7.3.24: US Trade Deficit Largest Since Oct. 2022

Note to Readers: This is a concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,537.02

KWEB (Chinese Internet) ETF: $28.08

Analyst Team Note:

Macro Chart In Focus

Analyst Team Note:

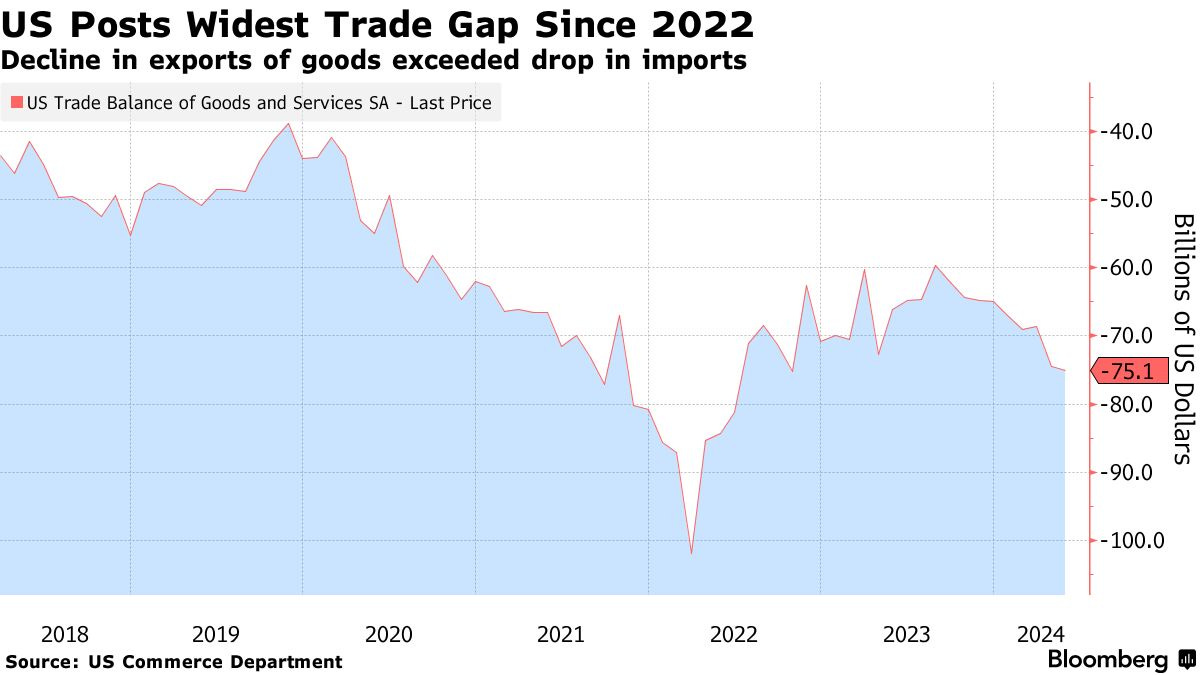

The U.S. trade deficit widened to $75.1 billion in May 2024, the largest since October 2022, as exports declined more than imports.

The widening deficit is expected to negatively impact second-quarter GDP growth.

Exports of goods dropped to their lowest level since November, driven by declines in industrial supplies, aircraft, and automobiles. Factors contributing to this include limited economic growth overseas and a strong U.S. dollar.

On the import side, cooling consumer spending and increased retail inventories may continue to dampen demand for foreign goods. Notable changes include record-high services exports and imports, increased travel exports, and widening trade deficits with China and Mexico.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

The U.S. services sector experienced a significant contraction in June, with the Institute for Supply Management's (ISM) composite gauge of services dropping 5 points to 48.8, the lowest level in four years.

This decline was driven by a sharp pullback in business activity and declining orders, with the business activity index plunging 11.6 points and new orders shrinking for the first time since late 2022.

Eight out of 18 services industries reported contraction, including real estate, mining, and retail trade.

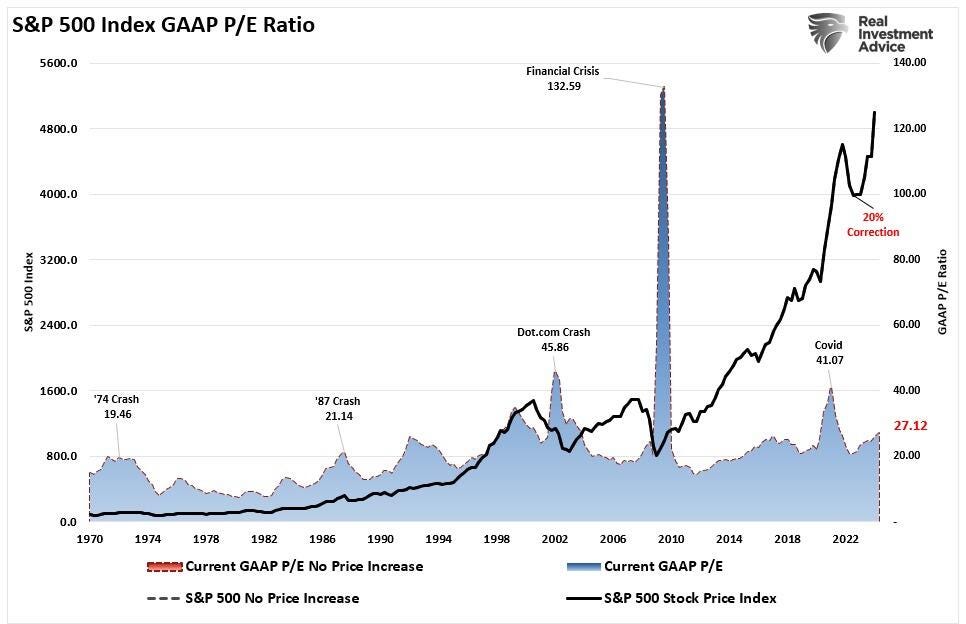

Chart That Caught Our Eye

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.