7.4.22: A shortened trading week ahead

Key U.S. and China brief market notes by Larry's Analyst Staff Team

Note to Readers: This is a new concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3825.33

KWEB (Chinese Internet) ETF: $33.18

Analyst Team Note:

If you’re feeling down about your portfolio this year, you’re not alone. According to Goldman’s Prime Services, the average hedge fund is down 18% YTD, while the most popular hedge fund stocks have underperformed the S&P 500.

KWEB is slowly but steadily approaching its 200-day moving average. Will be interesting to see if it can breach that 36.81 level. While everyone is tightening, China is easing…

Macro Chart In Focus

Analyst Team Note:

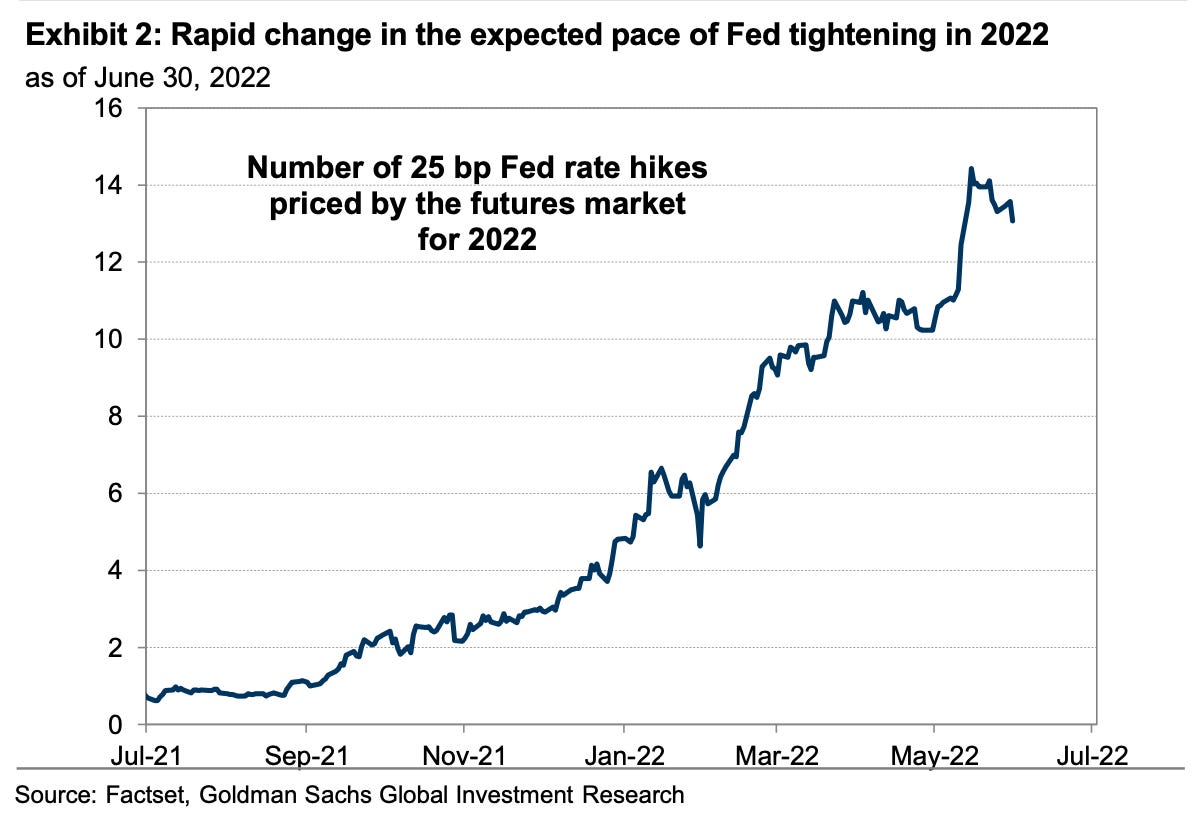

“The 2022 bear market in a nutshell: Higher-than-expected inflation readings translated into a faster-than-expected pace of Fed tightening (see chart above), which prompted a back-up in nominal 10-year Treasury yields (1.4% to 3.0%) and a jump in real yields which compressed the S&P 500 P/E multiple by 24% (from 21x to 16x), and led to a 20%+ decline in US equities.” - Goldman Sachs

As Goldman said above, this bear market has really been about re-rating what ‘fair value’ means for stocks, rather than falling earnings. In fact, despite recession fears, S&P 500 consensus 2022 and 2023 EPS estimates have both been revised up so far this year. This means that while multiples have compressed substantially, it’s possible that forward earnings multiples are propped up by optimistic earnings estimates.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Lots of important data points this week including the release of June’s Fed minutes on Wednesday. Will be watching durable goods, ISM, nonfarm payrolls, and consumer credit.

We got some data last week that pointed to slowing consumer spending. Personal consumption increased 1.8% QoQ, well below the 3.1% consensus estimate, and personal spending increased 0.2%, below the 0.2% estimate. Meanwhile, the personal saving rate ticked up to 5.4%, previously 5.2%. The tightening of financial conditions have clearly already started to weigh on consumer behavior.

Chart That Caught Our Eye

Analyst Team Note:

Commodities on course for best year since 1946, government bonds worst year since 1865 , S&P500 (real terms) worst since 1872.

From 2020-2021, a total of $32 trillion was injected into the global economy in the form of fiscal and monetary stimulus. In 2022, only $2 trillion has been removed so far by QT. The central banks are just getting started… The ECB hasn’t even hiked rates yet!!

While sentiment is pretty bad (AAII Bull-Bear spread at -23.92%), equity flows are still showing no signs of capitulation. YTD, net flows into equities are up 1.1% and have stayed flat in the past four months.

Source: Bank of America, Barclays

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.