7.17.24: Earnings Growth Expected for Broader Market After 5 Quarters of Decline

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Make sure to check out Interactive Brokers above as idle cash now will yield more than 4.5% as the Fed just raised rates.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,609.46

KWEB (Chinese Internet) ETF: $27.59

Analyst Team Note:

Traders are anticipating a diverse earnings season for S&P 500 companies, evidenced by a historically low one-month correlation of 0.03.

Options are suggesting an above-average earnings-related stock movement of 4.3% in either direction, surpassing the historical average of 4.1% since 2012.

Earnings-day volatility compared to non-earnings days has reached its highest level since 2018.

Macro Chart In Focus

Analyst Team Note:

The second quarter of 2024 is expected to mark a significant turning point for the S&P 500, as the "Other 493" companies (excluding the Magnificent 7 tech giants) are projected to achieve their first quarter of EPS growth after five consecutive quarters of flat or declining earnings.

This shift comes as the S&P 500 index overall has been experiencing EPS growth for three straight quarters, primarily driven by the Magnificent 7.

However, the growth rate of these tech giants is anticipated to slow down for the second consecutive quarter and continue decelerating into the third quarter.

Analysts predict this narrowing growth differential between the Magnificent 7 and the Other 493 will serve as a catalyst for broader market expansion, potentially leading to a more balanced performance.

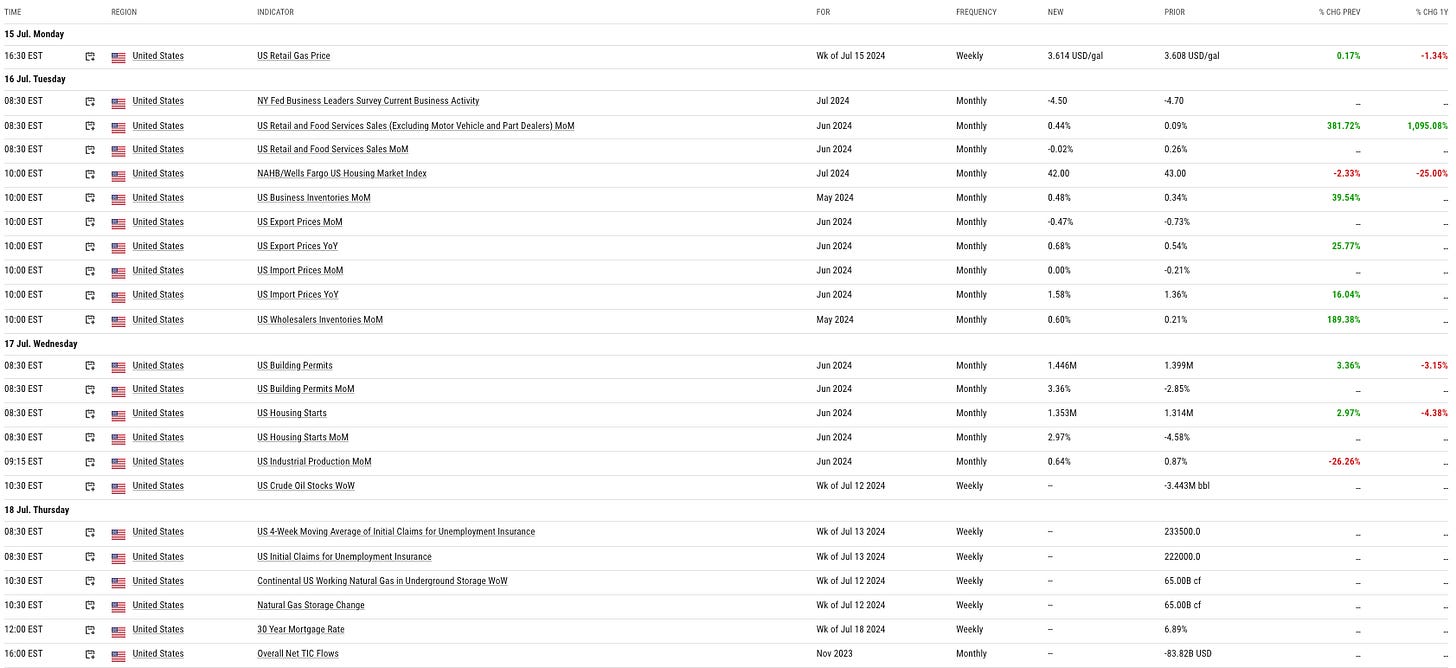

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

U.S. retail sales in June 2024 showed unexpected resilience, defying predictions of a decline. Excluding auto and gas sales, retail purchases rose 0.4%, surpassing the anticipated flat growth.

While overall sales remained flat due to a 2% decline in auto dealer receipts (partly attributed to a cyberattack on dealership software), the broader picture indicated robust consumer spending.

Chart That Caught Our Eye

Analyst Team Note:

The Russell 2000 has experienced a remarkable surge, rising 12% in just five trading sessions as of July 16, 2024 - a pace not seen since April 2020. T

The surge is attributed to positive inflation data, which has led traders to anticipate earlier Federal Reserve rate cuts. This shift particularly benefits small-cap companies, which are typically more sensitive to borrowing costs.

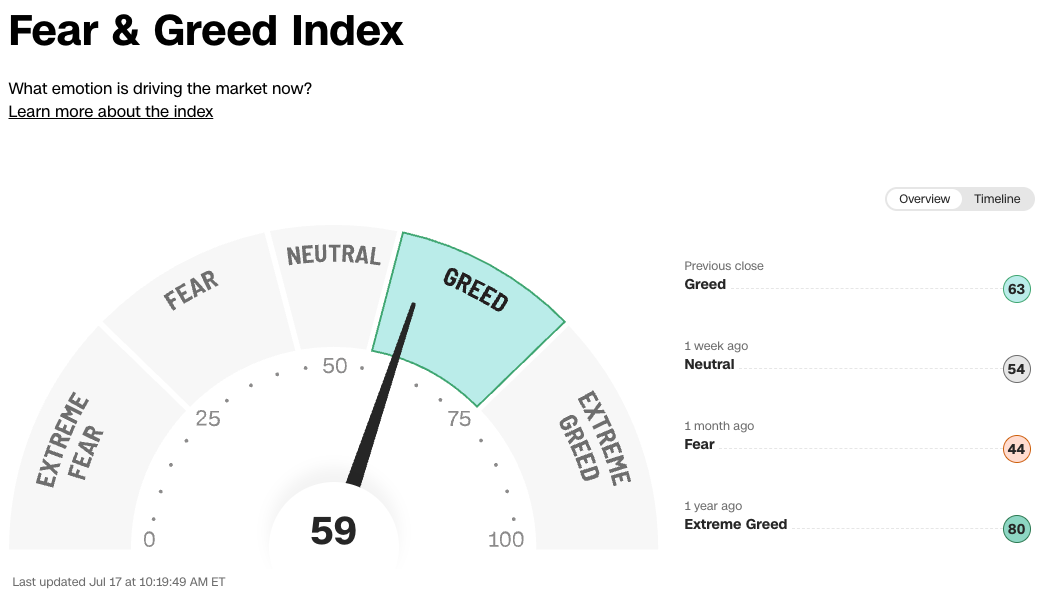

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.