7.13.22: Contrarian calls for Inflation CPI to peak are starting to emerge. Should we listen?

Key U.S. and China brief market notes by Larry's Analyst Staff Team

Note to Public Readers/Members: We are actively studying whether markets are pricing in June’s CPI as a near-term peak for inflation. Inside our Investment Community, we have provided actionable ranges where we believe risk-reduction or risk-addition may be appropriate as markets digest the report. We are also studying inter-market data to understand how different companies within the S&P 500 are moving after this latest inflation print so that we can proactively provide strategy on our views on China, Semiconductors, and Consumers in our next Bi-Weekly report set to be released on July 15th. For members inside the Community, make sure you are in our Discord server to receive timely opinions.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

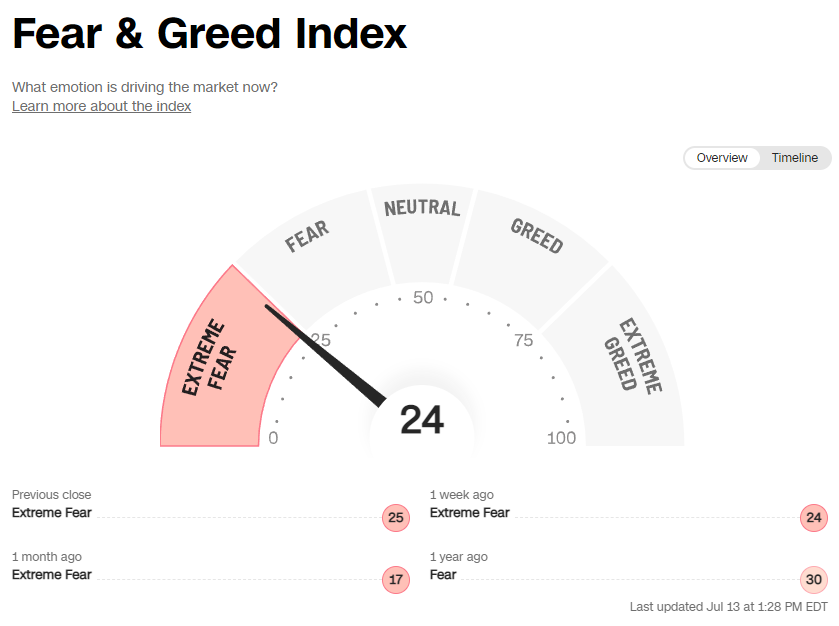

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 3818.80

KWEB (Chinese Internet) ETF: $30.09

Analyst Team Note:

There is now a divided camp on whether inflation has peaked or not. The conservative view is that Inflation not yet peaking → Fed likely to hike more aggressively (talks of 100bps) → Market now pricing in rate cuts in May 2023…

The aggressive view is that inflation has peaked and that last month’s data is already stale. We can see investors front-run this thesis by positioning in technology in today’s strong Nasdaq & ARKK relative rebound from morning trading.

While market participants can try their best to make a wager on inflation peaking/continuing higher, we believe a better source of time spent is on following the Russia-Ukraine war closely. Structural changes in commodity prices (a large component of CPI) is determined by geopolitical developments abroad.

Macro Chart In Focus

Analyst Team Note:

The consumer price index rose 9.1% from a year earlier in a broad-based advance, the largest gain since the end of 1981, Labor Department data showed Wednesday. The widely followed inflation gauge increased 1.3% from a month earlier, the most since 2005, reflecting higher gasoline, shelter and food costs.

Economists were projecting a 1.1% rise from May and an 8.8% year-over-year increase. This was the fourth-straight month that the headline annual figure topped estimates.

According to Bloomberg, futures are pricing a 50% chance of a 100bps hike in July.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

Analyst Team Note:

Today’s CPI report found that the cost of shelter increased 5.6% over the past year. Other info says otherwise…

According to Apartmentlist.com, the YoY rent growth currently stands at 14.1%.

Meanwhile the Case-Shiller Home Price Index, which tracks the change in value of single family homes, is up over 20% YoY.

The 5.6% increase that the Bureau of Labor Statistics is claiming shares a mixed signal compared to other reports.

Chart That Caught Our Eye

Analyst Team Note:

“The US dollar's surge represents a headwind for US earnings, as US companies in aggregate generate ~30% of sales abroad. We find a strong negative correlation over time between the rate of change in the dollar and S&P 500 earnings revisions. This bout of USD strength comes as corporates already face margin pressure from cost inflation, higher inventories, and slower demand.

The math suggests that every percentage point increase in the dollar on a Y/Y basis has an approximately 0.5 percentage point hit to S&P 500 EPS growth. Thus, the 16% year-on-year increase in the DXY index would translate into an 8% headwind for S&P 500 EPS growth.” - Morgan Stanley

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.