7.6.22: Fed Minutes are out. The Fed is now hyper sensitive to any data point regarding Inflation.

Key U.S. and China brief market notes by Larry's Analyst Staff Team

Note to Readers: The June Fed Minutes are out - a preliminary opinion of the Fed’s thinking will be provided inside Larry’s Patreon Community this evening to Members. More thorough research will be digested over the coming 2-3 trading days as Larry studies inter-market data based on the Fed’s statements.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

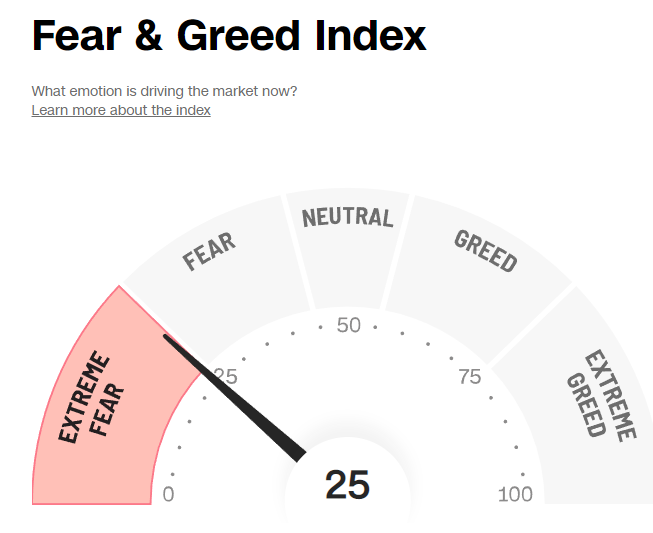

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3831.39

KWEB (Chinese Internet) ETF: $33.25

Analyst Team Note:

Continued discussions from the Biden administration about rolling back some tariffs on Chinese goods. The environment for Chinese stocks continue to improve. That said, Strategist Larry discussed in our July notes released on the first of the month that the asset class rating for Chinese Internet moved from buy in June to “hold". This was discussed when KWEB was near 34/shr. We believe the LT outlook on China is still positive, but given the large pace of gains in the past 45 days, it is the buyers who were willing to buy early who now have stronger hands. LT outlook still looks good; ST outlook requires more positive data to keep momentum going.

There’s even reports that Biden could announce his decision on rolling back Chinese tariffs this week. Strategist Larry believes that these tariff rollbacks will have a short-term boost to sentiment but this development may not change the long-term geopolitical relationship between U.S. and China. China’s underlying economic trends (particularly health in the Real Estate sector) are far more important than the U.S. handling of tariffs from the Trump administration. That said, any improvement in inflation, is a winner for all.

Macro Chart In Focus

Analyst Team Note:

Credit impulse is defined as the flow of new credit issued from the private sector as a percentage of GDP.

With the zero covid lockdowns mostly over and the case count stabilizing, China credit impulse has been slowly ticking up, with more stimulus likely ahead.

The theme so far has been: as the world tightens, China eases.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

US job openings dipped in May, though still remains near a record, indicating that there is still resiliency in the demand for labor even as optimism for the economy’s future continue to dwindle.

The growth of the services sector slowed in June to a two-year low.

ISM’s services employment index fell to its weakest since July 2020. The services’ difficulty in hiring and retaining workers may explain increases in lead times and backlogs.

Chart That Caught Our Eye

Analyst Team Note:

In our last newsletter, we wrote the following: “while multiples have compressed substantially, it’s possible that forward earnings multiples are propped up by optimistic earnings estimates”. This hypothesis has turned out to be correct. Forward earnings multiples are indeed being propped up by above-trend earnings estimates.

Morgan Stanley released a report today where it noted that “S&P 500 forward earnings estimates are 20%+ above the post-GFC trend”. This could lead to lower earnings estimates after Q2 earnings if guidance from companies is poor.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.