7.17.23: Fund Managers position themselves for a "less bad than feared" Earnings Season. Will they be right?

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

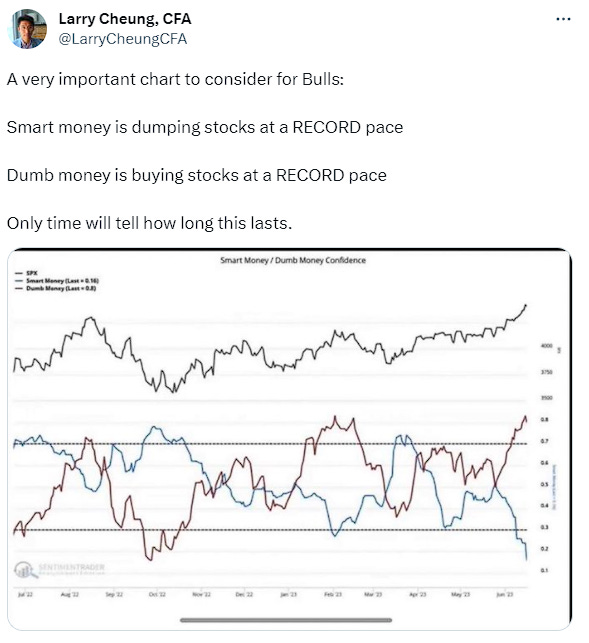

Note to Readers from Larry: The markets continue to grind higher in a seemingly unstoppable fashion. In my weekend premium note to members which focused on Technical Analysis, I discussed that the trend is undeniably higher (for now). As long as markets can stay above certain key levels that I outlined, the trend remains tactically to the upside. What is in front of us is clearly strong. What will be in front of us later on is still up for debate.

However, once this uptrend ends, I believe many people will be trapped. The more trapped bulls at high cost basis levels there are, the quicker and the steeper the decline will be.

In other words, more and more people participating in this rally gives the eventual Selloff more fuel down the road.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4505.42

KWEB (Chinese Internet) ETF: 29.25

Analyst Team Note:

Following a light Week 1 earnings, 30 S&P 500 companies contributing 11% of S&P 500 earnings are in. The earnings beat rate is above average at 77% but is weaker than last quarter’s 90%. Financials will be the biggest sector reporting for the second week, with more regionals, with 60% of Financials earnings in by Friday.

Macro Chart In Focus

Analyst Team Note:

Since 1750, productivity booms have been enabled by three main industrial revolutions.. The first, marked by the advent of steam power, the cotton gin, and railroads, took place from 1750 to 1830. The second, which occurred from 1870 to 1900, was characterized by the widespread adoption of the internal combustion engine and indoor plumbing. The third revolution, which began in 1960 and continues today, involved the proliferation of mainframe computing, the internet, and e-commerce. Each of these revolutions brought about significant improvements in productivity and living standards. While many technological innovations bring profits and benefits, their impacts on productivity are typically marginal, and this could be true for AI as well.

AI stocks are currently valued in a world of low bond yields, low capital costs, easy globalization, and ‘low’ inflation. With valuations at 31 times earnings, and a third of AI firms being unprofitable, there are potential hurdles ahead, such as data lockouts, power scarcity, and regulatory issues. Even if AI's overall economic impact is minimal, individual companies may still experience significant efficiency gains by integrating AI into their operations. Thus, the better play on AI is to invest in high-quality firms capable of effectively integrating AI into their business models.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

China's economic growth has slowed, leading several major banks, including JPMorgan, Morgan Stanley, and Citi, to downgrade their growth forecasts for the year to 5%. This figure aligns with Beijing's official GDP target, now under threat due to a notable weakening in consumer spending and contraction in property investment in Q2. This data, coupled with a relatively muted response in terms of economic stimulus from Beijing, has economists predicting that policy may fall behind the curve or fail to meet expectations.

In addition, the lack of major stimulus measures, despite weakening economic figures, suggests that Beijing may be cautious to avoid potential negative repercussions such as the build-up of debt. The disappointing economic data is accompanied by a high youth unemployment rate above 20%, which is expected to increase further in July, before cooling down after the summer.

Chart That Caught Our Eye

Analyst Team Note:

As the summer holiday travel season peaks, U.S. airports are experiencing high traffic, with June's average daily passenger throughput even surpassing 2019 levels at 2.56 million. This record marks the third time post-pandemic that such figures have been attained, the first two instances being in January and February 2023.

After a dismal 2020, flight traffic rebounded significantly in the second quarter of 2021, due to rapid vaccine rollouts. Despite trailing 2019 numbers by about 500,000 daily passengers on average during the summer season, the gap decreased to 350,000-400,000 by year-end. Through 2022, these figures steadily approached pre-pandemic levels, averaging 2.08 million daily passengers. As of July 12, 2023, average daily passenger traffic stands at 2.28 million, compared to 2.29 million over the same period in 2019.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.