7.28.23: Tech Stocks continue to be lead by strong Semicap Equipment performance Applied Materials and Lam Research

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: What a tremendous week for risk assets and my watchlist of names shared with Members over the past few weeks. I will be sharing premium content to my valued public readers this weekend to share the good vibes. Stay tuned. Have a great weekend.

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates. Cash is now an asset class that can hedge against uncertainty.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4537.41

KWEB (Chinese Internet) ETF: 29.51

Analyst Team Note:

The Dow Jones Industrial Average rallied 13 days in a row from 7/7 to 7/26, scoring a 5.29% gain over the period. This was the first streak of 13 consecutive up days since January 1987.

Macro Chart In Focus

Analyst Team Note:

Recent US economic reports indicate that key inflation and labor cost measures have decelerated significantly in the past months, sparking optimism for the avoidance of a potential recession.

The employment cost index, a broad indicator of wages and benefits, rose by only 1% in the second quarter, marking its slowest growth since 2021. Simultaneously, the PCE price index, the Fed's preferred inflation measure, reported a year-on-year increase of 3% in June, the smallest increase in over two years.

The inflation report also shows that core prices, excluding food and energy, increased by a less than anticipated 4.1%, the smallest rise since 2021. There are signs of strong consumer activity, as inflation-adjusted consumer spending in June showed its greatest increase since the beginning of the year.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

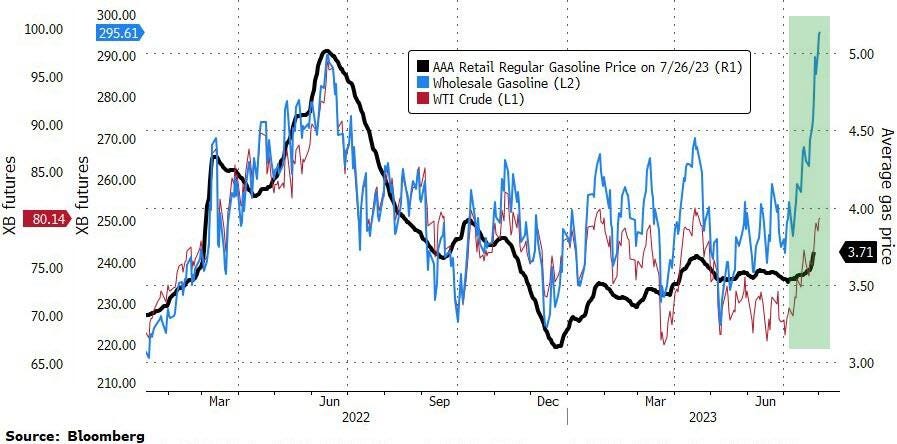

US retail gasoline prices have reached their highest point since November, with the average gasoline price increasing by 13.4 cents within a week, according to AAA data. On Thursday, the price for an average gallon of retail gasoline rose to $3.714, up from $3.687 the previous day, marking the highest price recorded this year and the second-highest for this period over the last decade. These increases were impacted by a reduction in gasoline inventories, which fell by another 800,000 barrels, and are now 7% below the five-year average for this time of year.

Factors contributing to these price increases include Exxon Mobil's shutdown of a significant US refinery for expected repairs, which led to gasoline futures rising by over 5%. The refinery, with a capacity of 522,000 barrels per day, could be closed for up to four weeks.

Moreover, according to GasBuddy data, US retail gasoline demand rose by 0.6% in the week ending Saturday, a week which typically represents the peak summer driving season.

Chart That Caught Our Eye

Analyst Team Note:

Affordable homes for first-time buyers are becoming increasingly scarce in the US real estate market. With mortgage rates near 7% and the average entry-level home price at a record $243,000, first-time buyers are finding affordability a significant challenge. According to Redfin, a first-time homebuyer now needs to earn $64,500 annually to ensure that the cost of an average entry-level home doesn't surpass 30% of their income, a substantial increase from $57,222 a year ago.

The situation is compounded by a decline of available homes, with new active listings down 23% year over year, and the number of affordable homes on the market less than half of what was available in June 2012. This lack of supply is partly due to existing homeowners choosing not to sell in the face of record-low mortgage rates.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.