7.25.22: This week sets the Tone. The coming weeks set the Direction.

Key U.S. and China brief market notes by Larry's Analyst Staff Team.

Latest Poll of Larry’s Friends on Youtube:

Privately, our primary view is that the hierarchy of importance in this week’s events are as follows: FAAMG Earnings > July FOMC > GDP Data Release

This week will be a powerful learning opportunity for beginner and intermediate level investors to learn about what is driving this market. Use every opportunity to learn.

We’ll be providing broad public commentary on Instagram and Twitter and detailed, actionable strategy inside our research Community. Do NOT take big one-sided position bets ahead of major events this week. You will experience whipsaw if that happens. In event-heavy weeks like this, the SIMPLER your strategy, the better.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

KWEB (Chinese Internet) ETF:

Analyst Team Note:

The broad sell-off in both risky and risk-free assets against a high inflation backdrop means that performance has been terrible so far this year. However, cheaper valuations potentially mean an opportunity for tactical entries.

Per Morgan Stanley, nominal expected returns across most assets are now above 20-year averages and equity risk premiums have risen above long-run averages, the first time in a long while.

Macro Chart In Focus

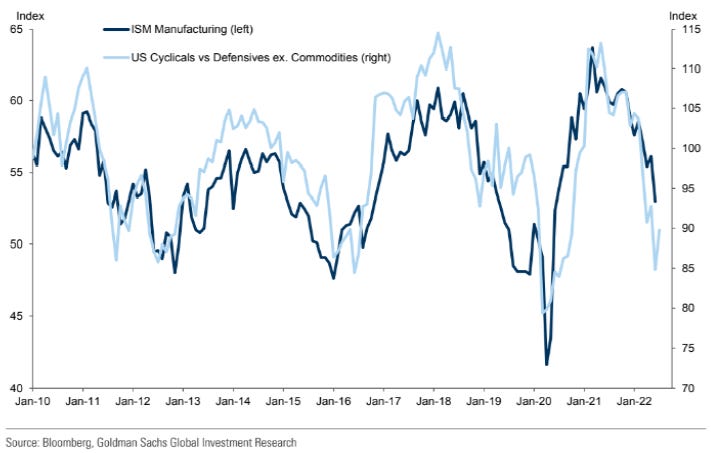

Analyst Team Note:

The cyclical vs. defensives trade is already pricing in a manufacturing recession (ISM manufacturing index sub-50). According to Goldman, “This has set the stage, in our view, for some relief from the more severe recession and overtightening fears that have been priced, a process that has already begun in the last few days”.

Goldman goes on to list three main reasons why the market may have some room for relief in the short-term.

Growth and inflation news are more mixed than consistently threatening. More forward-looking data has been soft and the economy is clearly slowing. But U.S. data surprises are still positive on a rolling monthly basis (surprises in retail and payrolls surprises offsetting weakness in claims and manufacturing surveys) and services activity looks less alarming.

The risk of Fed overtightening has eased a little. The reversal in UMich inflation expectations, which partly motivated the Fed’s 75bp June hike, has removed the pressure to respond to a “credibility” challenge.

The more than 20% rise in gasoline prices from mid-April to mid-June may have played a larger role than appreciated in the near-term data picture, raising inflationary expectations while squeezing consumer incomes and hurting sentiment. A reversal in that spike is now well underway and may have more room to run. Given the outsized role that gas prices play for US consumer sentiment, the shift here has already started to provide some support for growth and relief to inflation expectations, and likely has room to do more.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Will get a big FOMC rate decision (75 bps is priced in) and GDP print this week.

Given that the White House came out and stated the quote below, it’s pretty likely we’re for a negative GDP print for Q2.

“It is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession” - White House Blog

Chart That Caught Our Eye

Analyst Team Note:

Investors are deleveraging at a record pace.

“FINRA margin debt fell to $683b in June, which is a 27% drop from the peak in late 2021. Oversold readings from two indicators suggest the later stages of deleveraging from margin debt, in our view. The margin debt 12-month rate-of-change (ROC) reached a new cycle low at-22.52%. This marks the deepest oversold since the Great Recession in 2008-2009. The 12-month z-score for margin debt hit-2.10 in June, reaching oversold territory below-2.0, which was last seen at the March 2020 low for the SPX.” - Bank of America

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.