7.31.23: Stocks close out another winning month, adding heat to Bearish speculators who remain in short positions. Will Bears ever be vindicated?

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: In this past weekend’s premium Strategy note to members, I shared several names that I believed could see market outperforming qualities. We got an immediate positive reaction from the market today on the names mentioned (which is a nice bonus, because usually ideas take time to play out).

I am actively hunting for gems and tactical relative valuation in this market context.

Will continue to find such opportunities. Much more to come. Make sure to share my work.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4582.23

KWEB (Chinese Internet) ETF: 31.74

Analyst Team Note:

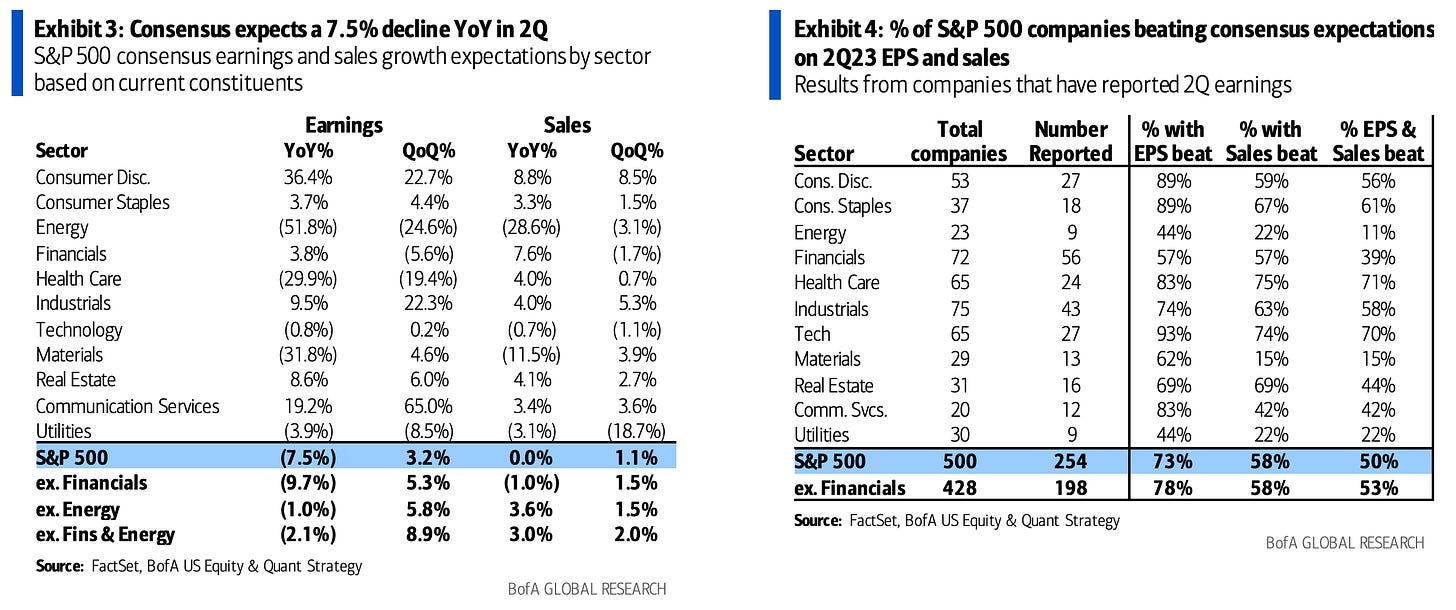

So far, 254 S&P 500 companies contributing 64% of S&P 500 earnings have reported earnings. Reported companies have beaten consensus by 4%, largely driven by the Consumer Discretionary sector. Sales surpassed expectations by 1%, suggesting that margin stabilization was a significant factor in the EPS beat. Notably, 73% beat EPS estimates, 58% surpassed sales forecasts, and 50% exceeded both, which are significantly higher than the historical averages of 64%, 59%, and 45% respectively.

