7.7.23: Market participants reduce risk ahead of next week's Inflation Data

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Informal Note to Public Readers from Larry: What a great day for China Internet today. My analysis on this topic (among others) will be discussed in my next note to members inside our Investment Community released later this weekend.

Have an awesome weekend.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4411.59

KWEB (Chinese Internet) ETF: $26.49

Analyst Team Note:

Cash: 1st inflow to money market funds in 4 weeks…total cash AUM now $7.8tn

Credit: largest inflow to IG bonds in 5 months ($9.0bn), plus 1st inflow to HY bonds in 4 weeks ($0.5bn)

Stocks: 1st time since Nov ’22 inflows to Developed Markets ($31bn past 8 weeks) trending higher than into Emerging Markets ($14bn)

US & Japan: inflows to Japanese stocks in past 5 weeks ($8.9bn); largest inflow to US large cap funds in almost 8 months ($12.9bn).

Source: BofA

Macro Chart In Focus

Analyst Team Note:

June's economic data showed a healthy growth in payrolls by 209,000, despite falling short of economists' predictions. The unemployment rate dropped to 3.6%, while average hourly earnings rose by 4.4% year-over-year, a slight increase from May's pace of 4.3%. In terms of industries, most saw an addition of jobs, with health care and government leading the way. Leisure and hospitality posted a modest increase of 21,000 jobs, and construction saw a rise of 23,000 in employment.

The robust job gains, together with wage acceleration and lower unemployment, strengthen the argument for a Federal Reserve interest rate hike this month and suggest further economic tightening later in the year.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

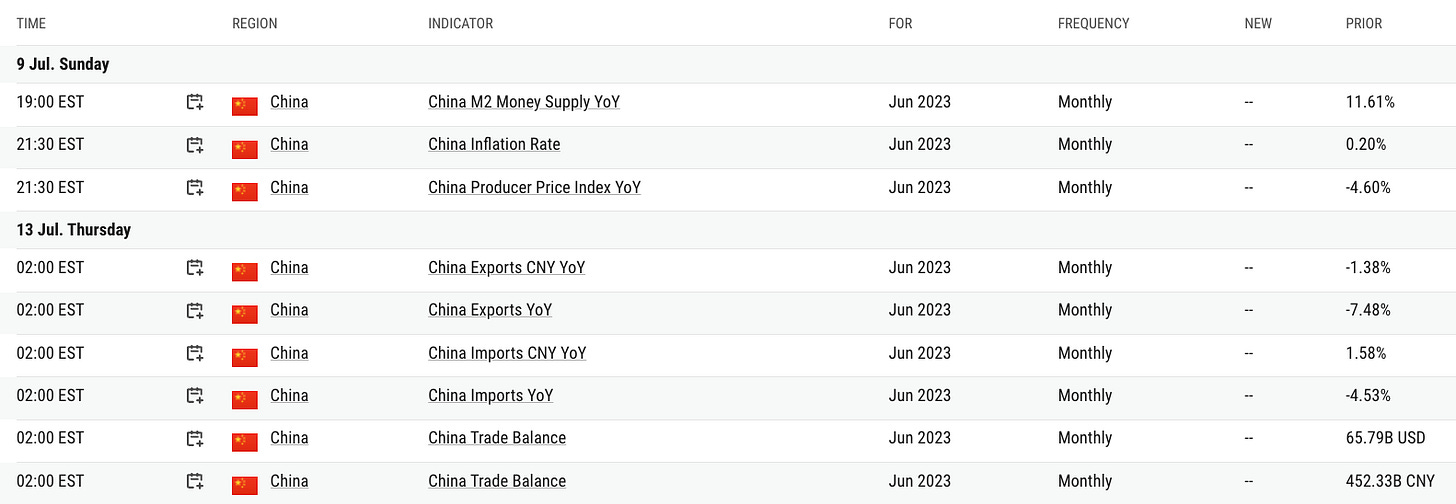

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

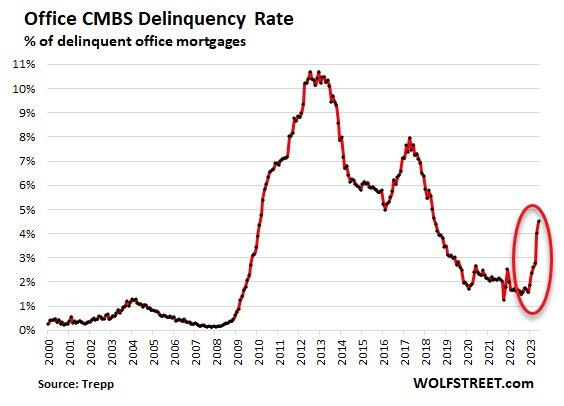

The delinquency rate of Commercial Mortgage-Backed Securities backed by office properties has surged to 4.5% in June 2023, up from 1.6% in December 2022, marking the quickest six-month increase since 2000.

This is reflective of a significant structural shift in the office space sector due to companies realizing they do not need as much physical office space, thus leaving office towers partially or entirely vacant.

Due to the rise in interest rates since March 2022, landlords with variable-rate mortgages have been facing increased financial pressure, with some, like Blackstone and Brookfield, choosing to default on their mortgages and leave their properties, which are then sold at significantly lower prices than their loan values.

This scenario is causing significant losses for CMBS holders, and this trend of vacant office towers is viewed as a long-term structural issue that will need to be addressed over the coming years.

Chart That Caught Our Eye

Analyst Team Note:

The Fed balance sheet shrank by $42.6 billion last week (the biggest drop since May). The Fed's balance sheet is now well below pre-SVB levels - at its smallest since Aug 2021...

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.