7.14.23: Markets continue to experience sector rotation with Financials now leading the leg higher

For Public Readers: Weekly Key U.S. and China brief market notes by Larry Cheung's Analyst Staff Team for our Public Email List

Note to Readers from Larry: Hope everyone had a great week. I am flying out this weekend for a real estate conference to speak on Monday as a presenter, so I will be sending the weekly premium note for Members at a slightly adjusted schedule.

Members will receive the note by Monday evening. If possible, I’ll try to do earlier, but this weekend schedule is very hectic - so wanted to give a heads up.

Key Investing Resource: Strategist Larry uses Interactive Brokers as his core brokerage. Feel free to check out IB. I currently park excess cash (yielding 4.5%+ on idle cash) at Interactive Brokers. Check it out. It’s a great brokerage.

In our emails, we will provide the following coverage points:

Brief Overview of U.S. & China Markets

Macro Chart in Focus

U.S. & China Upcoming Economic Calendar

Chart That Caught Our Eye

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 4510.04

KWEB (Chinese Internet) ETF: $30.15

Analyst Team Note:

Over the past 15 years, there has been a significant correlation between central bank liquidity and the performance of the Nasdaq 100, as shown in Chart 3. However, in the past six months, there's been a notable disconnect between this longstanding relationship largely due to improvements in CPI and the AI hype. In addition, the Silicon Valley Bank fiasco reminded investors that central banks tend to inject liquidity into the economy faster than they withdraw it, which could further contribute to this disconnect, as increased liquidity can stimulate economic activity and potentially inflate asset prices.

Macro Chart In Focus

Analyst Team Note:

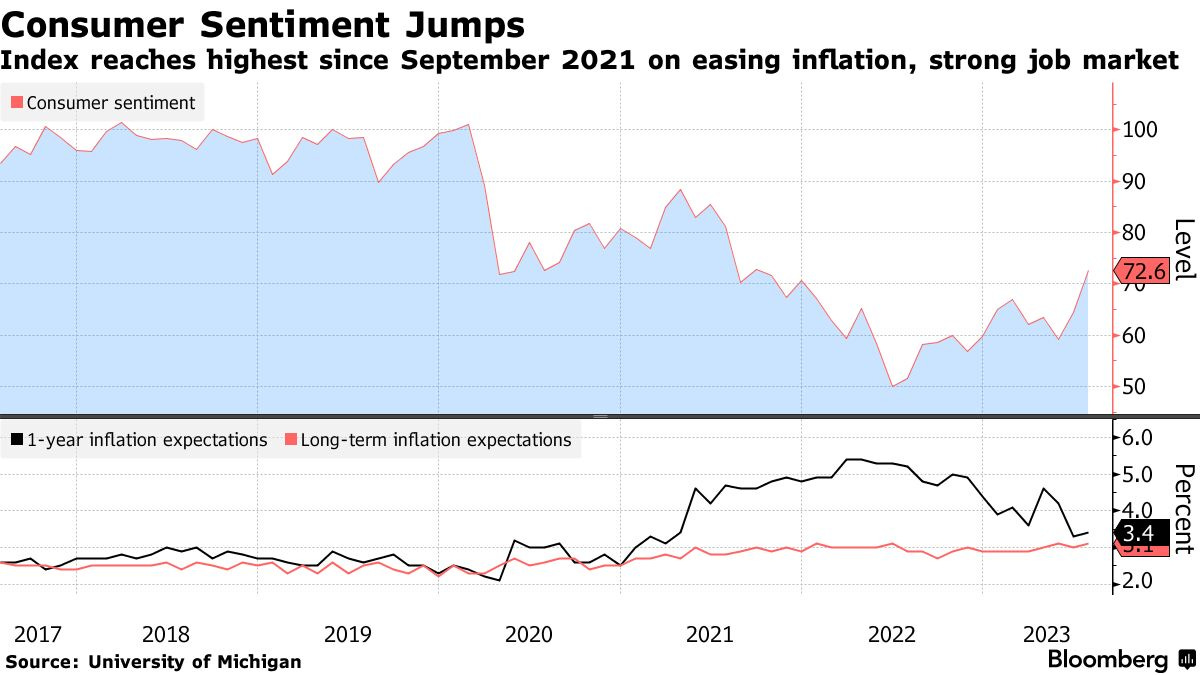

Consumer sentiment in the U.S. rose significantly in early July, reaching its highest point in nearly two years due to declining inflation and a robust labor market. According to the preliminary index from the University of Michigan, consumer sentiment surged by 8.2 points to 72.6, the largest monthly gain since 2006 and surpassing all economist forecasts in a Bloomberg survey.

Short-term inflation expectations saw a slight increase in July, rising to 3.4% from 3.3% a month earlier, yet this is still notably lower than the previous year's peak of 5.4%. Joanne Hsu, director of the survey, attributed the sharp increase in sentiment to the continuing deceleration in inflation and stable labor market conditions.

Even though sentiment hasn't fully recovered to pre-pandemic levels, it has shown steady improvement in line with consistent employment growth and wage increases. Despite high prices proving most challenging for lower-income households, all demographics showed improved sentiment, with the exception of lower-income consumers.