Macro Chart In Focus

Analyst Team Note:

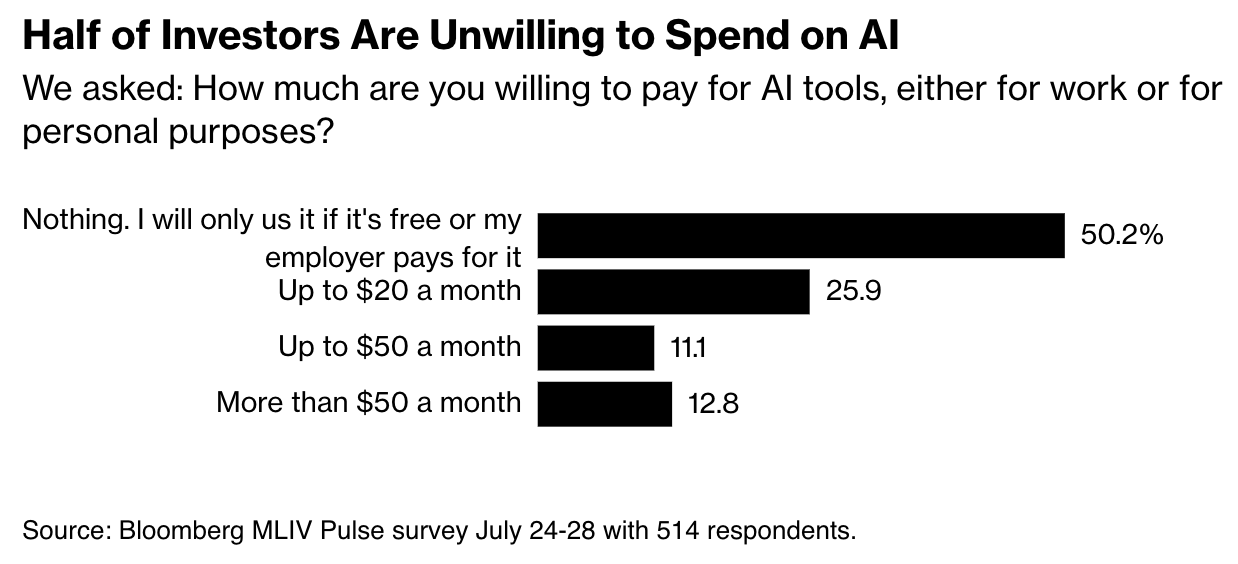

According to a survey by Bloomberg, 77% of 514 strategists intend to either increase their exposure to tech stocks or maintain it at the same level over the next six months, indicating continued optimism in the sector. This bullish sentiment has driven the Nasdaq 100 to record its best first half in history, significantly boosting market valuations. However, respondents show some skepticism towards the AI era, with half of them unwilling to pay for AI tools for personal or business use and most firms not planning to use AI for trading or investing in the near future.

The surge in the Nasdaq 100 is largely attributed to the increasing demand for advanced tech, with key players like Apple and Microsoft leading the rally. The benchmark now trades at approximately 25 times estimated earnings, surpassing its 10-year average of nearly 21 times. AI is drawing attention from senior corporate executives, especially during this earnings season, with less focus on the potential recession.

64% of respondents do not believe AI will take over core aspects of their jobs within the next three years. Goldman Sachs economists estimate that AI will impact 70% of US jobs, though only a fraction of these will be replaced by new technologies.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

A Zillow survey revealed that US homeowners are twice as likely to consider selling their homes if their mortgage rate is 5% or higher. However, only 20% of mortgaged homes meet this criteria, with 38% of these homeowners planning on selling. Despite high mortgage rates discouraging movement, only 21% of mortgage holders with rates below 5% contemplate selling. As existing-home sales have decreased almost every month since last year, potential buyers are increasingly considering new construction due to the shortage of resale market inventory.

Approximately 80% of mortgage holders have a rate of less than 5%, and 90% have a rate under 6%. Almost a third enjoy rates lower than 3%. Zillow's senior economist predicts these rates won't reach 5% in the near future, implying homeowners will likely move for significant life events.

Meanwhile, nearly 25% of homeowners contemplate selling their homes within three years or have listed them for sale, indicating a potential increase in inventory. Besides mortgage rates, homeowners are also motivated to move for upgrading homes or accommodating growing families.

Chart That Caught Our Eye

Analyst Team Note:

The IMF estimates that global economic growth will slow down by the end of 2024, with global real GDP projected to grow by 3.0% in both 2023 and 2024, following a 3.5% increase in 2022. While emerging and developing Asia are predicted to experience the highest growth rates (5.3% and 5.0% in 2023 and 2024 respectively), advanced economies like the United States and Germany are expected to experience a decline. The US economy is projected to slow from 2.1% growth in 2022 to just 1.0% by 2024, and Germany is forecasted to see a 0.3% contraction in its GDP in 2023 due to weakened manufacturing output and economic contraction in the first quarter.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.