7.26.24: GDP Beats Expectations, Inflation Moderates

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,459.10

KWEB (Chinese Internet) ETF: $26.42

Analyst Team Note:

Wall Street's once-reliable strategy of investing heavily in Big Tech was disrupted this week, leading to widespread stock volatility and losses for momentum-focused investors.

An earnings miss from Tesla and concerns about Alphabet's spending contributed to the turmoil, while popular bond and commodity bets also faltered.

Macro Chart In Focus

Analyst Team Note:

The U.S. economy grew at an annualized rate of 2.8% in the second quarter of 2024, surpassing expectations and reflecting solid gains in consumer spending and business investment, despite inflation pressures subsiding.

Growth was bolstered by inventory building and increased government spending, though the housing market regressed and the trade deficit widened, slightly dragging on GDP.

Consumer spending rose by 2.3%, driven by services and goods, supported by wage gains. Business investment also surged, particularly in equipment.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The Federal Reserve's preferred measure of underlying U.S. inflation, the core personal consumption expenditures (PCE) price index, rose by 0.2% in June and 2.6% from a year ago, indicating a modest pace of inflation.

Inflation-adjusted consumer spending also increased by 0.2%, with May's figures revised higher.

Despite the positive inflation data, consumer sentiment remains low, and the saving rate has fallen to 3.4%, indicating potential future constraints on spending.

Chart That Caught Our Eye

Analyst Team Note:

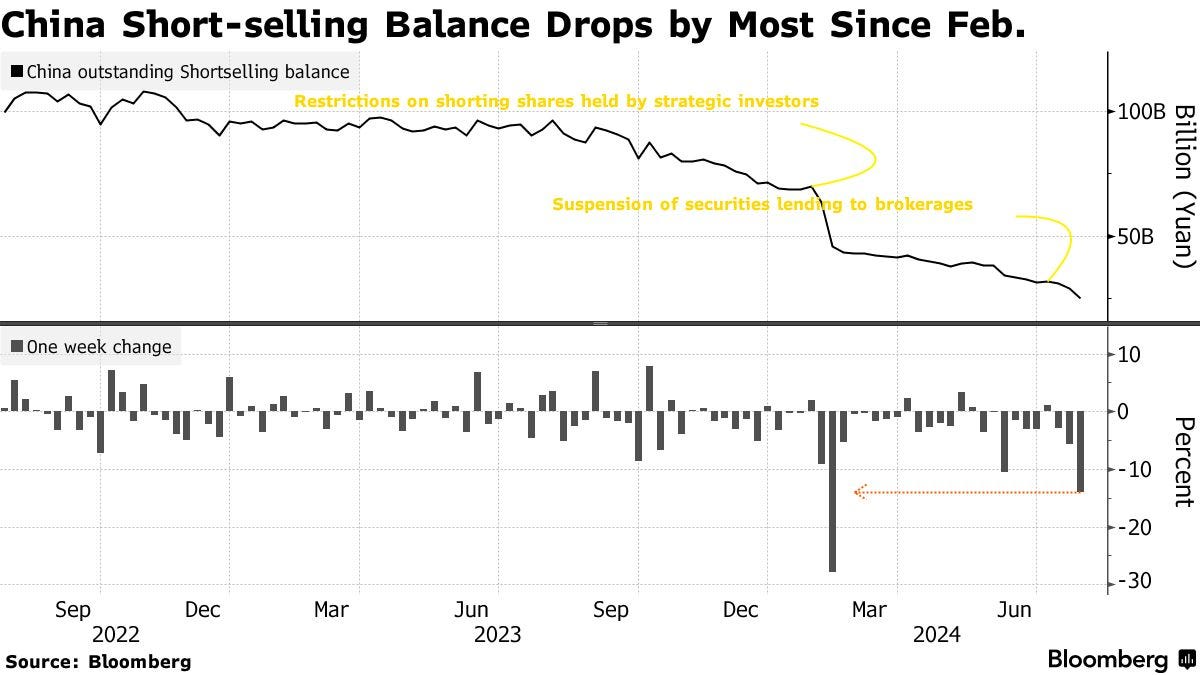

Chinese stock traders rapidly unwound their short positions this week, marking the fastest pace since February, as they took advantage of a significant equity selloff to close trades before a regulatory deadline.

The combined outstanding amount of short positions in Shanghai and Shenzhen markets decreased by 14% from the previous week, reaching 25.1 billion yuan ($3.5 billion) as of Thursday, which is the lowest level since May 2020.

Additionally, traders faced pressure to return borrowed stocks before the September 30 deadline, which is part of strict measures introduced earlier this month to curb short selling and quantitative trading strategies.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.