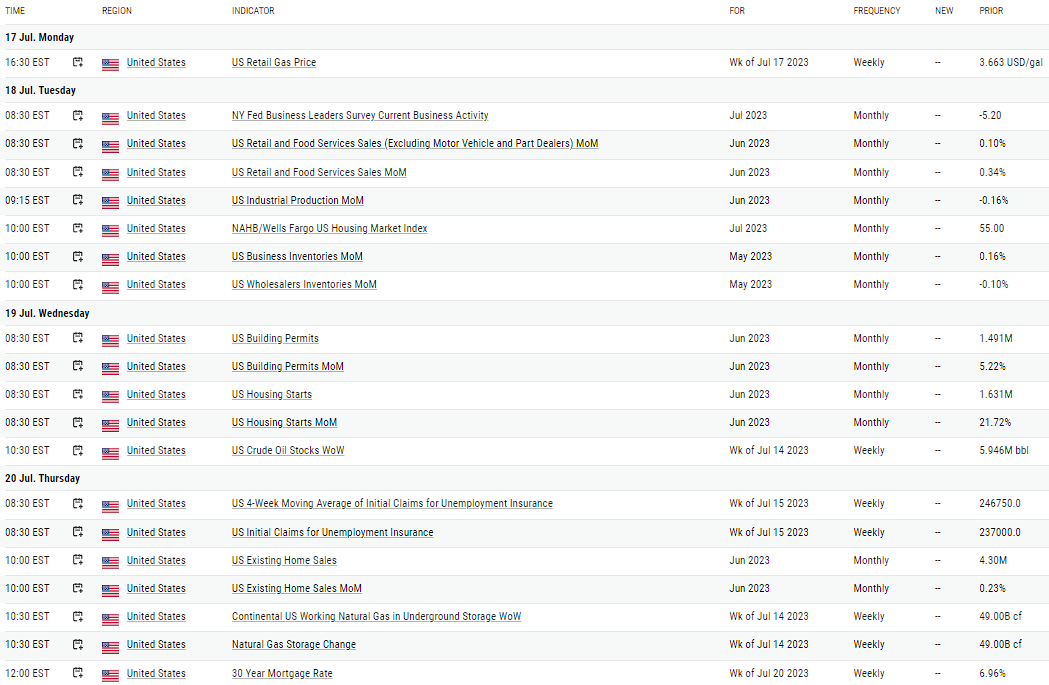

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

The latest Survey of Consumer Expectations from the Fed reveals that consumer predictions about their ability to pay the minimum required balance on a debt over the next three months is at a 12% chance, which aligns with the 10-year historical average. However, there are variations in these expectations based on income brackets, with middle-income consumers ($50-$100K) showing a strong capacity to meet their financial obligations. Interestingly, high-income customers ($100K+) show an increase in their expected inability to make payments, which may indicate growing concerns about the economy and the labor market.

As we move into the second quarter, the spotlight will be on high-income consumers' credit outlooks. There's increasing investor concern about a potential slowdown in high-income consumer spending, a trend that could notably impact American Express (AXP) due to its predominantly high-earning cardholder base.

Chart That Caught Our Eye

Analyst Team Note:

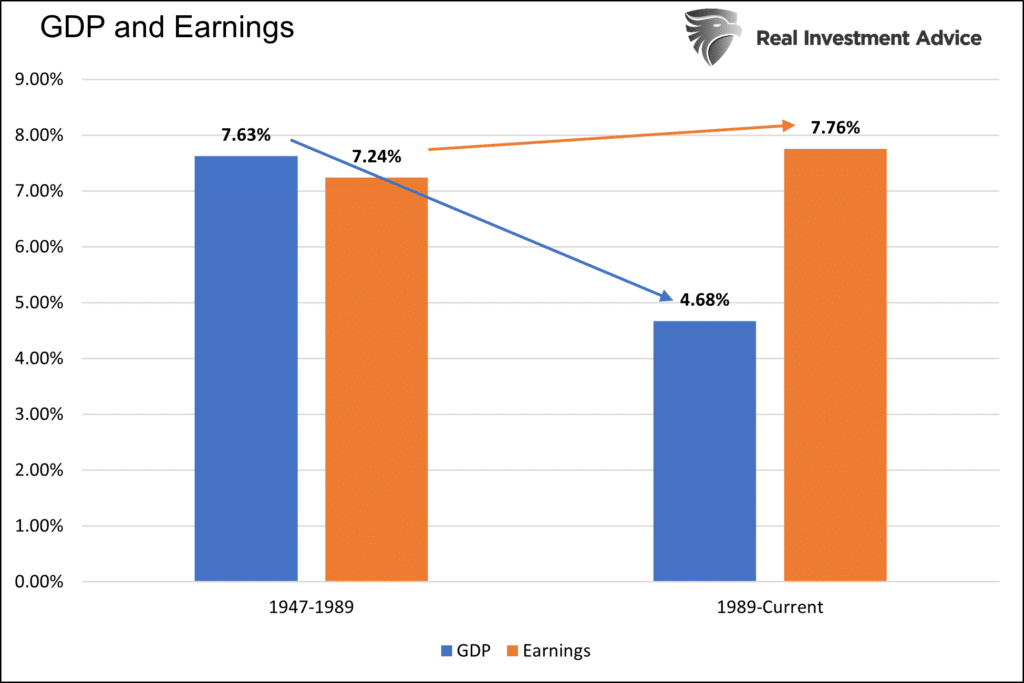

Corporate earnings have grown faster over the last 30 years than in the 40 years before. According to a Fed whitepaper, “the reduction in interest and corporate tax rates was responsible for over 40 percent of the growth in real corporate profits from 1989 to 2019”.

Corporate profits would have grown by 4.50%, not 7.76% annually, without the boost from interest rates and taxes, assuming his 40% contribution calculation is correct.

Sentiment Check

Make sure to check Larry’s most recent market updates via his personal newsletter.