7.27.22: The Fed has spoken, and we think He remains Hawkish (great detail will be provided inside our Community in upcoming August research report)

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Note to Readers (view on Desktop): On July 23rd, in a note to the Community, Strategist Larry tempered his enthusiasm on Alibaba and the Chinese Internet sector given the fading risk/reward setup with Speaker of the House Nancy Pelosi’s plans to visit Taiwan, a move that would significantly elevate U.S.-Sino Tensions.

He guided his members to stop adding risk to Alibaba until the dust settles with Pelosi (see image below). And for those who want to take an immediate view on elevated tensions, to reduce exposure if they wish.

We remain LT positive on Alibaba and China. However, we must provide the guidance that will ensure the long-term survival of all our members. When risk/reward tilts back in favor for China, Strategist Larry will immediately let his Community know. Everything we do is based on thoughtful fundamental, macro, and geopolitical research.

A concise strategy note inside our News Feed on Discord

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

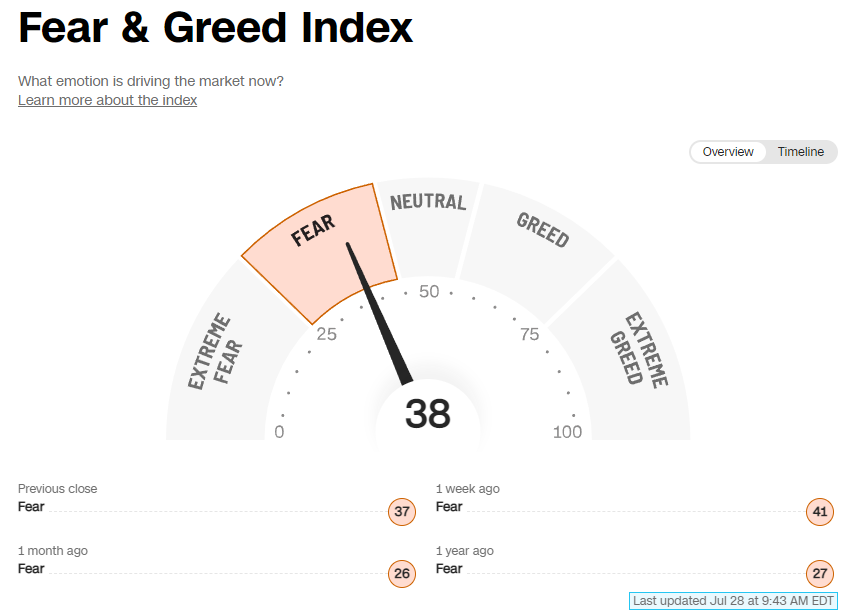

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

Everything is trading off the Fed. The big question is whether the Fed will pivot because of a slowing economy or continue to push forward in their fight against inflation.

The market is pricing in a pivot though it doesn’t seem likely given Jerome Powell’s statements yesterday.

“There would be the risk of doing too much and, you know, imposing more of a downturn on the economy than was necessary. But the risk of doing too little and leaving the economy with this entrenched inflation only raises the cost. If you fail to deal with it in the near term, it only raises the cost of dealing with it later.” - Jerome Powell

Macro Chart In Focus

Analyst Team Note:

Q2 Real GDP fell 0.9% following a 1.6% decline in Q1. Technical Recession…

Fed Fund Futures market are now pricing in a 50 bps hike in September, 25 bps hikes in November and December, and then rate cuts in March and July 2023.

Markets currently rallying off the potential of a Fed ‘pivot’ but we view this rally to be short-sighted and overdone.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

“US economy is showing clear signs of deterioration, with services PMI hinting towards a sharp reversal from post-pandemic era growth in services. This is especially concerning given the shift from goods to services consumption since the pandemic. Moreover, uncertainty in the macro backdrop is well reflected in the dispersion of real GDP estimates, which is approaching 2008 levels.” - Barclays

President Biden and President Xi are planning to have a phone call today (or soon). Watching for any developments there.

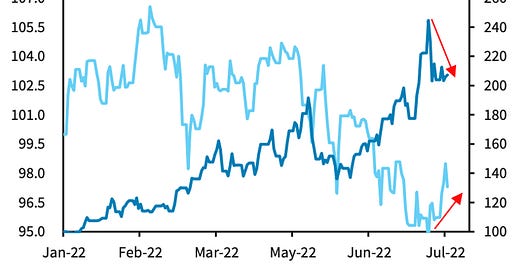

Chart That Caught Our Eye

Analyst Team Note:

The bulk of equity de-risking YTD has come from HF/Systematic funds. Their exposure is short and prone to covering. If positive market momentum holds, trend followers could turn buyers of equities given their low exposure.

Sentiment remains uber-bearish but positioning is far less depressed. Recent equity outflows look small compared to previous recessions, and asset allocation of both MF and retail investors is still OW equities.

Source: Barclays

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.