7.26.23: Firm Fundamentals in Big Tech continue to support the market

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: As the broader markets consolidate and enter a range bound market, select themes and companies are starting to gain internal traction and relative strength.

These environments are very good for stock-selection and sector rotation strategists like myself as the correlation between the average stock and the index begins to break down.

I think it is very hard to forecast the broader market at the moment, but I am able to do so with much more clarity on single-name companies. Members inside our Community have enjoyed researched opinions on companies shared with them in the past several weeks.

Although my description of the company and target levels may be brief in my Letters, rest assured that I have done a lot of homework on the name.

My levels on the stocks aligning with market outcomes that happen after I publish is the result of serious due diligence. This is no coincidence.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers. Check it out. It’s a great brokerage..

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4567.46

KWEB (Chinese Internet) ETF: $29.48

Analyst Team Note:

Investors are adding leverage and optimistic once again…

Macro Chart In Focus

Analyst Team Note:

The Federal Reserve increased interest rates to the highest point in 22 years, with a range of 5.25% to 5.5%, marking the 11th increase since March 2022. The decision, aimed at controlling inflation, was unanimous. Chair Jerome Powell stated that further increases would be dependent on incoming data and that officials had not decided on future moves.

Powell highlighted that the Fed will be closely monitoring signs of moderate growth, improved inflation, and better balance in supply and demand, particularly within the labor market. He suggested that either holding the rates steady or increasing them again could be justified based on future data. The Fed futures market is expecteding a ~50% chance of another quarter point increase before the end of the year.

The FOMC described inflation as "elevated" and upgraded the description of economic growth to "moderate" from "modest". While recent consumer price data showed inflation receding to 3% from last year's peak of 9.1%, officials remain concerned about "core" inflation. Powell said that the policy had not been restrictive enough for long enough to have its full desired effects, adding that the Fed would keep the policy restrictive until inflation sustainably drops to their 2% target.

