7.1.24: US Manufacturing Activity Declines for Third Straight Month

Letters From Larry is brought to you by our friends at YCharts. With YCharts, each output is a powerful visual that brings your analyses to life and intuitively explains the “why” behind your strategy. Go beyond a simple price chart and educate clients about the levers that truly impact performance or risk—and emphasize your most important insights with tailored proposal reports designed with custom talking points, compliance-approved messaging, and seamless personalization options for importing marketing collateral and firm branding.

Click here to start your free YCharts trial and get 15% off your initial YCharts Professional subscription when you tell them I sent you (new customers only).

Note to Readers: This is a concise email newsletter format sent as part of Larry’s Investment Analyst Team communications to his public audience. To read his personal opinions, please read his separate public letters here. This email is designed to be primarily data-driven and will be sent out on Mondays/Wednesdays/Fridays. More qualitative commentary along with our actionable conclusions is provided inside our Investment Community.

This email is brought to you by Interactive Brokers, one of our preferred brokerages to buy HK-Listed Shares in our China Internet Equity Coverage Universe.

In our emails, we will provide the following coverage points:

Brief Snapshot of U.S. & China markets and valuation

Our Analyst Team’s Chart in Focus

U.S. & China Upcoming Economic Calendar Snapshot

Notable Chart from Media Outlets

Fear & Greed Index Recap

I hope you find this newsletter to be insightful and enjoyable! - Larry and Team

U.S and China Markets Brief Snapshot 🇺🇸 🇨🇳

(Powered by our Channel Financial Data Provider YCharts)

S&P 500 Index: 5,475.09

KWEB (Chinese Internet) ETF: $27.10

Analyst Team Note:

The S&P 500 delivered an impressive 15.3% return in the first half of 2024, significantly outperforming long-term treasury bonds by 20 percentage points.

This strong performance led to shifts in asset allocation strategies, with strategists increasing their recommended equity allocations by an average of 64 basis points while reducing bond allocations by 1.6 percentage points.

Sell-side strategists responded by raising their year-end S&P 500 targets by approximately 10%, from around 4800 in December to about 5300 currently.

Additionally, strategists increased cash allocations by an average of 80 basis points as expectations for Federal Reserve rate cuts were delayed.

Macro Chart In Focus

Analyst Team Note:

The U.S. bond market experienced a downturn as traders assessed the potential economic implications of the November presidential election, particularly following last week's debate between Joe Biden and Donald Trump.

The key issue is the market now has to contend with rising probabilities of changes in immigration and tariff policies in an economy where growth has already been cooling, making the market more likely to price more rate cuts.

Upcoming Economic Calendar

(Powered by our Channel Financial Data Provider YCharts)

U.S Economic Calendar (Upcoming Data Points)

China Economic Calendar (Upcoming Data Points)

N/A

Analyst Team Note:

U.S. manufacturing activity continued to contract in June, marking the third consecutive month of decline. The Institute for Supply Management's (ISM) manufacturing index registered at 48.5, slightly lower than May's 48.7 and below market expectations of 49.1.

While the overall gauge indicates shrinking activity, there were some positive signs, including a pickup in new orders and a significant drop in the prices paid index, which fell 4.9 points - the most since May 2023.

However, production and employment indexes slipped into contraction territory.

The persistent contraction is attributed to subdued demand, high borrowing costs, and companies' reluctance to invest in capital and inventory due to current monetary policy and economic conditions.

Chart That Caught Our Eye

Analyst Team Note:

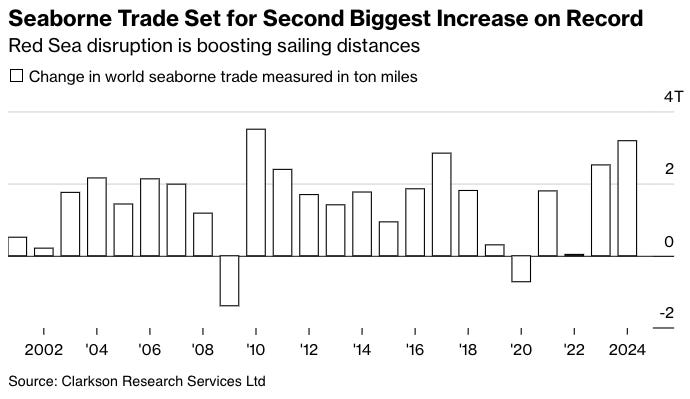

Global sea transport, measured in ton miles, is projected to experience its most significant annual increase since 2010, with a 5.1% rise expected in 2024 compared to 2023.

This surge is primarily attributed to geopolitical disruptions in the Middle East and Europe, particularly the attacks by Houthi rebels in the Red Sea and Gulf of Aden, which have forced ships to reroute around the horn of Africa.

Sentiment Check

We want to take a moment to thank Interactive Brokers for being one of our Channel’s trusted Partners and to inform my audience of the special features they have given that our online friends here closely follow Chinese Internet stocks (BABA/Tencent).

Much of Larry’s audience is concerned about the US ADR issue of Chinese Stocks being delisted.

Interactive brokers allows investors to buy HK-listed shares of Alibaba, JD, Tencent, and other brand name Chinese Internet companies on the HK market. This will effectively reduce any confusion or work you will have to do in case there is the event of delisting US ADRs

Make sure to check Larry’s most recent market updates via his personal newsletter. See you in our next update.