed in Q4 2008. We believe this supports our view that 2H’22 presents almost all the advertising companies with easier YoY revenue comps, which could still produce flat to accelerating revenue trends (vs. Q2’22 levels) even with macro-driven headwinds.” - Goldman Sachs

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.