7.21.23: The Street is now very focused on Margins and Growth this Earnings Season

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Hope everyone had a good week! I’m excited to share my weekly premium strategy update with Investment Community Members later this weekend. As always, a very thoughtful preview will be provided for all readers. Stay tuned!

The Street is now hyper-focused on margins and growth rates. Given that expectations have been generally lowered across the board, it is imperative that companies have a “beat and raise” outcome to stay in favor with mercurial investors.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4534.87

KWEB (Chinese Internet) ETF: 28.07

Analyst Team Note:

US bank stocks are witnessing a surge, driven by better-than-anticipated earnings reports that have encouraged investors. The KBW Bank Index, led by lenders like Zions Bancorp and KeyCorp, has risen by roughly 7% this week, marking its most significant climb since May of the previous year and outperforming the S&P 500 Index's 0.8% gain.

Despite higher deposit costs in Q2 earnings, the main takeaway is the stabilization of these companies after a rough period in March. The positive earnings updates have also helped the sector reduce its drop this year to 13%, from as much as 29% in May.

Macro Chart In Focus

Analyst Team Note:

The reintroduction of student loan payments, expected in October, could drastically affect consumer spending in the United States, according to a report from Oxford Economics. With payments expected to total $9 billion monthly, the nation could see a yearly loss of over $100 billion in consumer spending. The resumption of these payments, along with the Supreme Court's recent dismissal of President Biden's student loan forgiveness program, could potentially reduce the growth of the gross domestic product by 0.1% in 2023 and 0.3% in 2024, increasing the chance of a recession.

As many Americans are already grappling with rising housing costs and inflation, the average monthly bill of $400 is expected to add significant financial strain.

Approximately 20 million borrowers switched to forbearance status at the onset of the pandemic, saving roughly $7.5 billion in student loan payments each month. This figure has since grown to $9 billion monthly due to new graduates not yet making payments. This significant drop in consumer spending is expected to start in the fourth quarter of the year. Nevertheless, the report suggests that the overall impact may be softened by the considerable savings accrued during the forbearance period, amounting to a collective $87 billion by mid-2022.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

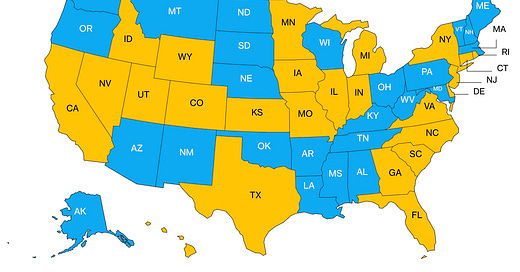

In June, half of the states in the U.S. reached or came close to record-low unemployment rates, demonstrating the resilience of the labor market. According to the Bureau of Labor Statistics, 25 states now have unemployment rates at or within 0.1 percentage point of a historical low. New Hampshire and South Dakota had the lowest rates, with just 1.8% unemployment. Arkansas, Mississippi, Oklahoma, Pennsylvania, Ohio, Massachusetts, and Maryland also reported fresh record-low unemployment figures.

However, not all states are enjoying the same success. California's unemployment rate has increased by 0.7 percentage points compared to the previous year, the largest increase among all states, taking it to an unemployment rate of 4.6%. This is largely due to a significant number of tech-related job losses. Nevada currently has the highest unemployment rate among the states at 5.4%.

Chart That Caught Our Eye

Analyst Team Note:

Post-GFC central banks injected $20tn of QE, post-COVID $13tn, have barely reduced QE from $33tn to $31tn in the past 18 months. The $13tn of QE post-COVID has been super-charged by an additional $15tn of US/EU/Japan fiscal policy stimulus.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.