7.24.23: One of the most important Fundamental and Macro driven weeks of the year has arrived

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Hope everyone had a great weekend! We start the week off with continued sector rotation that is playing out in our research opinions’ favor from the past several weeks. I expect the rest of this week to be much more action packed.

Best of luck to all the good folks. Be back with more later.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers. Check it out. It’s a great brokerage..

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index:

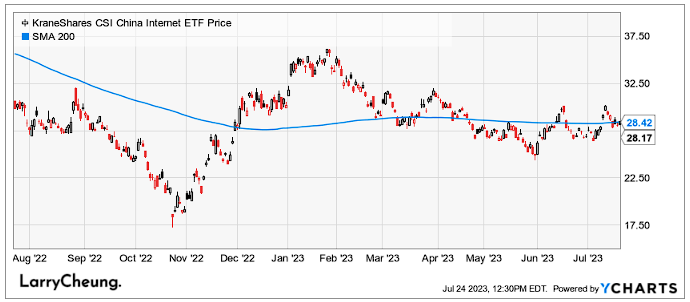

KWEB (Chinese Internet) ETF:

Analyst Team Note:

While profits at S&P 500 firms are forecast to drop for a third straight quarter, earnings are improving when excluding the energy sector, the lone sector to have a strong 2022. Profit growth ex. energy is expected to return in the second half of the year according to Bloomberg.

Macro Chart In Focus

Analyst Team Note:

U.S. home prices are seeing a resurgence after a brief decline last year, potentially complicating the Federal Reserve's efforts to bring down inflation. The demand for homes continues to exceed supply across the nation, despite increased borrowing costs. Economists and Fed officials suggest that if the robust housing market leads to slower progress in controlling inflation, rates may have to be raised higher or maintained for a longer duration.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

A LinkedIn survey recently revealed that US workers' confidence in their ability to secure or retain a job has risen to its highest level since late March, signaling a potential rebound from the slump experienced since the beginning of the year due to mass layoffs. This improved sentiment comes as job cuts have slowed and the odds of a recession have been revised down.

This increase in worker confidence comes at the same time as a rise in the rate of voluntary job exits, with over 4 million US employees resigning in May, the highest number since the start of the year.

Chart That Caught Our Eye

Analyst Team Note:

Tesla has begun offering 84-month auto loans to make new vehicles more affordable as average borrowing rates hit two-decade highs. This move comes after CEO Elon Musk commented on the need to address the auto affordability crisis, especially amidst rising interest rates that inflate the cost of cars. Though 84-month loans are less common and involve higher interest costs, they allow consumers to spread payments over seven years, thereby stimulating demand.

For the love of God please don’t take out a 84-month car loan.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.