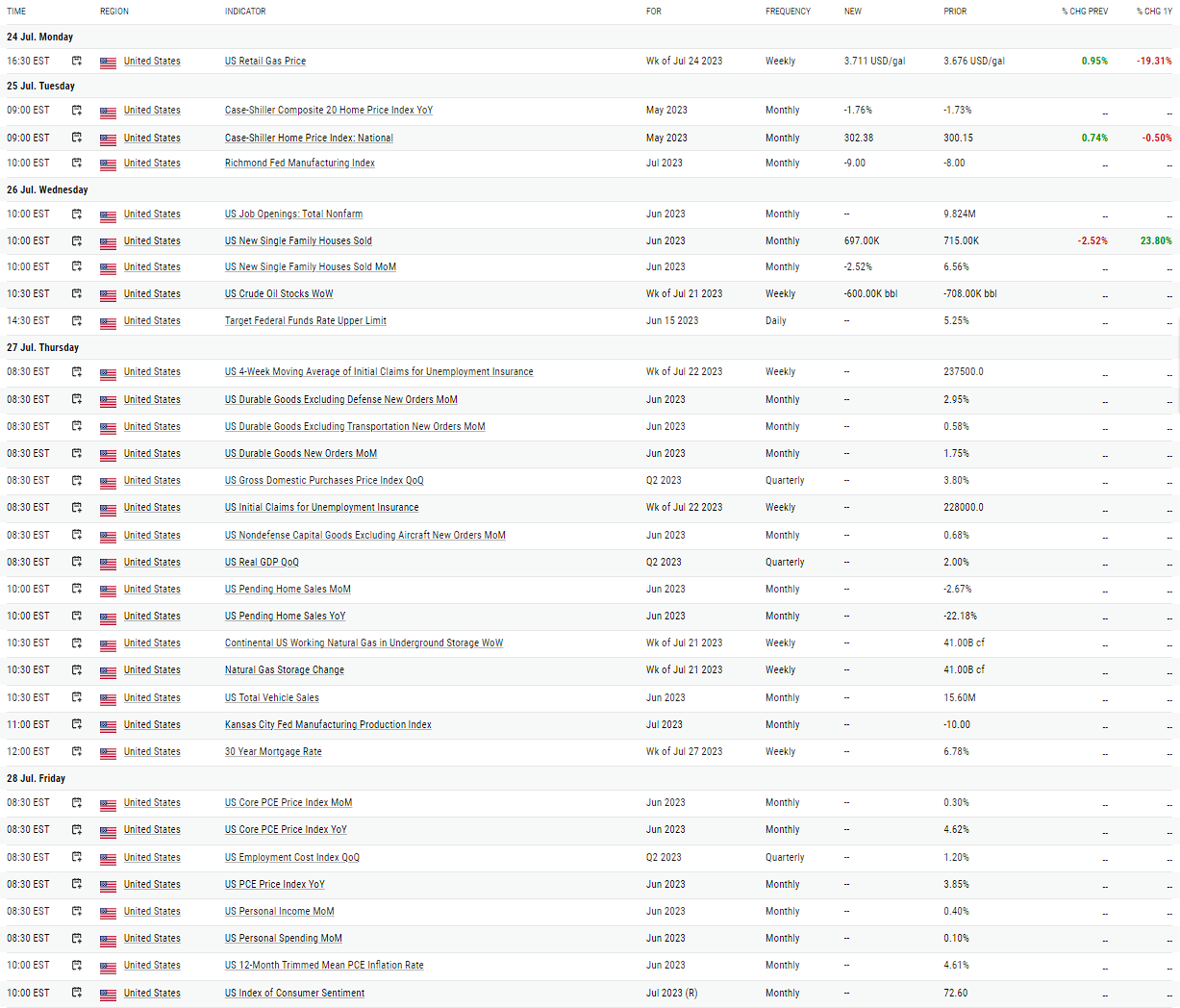

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

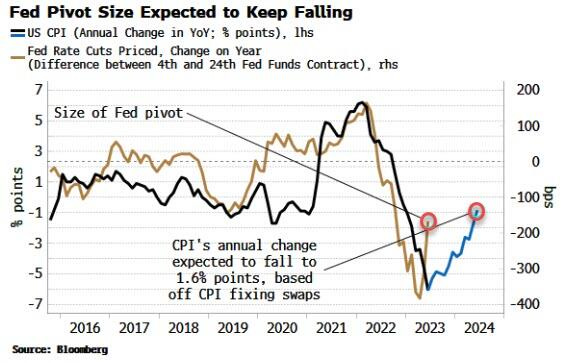

Following the 25 basis point rate hike in the latest FOMC meeting, the market has priced in just 10 basis points of further rate rises.

The 'hawks,' such as Fed Governor Christopher Waller, prioritize suppressing inflation, while 'doves,' like Chicago Fed's Austan Goolsbee, are more worried about the slowing economy and potential unemployment rise due to price-growth control. Despite this divergence, slowing inflation indicates that the pivot could fall further, causing the latter part of the short-term rates curve to steepen. A re-flattening of this curve would only be likely if there are signs of an inflation resurgence, leading to several more anticipated rate hikes.

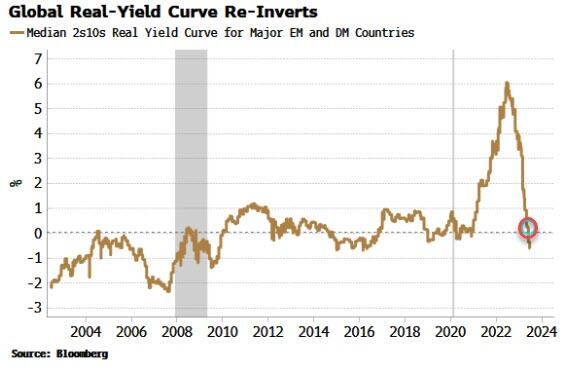

Chart That Caught Our Eye

Analyst Team Note:

The recent re-inversion of the global real-yield curve suggests that central banks are nearing the end of their tightening cycles, maintaining a potentially favorable environment for risk assets. However, a resurgence in inflation could pose a threat to these assets as central banks may re-engage in tightening policies. While the curve is currently shaped by the rapid global inflation deceleration, any return of inflation - possibly prompted by the stimulus in China and an emerging rally in oil - could mark a decrease in excess liquidity and the potential for higher interest rates.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.